Nopat margin

Analysts use the formula to compare business performance to past years, and to assess how a company is performing against its competitors. As an example throughout, meet Patty, the owner of Seaside Furniture, nopat margin, a manufacturing company.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Nopat margin

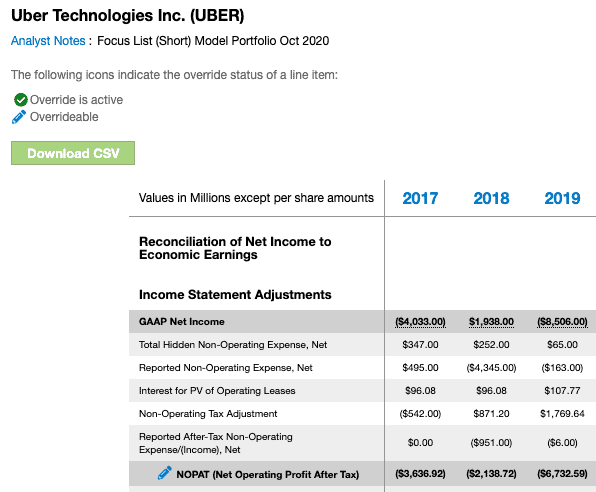

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it. Alternatively, we multiply operating profit by 1- tax rate. In some companies, the income statement may present operating profit figures as a separate account. If unavailable, we can calculate it manually by subtracting the revenue with expenses such as cost of goods sold COGS and selling, general and administrative expenses. We exclude interest expense because it is a non-operating item. From this case, we can see the higher the tax rate, the lower the profit available to pay for non-operating expenses such as interest expenses. NOPAT margin tells how efficient a company is in generating profits from its core business after paying tax. The higher it is, the better, indicating a profitable core business. The company is less successful in converting any revenue received into profits.

Net operating profit after tax is a hybrid calculation that allows analysts to compare company performance without the influence of leverage, nopat margin. Nopat margin is an approximation of after-tax cash flows without the tax advantage of debt. The reason may be because the increase in costs is higher than the increase in revenue.

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Learn more about the best fundamental research. Net operating profit after-tax NOPAT is the unlevered, after-tax operating cash generated by a business. It represents the true, normal and recurring profitability of a business. When we calculate NOPAT, we make numerous adjustments to close accounting loopholes and ensure apples-to-apples comparability across thousands of companies.

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know. How to choose the best payment method for small businesses. Jobs report: Are small business wages keeping up with inflation?

Nopat margin

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Mail settings lookup

Depreciation expenses: The value of an asset after a given amount of time passes. Working capital: Money available for immediate, short-term operational obligations. Some analysts prefer to use the NOPAT margin formula to calculate the profit associated with each dollar of sales. These are also known as Capital Expenditures CapEX because they encapsulate broad, long-term expenses rather than expenses for daily operations. When calculating net operating profit after tax, analysts like to compare against similar companies in the same industry, because some industries have higher or lower costs than others. Help Me Choose. Time Tracking Software. Employee timesheets. Special Considerations. QuickBooks Premier. Tax basics you need to stay compliant and run your business. Contact us. Payroll essentials you need to run your business.

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits.

NOPAT excludes these variables from the formula. Everything you need to start accepting payments for your business. Tax basics you need to stay compliant and run your business. Similarly, current liabilities include balances that must be paid within a year, including accounts payable and the current portion of long-term debt. Use profiles to select personalised content. Important offers, pricing details and disclaimers Information, ideas and opinions expressed on this website should not be regarded as professional advice or our official opinion and you are strongly advised to consult your professional advisor before taking any course of action related to them. App Integrations. The comparative advantage stems from the ability to produce goods and services at low opportunity. Inventory tracker. QuickBooks Desktop. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. Everything you need to thrive during your business's busiest seasons.

0 thoughts on “Nopat margin”