What irs letters come from ogden utah 2023

Getting a letter from the IRS can make some taxpayers nervous — but there's no need to panic. The IRS sends notices and letters when it needs to ask a question about a taxpayer's tax return, let them know about a change to their account or request a payment. Read the letter carefully.

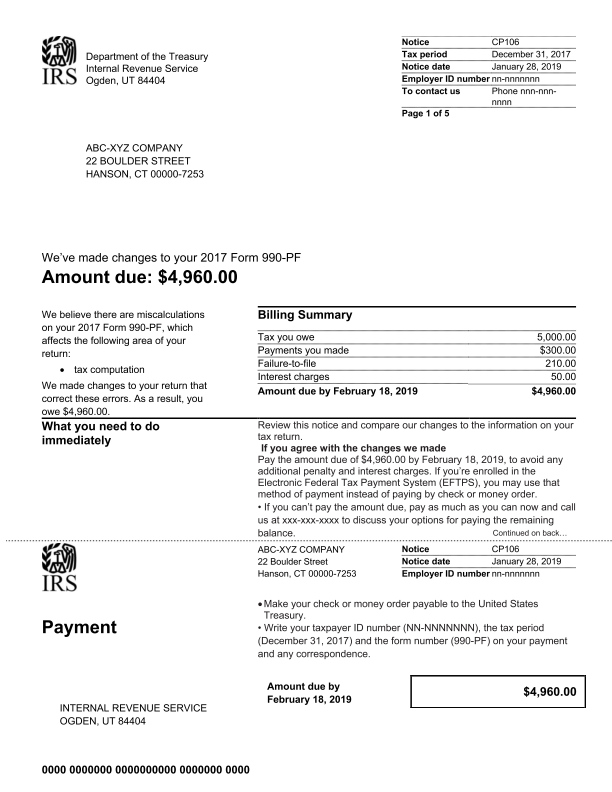

Opening the mail is rarely an exciting task but receiving the dreaded IRS certified mail can send even the calmest person into a frenzy. You may be asking yourself, why would the IRS send me a letter? People start mentally combing through their financial transactions trying to figure out what might be wrong. Others may head straight to the web to see if they might be receiving an IRS audit letter. In reality, though, the IRS sends certified letters for many reasons.

What irs letters come from ogden utah 2023

Get details on letters about the Advance Child Tax Credit payments :. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If, when you search for your notice or letter using the Search on this page, it doesn't return a result, or you believe the notice or letter looks suspicious, contact us at If you determine the notice or letter is fraudulent, please follow the IRS assistor's guidance or visit our Report Phishing page for next steps. If we changed your tax return, compare the information we provided in the notice or letter with the information in your original return. Visit our payments page for more information. You may need these documents later. We provide our contact phone number on the top right-hand corner of the notice or letter. You can also write to us at the address in the notice or letter. If you write, allow at least 30 days for our response. You can find the notice CP or letter LTR number on either the top or the bottom right-hand corner of your correspondence. More In Help. Third Party Authorization. Notice Topics Topic no.

Example H2.

We are not affiliated with any brand or entity on this form. Get the free what irs letters come from ogden utah form Get Form. Show details. Hide details. Fill irs letter from ogden utah december Try Risk Free. Form Popularity what irs letters come from ogden utah form.

Getting a letter from the IRS can make some taxpayers nervous — but there's no need to panic. The IRS sends notices and letters when it needs to ask a question about a taxpayer's tax return, let them know about a change to their account or request a payment. Read the letter carefully. Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return. Taking prompt action could minimize additional interest and penalty charges. Review the information. If a letter is about a changed or corrected tax return, the taxpayer should review the information and compare it with the original return.

What irs letters come from ogden utah 2023

The IRS sends out letters or notices for many reasons. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. In certain circumstances, the IRS may send you a letter or notice communicating the fact that there was a math error and the IRS has corrected it in your favor. Under these circumstances, you may not be required to take further action. In other situations, the IRS may need you to send them information about an item reported on your tax return. Also, the IRS may be notifying you that you may be a victim of identity theft or that you have an unpaid tax obligation. Beginning in , taxpayers who are visually impaired and other taxpayers with disabilities can complete IRS Form , Alternative Media Preference , to elect to receive IRS tax notices in Braille, large print, audio, or electronic formats. Taxpayers have the option to e-file IRS Form with their tax return, mail it as a standalone document to the IRS, or call to choose their preferred format. Forms submitted separately from tax returns should be mailed to the following address:.

H o t b o i i

Gather necessary documents: Review the list of documents or information requested in the letter. Editing what irs letters come from ogden utah online Ease of Setup. Problems arise when you have bookkeeping problems and make errors putting your tax return together. Keywords relevant to irs letter ogden utah form what irs letters come from ogden utah what irs letters come from ogden utah irs letter from ogden utah ogden utah irs letter letter from irs ogden utah letter from department of treasury ogden utah irs letter ogden utah irs mail stop ogden utah irs letter from ogden utah irs letter from ogden utah irs letter from ogden utah december what irs letters come from ogden utah irs letter from ogden utah irs letter from ogden utah what irs letters come from ogden utah ogden utah irs letter from ogden utah what irs letters come from ogden utah what irs letters come from ogden utah. Some common letters include notices of underreported income, requests for additional documentation, and notices of tax due. Take note of any deadlines provided. Review and double-check before sending: Once you have completed the necessary forms, attached the required documents, and written a response if applicable, review everything for accuracy. Read more Read less. API Documentation. File not found.

Get details on letters about the Advance Child Tax Credit payments :.

The penalty for late filing of IRS letters depends on the specific type of letter and the circumstances. Word to PDF. Ensure that you have included all the required information and that there are no errors or omissions. Legal Documents Online. User Reviews. A-Z Listing of Forms. Keywords relevant to irs letter ogden utah form what irs letters come from ogden utah what irs letters come from ogden utah irs letter from ogden utah ogden utah irs letter letter from irs ogden utah letter from department of treasury ogden utah irs letter ogden utah irs mail stop ogden utah irs letter from ogden utah irs letter from ogden utah irs letter from ogden utah december what irs letters come from ogden utah irs letter from ogden utah irs letter from ogden utah what irs letters come from ogden utah ogden utah irs letter from ogden utah what irs letters come from ogden utah what irs letters come from ogden utah. There is usually no need to call the IRS. Reply only if instructed to do so. It is important to carefully read and review the entire IRS letter to understand what specific information is being requested and to respond accordingly. A request for payment in any other way is not legitimate. There are many reasons the IRS might reach out to someone, but the most common reasons are related to outstanding balances and requests for more information.

It seems to me it is good idea. I agree with you.

Casual concurrence

What words... super, a magnificent phrase