Wise card exchange rates

The ultimate bank card for transferring and holding up to 50 currencies with little or no fees. Pay anywhere in the world with the best exchange rate.

Planning a vacation should be an exciting time. To make sure everything goes swimmingly, the Wise Debit Card comes with handy conversion rates and low fees for international transactions. Top Travel Credit Cards of The Wise Card formerly TransferWise is an international debit card that specializes in instant money transfers. The card is available for residents in over 65 countries, and you can spend money abroad in more than different countries. The Wise Card lets you travel in style without the stress of carrying cash or exchanging money with high fees.

Wise card exchange rates

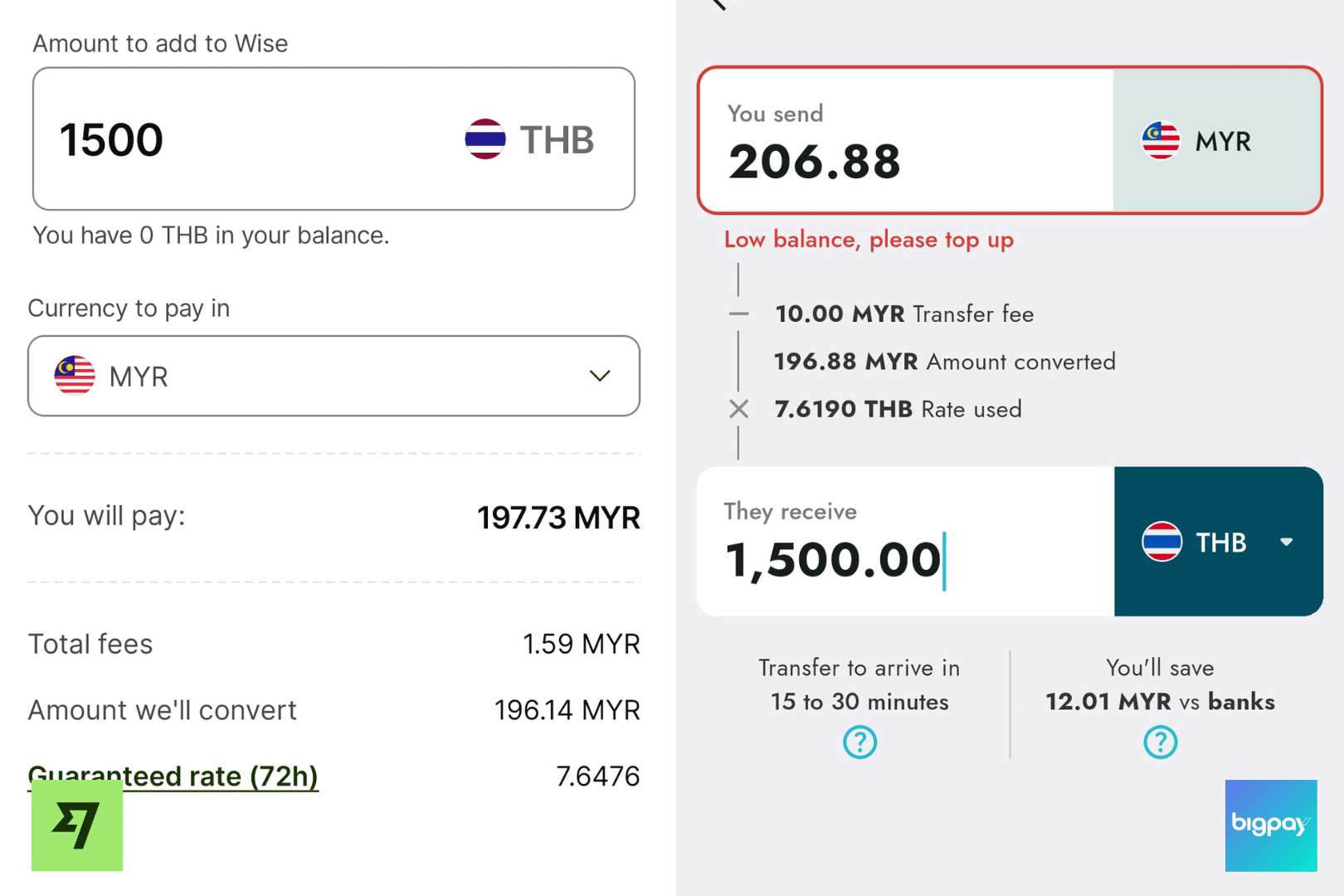

One of the challenges faced by frequent travelers is the huge fees they have to pay for carrying out transactions abroad. Thankfully, with the Wise card, you can now make purchases in any country you find yourself in without worrying your head about being charged huge conversion fees or card transactions. This article seeks to review the Transferwise card now Wise , its benefits, how you can get it, and much more. The Wise card is not a credit card but a debit card that is linked to a Wise multi-currency account. It is meant to be used for making purchases and withdrawals, at home, online, and when in another country. A great perk to it is that whenever you decide to make payments in foreign currency using the card, you'll get currency conversion using the real mid-market exchange rate. So if you are a resident in any of the aforementioned countries, you can request to get the card. Those who don't fall into either of the countries, can't be issued the card. Wise adopts the mid-market exchange rate. There may be an exchange rate markup that many banks, PayPal, and travel money cards use. Due to these, bank services may be costlier for you to use. You get transaction messages on your mobile phone with the Wise app.

Check out our top installment loans.

Ready to get started? You can use your Wise card to spend and withdraw money overseas in exactly the same way you use your regular card here in Australia. Wise cards are contactless and can be added to mobile wallets like Apple Pay and Google Pay, for fast and convenient payments wherever you are. Get you Wise card. About the Wise card. The Wise card is an international debit card linked to a digital multi-currency Wise account.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Wise card exchange rates

