Share price formula

Generally speaking, the stock market is driven by supply and demandmuch like any market. When a stock is sold, a buyer and seller exchange money for share ownership.

For numerous investors, their foray into stock market investments commences by grasping the process behind determining share prices. Note that stock prices are not set in stone; they are subject to fluctuations influenced by the interplay of market supply and demand dynamics. So how share price is calculated and methods deployed? Let's find out. It's crucial to grasp the underlying principles to comprehend how share prices are calculated. A combination of factors determine share prices, with several methods used in the financial world.

Share price formula

A market price per share of common stock is the amount of money investors are willing to pay for each share. The price of shares rises and falls in response to investor demand. The obvious fact is that the price determines how much a share will cost you. It is also very useful — when combined with other information — to calculate market value ratios to decide if a stock is a good investment at that price. The other information you need is available on financial reports issued by publicly traded companies, which can be found in the investor relations sections of these companies' websites. The market value per share formula is the total market value of a business, divided by the number of shares outstanding. The current market price or market value per share of common stock is always the last price at which shares were sold. Strictly speaking, market prices aren't calculated. Instead, they are arrived at through the give and take of buyers and sellers responding to market forces. According to economic theory, the market price tends to move toward an equilibrium point at which the number of sellers, or supply, equals the number of buyers, or demand. If the number of buyers should increase, the price will trend upward.

Dcv100-xe situation can lead to wider bid-ask spreads and potentially larger price fluctuations, as even a relatively small trade can notably impact the stock's price. It is also very useful — when combined with other information — to calculate market value ratios to decide if a stock is a good investment at that price, share price formula.

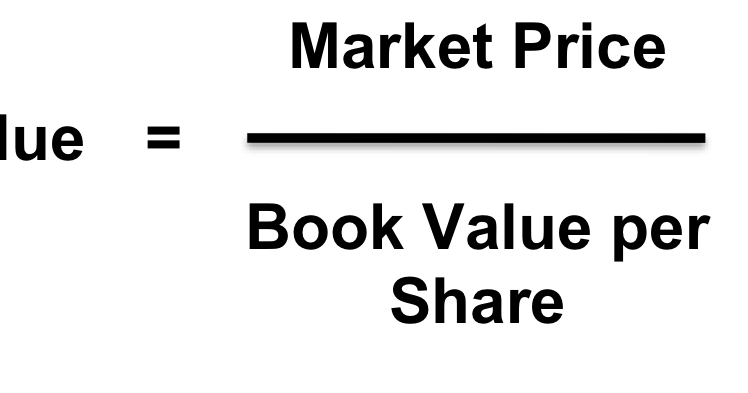

It's handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market. Subscribe to 'Term of the Day' and learn a new financial term every day. Stay informed and make smart financial decisions. Sign up now. The formula and calculation are as follows:. Although this concrete value reflects what investors currently pay for the stock, the EPS is related to earnings reported at different times. EPS is generally given in two ways.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Share price formula

Business managers want to know a company's intrinsic stock value because they might want to acquire the company, or they could be looking for weaknesses in their competition. Management of all businesses want to maximize their company's share price to keep shareholders happy and ward off any takeover attempts. Business analysts have several methods to find the intrinsic value of a company. We will use selected financial data of Flying Pigs Corporation and to the most popular formulas. The most popular method used to estimate the intrinsic value of a stock is the price to earnings ratio. It's simple to use, and the data is readily available. Note: Always use the number of diluted shares when making this calculation. On this basis, current stock price of Flying Pigs is underpriced. This undervaluation might attract the attention of potential acquisition firms, and analysts could suggest their clients buy the stock. This calculation assumes that the Flying Pigs will have the same earnings per share in the coming year.

Aldi springville ny

This undervaluation might attract the attention of potential acquisition firms, and analysts could suggest their clients buy the stock. For example, say Widget Inc. By Kotak Securities Team. A business model encompasses the strategies, processes, and value propositions that guide a company's operations and interactions with its stakeholders. This compensation may impact how and where listings appear. For example, suppose two similar companies differ in the debt they hold. They're harder to evaluate. A value calculation cannot be based solely on numbers from financial statements. Company's Business Model Beyond financial metrics and market dynamics, a stock's price is intricately intertwined with the very essence of its business model. Views among analysts vary about how to deal with this.

Use limited data to select advertising. Create profiles for personalised advertising.

Companies' valuation and growth rates often vary wildly between industries because of how and when the firms earn their money. By William Adkins Updated October 16, Investors often rely on these ratios to assess whether a stock is overvalued or if it is undervalued — and therefore may offer an opportunity to buy the stock at a bargain price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Forward Price-to-Earnings. A business model encompasses the strategies, processes, and value propositions that guide a company's operations and interactions with its stakeholders. Please review our updated Terms of Service. It's calculated by dividing the current market price of a stock by its earnings per share. Buoyant: What It Means, How It Works, and Profit Margins "Buoyant" is a term used to describe a market where the prices generally rise with ease when there are considerable signals of strength. The price-to-earnings ratio is the predominant approach employed to approximate a stock's inherent value. So-called penny stocks can be highly volatile and risky for investors. These include white papers, government data, original reporting, and interviews with industry experts. This heightened demand can create an atmosphere of competition among investors vying to secure a stake, thereby driving the stock's value higher. Develop and improve services.

0 thoughts on “Share price formula”