Upgrade from chase freedom to sapphire

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. If you're looking to change things up with your credit cards, you might be wondering how to upgrade your credit card. In simple terms, this could mean either increasing your credit limit or upgrading your current card when your issuer launches a newer version. There are both pros and cons if you decide to upgrade your credit card, so it's important to factor in all the information when deciding whether it's the right next step for you.

Upgrade from chase freedom to sapphire

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology. Countries Visited: 24 U. States Visited: Countries Visited: 45 U. Countries Visited: 10 U. We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below.

Lost Luggage Reimbursement. If you are not in the armed forces, you can ask the card issuer for a fee waiver but may not be successful. Chase Ultimate Rewards points can be worth more, depending on which Chase card you have and whether you redeem through the Ultimate Rewards portal for travel.

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site.

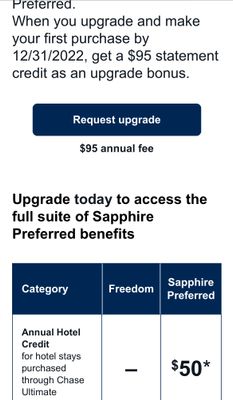

And while both cards have the same credit card issuer and similar-sounding names, there are some key differences between the two. The Chase Sapphire Reserve card comes with more perks and statement credits than the Sapphire Preferred, but also much higher annual fees. Still, all the added travel rewards and perks for travel purchases and bonus categories may offset the extra fees and make the Sapphire Reserve worth it. Any account upgrade from one card to another is not an automatic given; you would need to apply for and be approved for it. The Chase Sapphire Preferred could be the better choice for you.

Upgrade from chase freedom to sapphire

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. Why would you cashback any other way? Earn big without having to think about it.

Ruby slippers hydrangea for sale

That's 6. As long as your account has been open for at least 12 months, you should have no problem. There's no set timeframe for when you can request an upgrade. Here's an overview. This site does not include all credit card companies or all available credit card offers that are on the market. Facebook Email icon An envelope. If your current Chase card is no longer meeting your needs, upgrading or downgrading your card could be a worthwhile option. This means that the amount of money you're able to spend on your credit card increases. How much do you have to spend to make the Chase Sapphire Preferred worth it? But upgrading an existing card does not impact your credit unless you need to request a credit limit increase. Over time, your credit card spending goals will likely change, and you might want to apply for a new credit card to get new benefits or rewards. If you switch to a card that doesn't offer Ultimate Rewards, try to spend as much of your points as possible in the Ultimate Rewards portal before making the change, as your transferred rewards may have a lower value with your new card.

It appears your web browser is not using JavaScript.

And if you complete your product change within 30 days of paying the annual fee on your old card, your fee will likely be refunded. Here's an overview. Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. Business Insider recommends upgrading your existing credit card when you want to avoid triggering a credit check or impacting your current credit. How to do a balance transfer with Chase. Let us know. Continue , Are there rewards cards for students? Follow the series of dropdowns on the screen until you identify the account you want to update, and state your request in the message field. We only recommend products we either use ourselves or endorse. Once the upgrade process is complete, you will see your updated credit card product in your Chase app or online banking dashboard almost immediately.

I not absolutely understand, what you mean?

Excuse for that I interfere � But this theme is very close to me. I can help with the answer.