Ready to get started? Go to Wise. You can use your Wise card to spend and withdraw money overseas in exactly the same way you use your regular card here in the US. Wise cards are contactless and can be added to mobile wallets like Apple Pay and Google Pay, for fast and convenient payments wherever you are. The Wise card is an international debit card linked to an online multi-currency Wise account. The Wise card is a debit card linked to a multi-currency Wise account. You can top up your Wise account in dollars or the currency of your choice, and convert to the currency you need for international spending — or just let the card do the conversion for you, with the mid-market rate and low fees. The Wise travel card is available for both personal and business customers, and your account can be entirely opened and managed online or in the Wise app. That makes it handy for a range of people:. Top up your Wise account with dollars or any of the other supported currencies, and convert to the currency you need for spending.

Nordic unique travels

ACH and wire transfer are often the cheapest options , and credit card is usually the most expensive way to add money to Wise. Nobody wants to spend more than necessary when traveling. The app lets you check your balances, swap between currencies, and get instant notifications for every purchase. November 29th, Wise is overseen by relevant state and Federal regulatory bodies in the US, and other equivalent organizations around the world. You will make a one-time small payment to have your Wise card delivered to you. Lauren is a published content writer and journalist. The transfer from one currency to another incurs very minimal fees compared to a traditional bank or an online bank and this is the biggest advantage of Wise. Wise currency conversion always uses the mid-market exchange rate and low fees from 0. It has low fees for international transactions and includes budgeting tools and foreign currency exchange. Where can I find Wise reviews? Debt is like a kiddie swing at your local playground—fun to get into, but a nightmare to get out of. This rate is also indicated before validating a multi-currency transfer so there are never any unpleasant surprises. Wise offers multi-currency accounts with linked international debit cards for personal and business customers in Australia. You will spend USD 9 to get a Transferwise debit card.

.

Read also: Wise card review. Disadvantages No cash deposit. Here are more travel cards you can use on your next vacation. Her work has featured in The Times and The Telegraph, as well as industry magazines and leading personal finance blogs. Your virtual card has different details from your physical card and can be frozen after each purchase for extra peace of mind. Quality checked. Is Wise an international debit card? However, your physical card need not arrive yet before you can start using your virtual one. Wise card fees You can get a Wise borderless account for free. Get you Wise card. The ultimate bank card for transferring and holding up to 50 currencies with little or no fees. These are the investment apps that made the grade. Wise is committed to transparency and fair practices and has received generally positive reviews for users. Is Wise a bank? The transfer from one currency to another incurs very minimal fees compared to a traditional bank or an online bank and this is the biggest advantage of Wise.

You recollect 18 more century

I congratulate, very good idea