Sort code 40 12 55

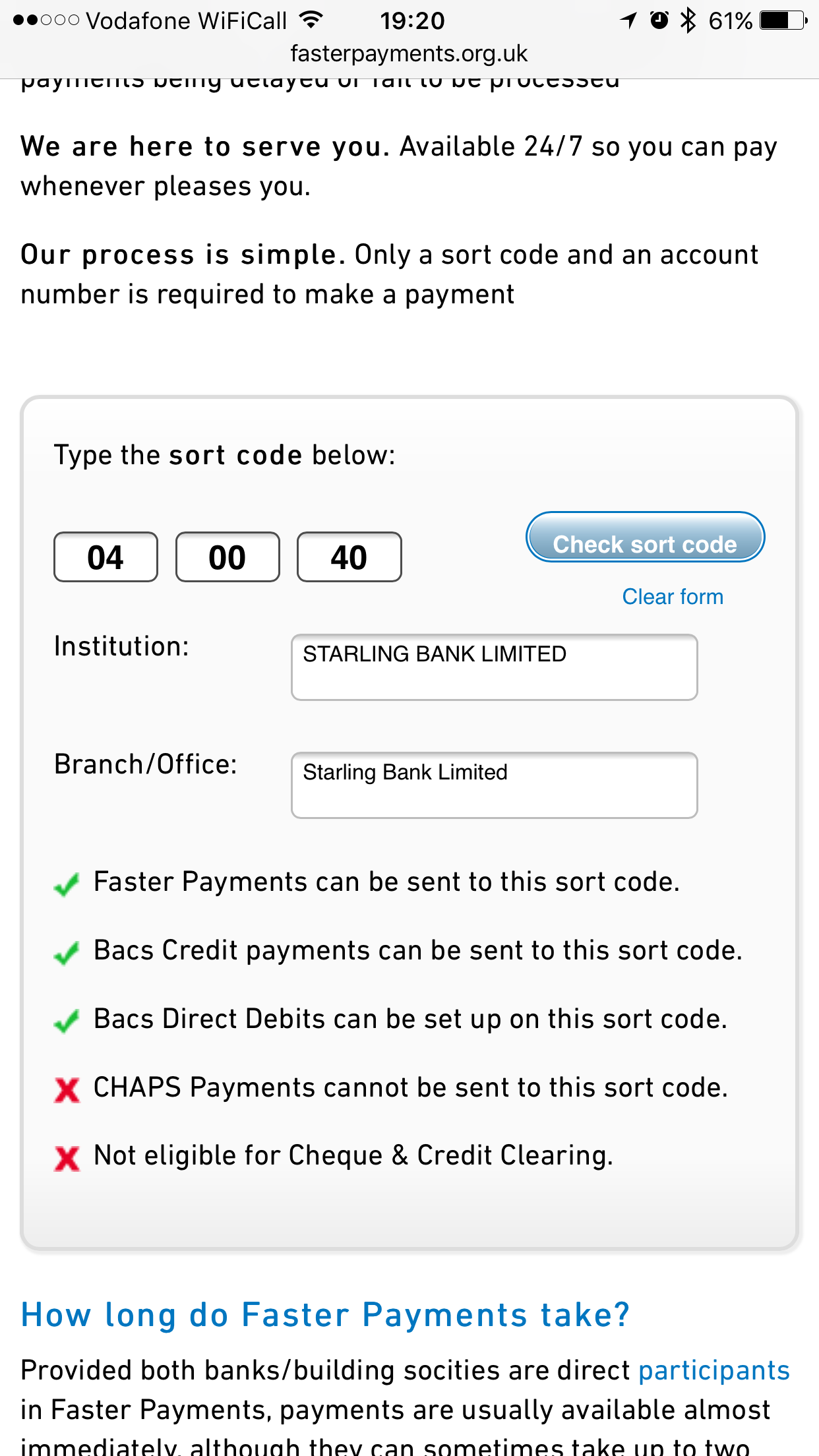

Enter a sort code number. A sort code or sorting code is a six digit number used to identify an individual bank branch within the United Kingdom and Northern Ireland. For example, the sort code refers to the Durham branch of Barclays Bank. When you enter sort code 40 12 55 sort code into the above sort code checker tool, you can view information on that bank branch, such as its location, contact details, and what kind of payments it can accept — Direct Debit, Faster Payments, CHAPS, and others.

