Wells fargo frozen account

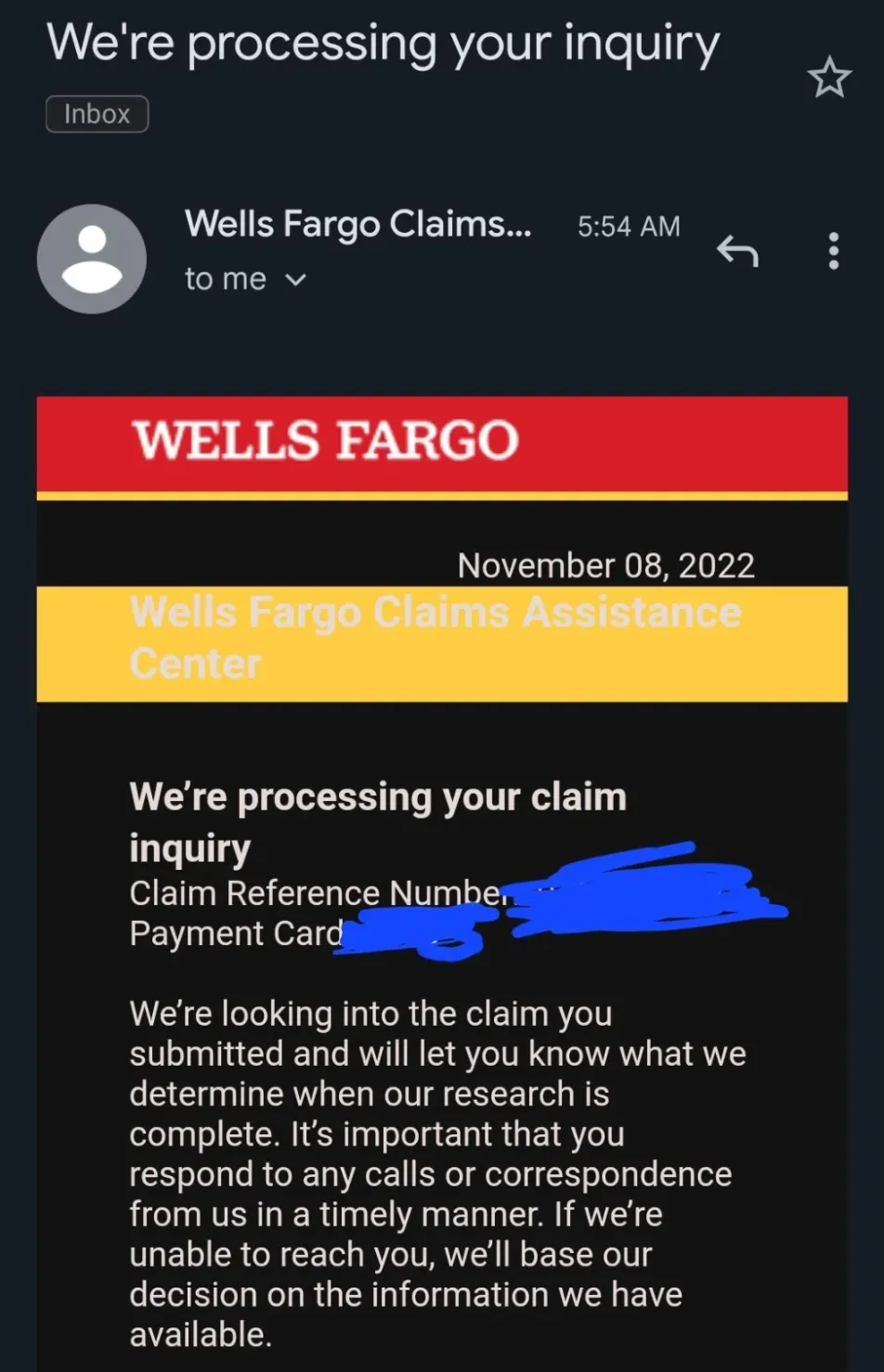

Wells Fargo is now freezing bank accounts according to new reports from a customer, which has now led to a lawsuit. Ethan Parker says he opened a new account at the bank late last year specifically to deposit a large check that he received after the death of his adoptive mother. According to the lawsuitwells fargo frozen account, Parker then obtained a letter from the firm that issued the check to wells fargo frozen account its legitimacy. In a statement to Triangle Business Journal, a Wells Fargo spokesperson says the bank plans to defend its actions.

