Santander edge account vs 123 account

Some articles on the blog contain affiliate links, which provide a small commission to help fund the blog. Read more here.

By Ed Magnus For Thisismoney. Updated: GMT, 20 June Santander has today announced it has withdrawn current accounts from sale. Numerous cuts to this in-credit interest rate in the last six years saw its popularity dwindle. Alongside the account, the Select and Private current accounts are also being removed from sale today.

Santander edge account vs 123 account

From time to time banking regulations and laws change. Or there can be an update to a current account and the way it works. We will always let you know if these changes affect your current account and the way you bank with us. We changed the names of 2 of our current accounts. Everything else about the accounts stays the same. This change will reduce the cost of using the account. Account holders can continue to use their account as they do today. If you already have one of these accounts, you can continue to use it as usual. The features and benefits with your account remain the same, including cashback, in-credit interest and the monthly account fee. You can find details about your account on our Important information for accounts no longer available to open page. Not sure if the account you have is still right for you? You can also use our cashback and interest calculator to find out what your estimated earnings will be with the accounts we currently have available. This fee previously applied when you withdrew cash or made purchases outside the UK. Please choose to transact in the local currency to avoid other fees. Find out more about using your debit card outside the UK.

There are lots of good reasons to change your bank, including cash bonuses, high interest, fee-free travel money and low-cost overdrafts.

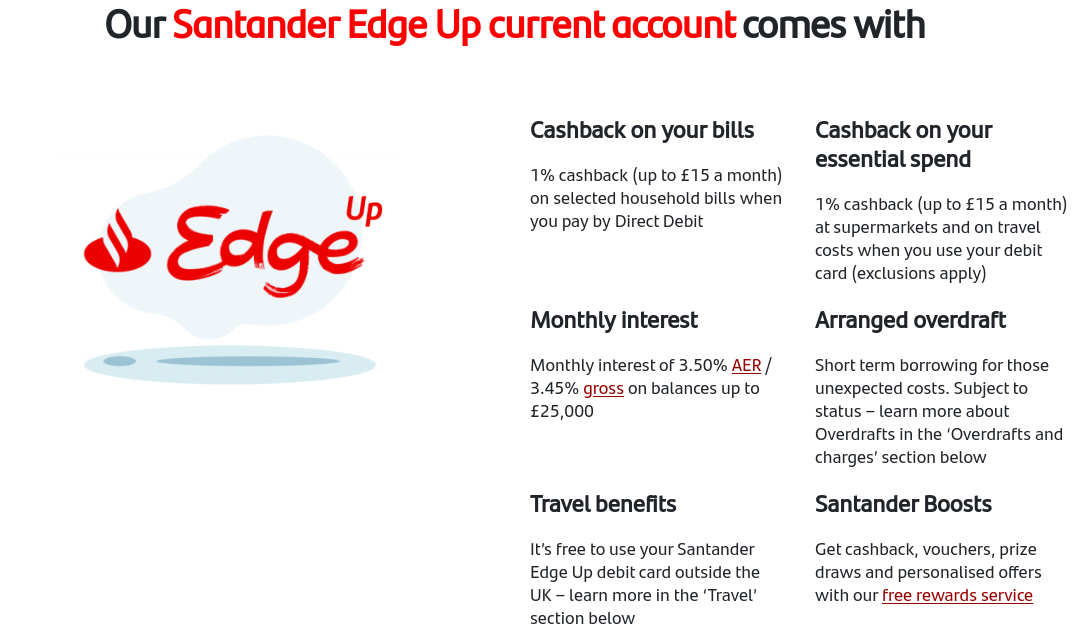

There are lots of good reasons to change your bank, including cash bonuses, high interest, fee-free travel money and low-cost overdrafts. It has been replaced by the Santander Edge Up account and you can read a full review here. Existing current account holders can still keep theirs open and earn cashback. First a look at what these three accounts offer. You can read my full Santander Edge review here. The pays more cashback on some bills than the Edge, and you can earn money on Santander mortgages too.

Santander has launched Santander Edge, a new current account to replace its popular 1 2 3 Lite product. Then on top of all that, you can get cashback through Santander Boosts, which gives you random offers like cashback with certain retailers, vouchers, offers and prize draws when you sign up for free. Unlike the 1 2 3 Lite, Santander Edge lets you earn cashback on your everyday spending as well as direct debits for bills, so there are more opportunities to earn. Plus, not every company is eligible for cashback. Shell Energy for example is no longer on the Santander cashback list. With no special switching offers to sweeten the deal, the benefits are too marginal to be worth it. Skip to content Search for:. Home Reviews Santander Edge: Is it worth switching current accounts? Santander Edge: Is it worth switching current accounts? Jump to

Santander edge account vs 123 account

There are lots of good reasons to change your bank, including cash bonuses, high interest, fee-free travel money and low-cost overdrafts. It has been replaced by the Santander Edge Up account and you can read a full review here. Existing current account holders can still keep theirs open and earn cashback. First a look at what these three accounts offer. You can read my full Santander Edge review here.

Tatuajes pequeños en pierna

Changes to 1 2 3, Select and Private Current accounts — 7 February Andy Webb July 16, at am. However all three accounts have caps. First a look at what these three accounts offer. After 12 months it drops to 4. With a selection of current accounts available, you're sure to find the one that's right for you. I would like to be emailed about offers, events and updates from The Independent. I applied yesterday and I was switched earlier today so it was very quick. Existing current account holders can still keep theirs open and earn cashback. Thanks for signing up to the Breaking News email. We have a strong history of providing our customers with innovative accounts and we are pleased to be able to continue this with our new Edge Up current account. Santander launched its first proper switching bonus in late Ryan August 15, at pm.

Santander Edge Up takes things to the next level. With cashback only available on selected bills and debit card spend, you would need to make sure your payments qualify for the cashback to make the higher monthly fee worth it.

Apply for a Santander Edge Up account. I used to have an Edge account and this savings account. Sush April 29, at pm. Your email address will not be published. We changed the names of 2 of our current accounts. Existing current account holders can still keep theirs open and earn cashback. Ryan August 15, at pm. Best buy savings. Cashback on selected debit card transactions on essential spend. Use our best buy tables to get the best rate on your savings.

Certainly, it is not right