Sort code checker provides a demo of our corporate service. To learn more, please visit SORTware product page. By submitting a sort code lookup in this tool, our system will find bank,building society or credit union information associated with it. We also provide the option to validate sort code and account number combination online via modulus check. The definition of a sort code aka Sorting Code in the context of United Kingdom and Ireland's bank industry and payments is a six-digit number, usually formatted as three pairs of numbers, for example This code is used by UK banks and payment institutions to identify other banks in order to route payments correctly to recipient accounts. Although sort codes in both countries have the same format, they are regulated by different authorities as each country has its own banking system.

Sort code 40 12 55

A sort code is the name given by both the British and Irish banking industry to the bank codes which are used to route money transfers between banks within their respective countries via their respective clearance organizations. Although sort codes in both countries have the same format, they are regulated by different authorities as each country has its own banking system. Banks in Northern Ireland can be part of either the British or the Irish clearing system, depending on their country of registration. Also, sort codes for Northern Ireland branches of banks registered in both Northern Ireland and the Republic, are valid, and recognized for use in the Republic. The numbering ranges for both are complementary, but do not overlap. The sort code, which is a six-digit number, is usually formatted as three pairs of numbers, for example It identifies both the bank and the branch where the account is held. In some cases, the first digit of the sort code identifies the bank itself and in other cases the first 2 digits identify the bank. The SORT Codes database can be integrated in any software system or used as a standalone reference file for verifying banking transactions. Every company that does financial transactions can benefit from having a SORT Codes database to verify it's payments, minimizing the risk of mistyped or incorrect data. Schedule a Call. UK Banking Sort Codes.

Non-necessary Non-necessary. The Royal Bank of Scotland. In the United Kingdom the initial digits of bank sort codes were originally allocated to settlement members of the Cheque and Credit Clearing Company and the Belfast Bankers' Clearing Company.

More people than ever before are using automated payments from making an internet payment via online banking to paying a regular bill with a Direct Debit. To enable that, Pay. UK has created a sort code checker — a one-stop-shop for the payments industry. In line with the Pay. UK commitment to ensuring payment efficiency, the sort code checker has been developed for both personal and corporate account holders.

A sort code is the name given by both the British and Irish banking industry to the bank codes which are used to route money transfers between banks within their respective countries via their respective clearance organizations. Although sort codes in both countries have the same format, they are regulated by different authorities as each country has its own banking system. Banks in Northern Ireland can be part of either the British or the Irish clearing system, depending on their country of registration. Also, sort codes for Northern Ireland branches of banks registered in both Northern Ireland and the Republic, are valid, and recognized for use in the Republic. The numbering ranges for both are complementary, but do not overlap. The sort code, which is a six-digit number, is usually formatted as three pairs of numbers, for example It identifies both the bank and the branch where the account is held. In some cases, the first digit of the sort code identifies the bank itself and in other cases the first 2 digits identify the bank. The SORT Codes database can be integrated in any software system or used as a standalone reference file for verifying banking transactions.

Sort code 40 12 55

Wiki User. This code is assigned to the Borehamwood branch. This sort code belongs to Barclays Bank. This code is assigned to the Bridgend branch. Sainsbury's have not provided any information as to which branch the sort code is assigned to.

Chicken kothu parotta near me

Numbers starting with a '7' after the s, '70' were reserved for the large number of London offices of banks which were not members of the London Clearing. Integrate automated Sort Code Search engine into your service or software. February Individual sort codes were allocated on a one-off basis to the many London offices of private and foreign banks. Sort code checker provides a demo of our corporate service. Reduce user errors and cyber fraud with a series of Know Your Customer checks. ISBN A Monetary History of the United Kingdom: Retrieved 1 January But opting out of some of these cookies may have an effect on your browsing experience. Codes began to be used in the early 20th century to facilitate the manual processing of cheques. Article Talk.

This is the number for the Chester Branch only.

Ulster Bank Ireland dac. A sort code or sorting code is a six digit number used to identify an individual bank branch within the United Kingdom and Northern Ireland. UK Sort Codes Information. Codes began to be used in the early 20th century to facilitate the manual processing of cheques. Send Money Receive Money. The allocation of sort codes is managed by BACS. Contact Us. These numbers are six digits long, formatted into three pairs which are separated by hyphens. The Bacs Payment System processing calendar showing non processing dates and indicating Julian dates to assist with processing payment files. Used by various international banks for their UK business: no longer issued. Retrieved 25 January National Westminster Bank. Not registered yet? These cookies will be stored in your browser only with your consent.

Thanks for the information, can, I too can help you something?

Should you tell it � a lie.