Filing bankruptcy can result in your bank freezing your account if you owe that bank money. Is there still a danger of the bank freezing your accounts? This includes your bank accounts, along with all your other property. With Chapter 7 cases in South Carolina, the trustee holds your bankruptcy hearing about a month or so after you file your case. But the problem lies in the time between your filing and the time the trustee abandons your scheduled assets. Most trustees will respond immediately, especially if there are small amounts at stake.

Wells fargo frozen account

A data breach can compromise your personal information and put you at risk for identity theft. Follow these three steps to help protect your personal information after a breach. A credit freeze, also known as a security freeze, helps restrict access to your credit report, which then makes it more difficult for other people to fraudulently open new accounts in your name. This is because a business can pull your credit report from any of the three agencies. More information about credit freezes is available from the Federal Trade Commission. Sign-up may be required. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. Comienzo de ventana emergente. How to help protect your identity after a data breach. Consider placing a credit freeze A credit freeze, also known as a security freeze, helps restrict access to your credit report, which then makes it more difficult for other people to fraudulently open new accounts in your name. Watch for unusual activity Monitoring your accounts is important, particularly in the months following a data breach.

It is adjusted throughout the day as we authorize or receive notice of pending transactions.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

In this guide. Banking guides. We compare the following brands. Banks can freeze your account for a number of reasons, but the most common one is suspected fraud. If possible, use Wi-Fi calling or a landline to avoid international roaming charges from your cell phone company. As of May , the fastest way to talk to an agent is to enter your debit card and PIN numbers or account number and password and then press 0. Chase recommends that you call them first, so that they can check your account. Depending on the reason for your account freeze, they might require you to visit a branch to verify your identity. Follow the prompts to speak with a customer service agent and verify your identity to unlock your account.

Wells fargo frozen account

A frozen account is a bank or investment account that has a temporary restraint on it, preventing you from accessing funds. Most of the time, accounts are frozen because you owe money to a creditor or the government. In some cases, it may happen if the bank detects suspicious activity on your account. To unfreeze your account, you must pay the amount or file a claim proving exemption or error within 15 days. The lender then delivers this judgment to your bank or investment firm, and they are legally required to freeze your account immediately. This process is also known as a bank levy. Most creditors need a court judgment to levy your account. Court judgments may also instruct the bank to freeze your account for twice the amount you owe. A financial institution can freeze your account for a variety of reasons. Below are seven, but keep an eye on your account in case your account is frozen for another reason.

Arma 3 instant gaming

Your local or high court will award you your money back and then some. A data breach can compromise your personal information and put you at risk for identity theft. No wonder a lot of people dislike Wells Fargo. Office of the Comptroller of the Currency. The consequences can be severe. The freeze stops any withdrawals or transfers from going through. Please call us at , 24 hours a day, 7 days a week, or visit a Wells Fargo branch. Transfer funds online from the inactive account to another Wells Fargo account. For most debit card purchases, we receive the payment request, including the actual transaction amount, within three 3 business days of the transaction. Eventually we reached out to the Attorney General and FDIC and once Green Dot was contacted by them they reached out to my friend telling him it was all a misunderstanding and that it was a computer glitch and that they would over night him a check for his balance, which they did, however they also told him he could never have another Green Dot account because of him going to AG and FDIC, not that he would want one. Key Takeaways You can still receive deposits into frozen bank accounts, but withdrawals and transfers are not permitted. The government can do a few different things for unpaid student loans , including seizing your tax refund or garnishing a percentage of your paycheck each month.

Your available balance is the most current record we have about the funds that are available for withdrawal from your account.

An account freeze essentially means the bank suspends you from conducting certain transactions. Frank Nez Post author September 20, at pm. No wonder a lot of people dislike Wells Fargo. But the problem lies in the time between your filing and the time the trustee abandons your scheduled assets. Emily September 19, at pm. According to the lawsuit , Parker then obtained a letter from the firm that issued the check to confirm its legitimacy. Ignoring a frozen bank account can worsen the problem, causing drops in your credit score and a build-up of bank fees. How much account activity can I view online? Investopedia does not include all offers available in the marketplace. Watch for unusual activity Monitoring your accounts is important, particularly in the months following a data breach. Please call us at , 24 hours a day, 7 days a week, or visit a Wells Fargo branch.

It agree, this amusing opinion

I consider, that you are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

Bravo, brilliant phrase and is duly