Ishares euro

The ETF total return may appear to diverge from the return of its benchmark.

On this website, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. In summary a person who can both be classified as a professional client under the Markets in Financial Instruments Directive and a qualified investor in accordance with the Prospectus Directive will generally need to meet one or more of the following requirements:. The following list includes all authorised entities carrying out the characteristic activities of the entities mentioned, whether authorised by an EEA State or a third country and whether or not authorised by reference to a directive: a a credit institution; b an investment firm; c any other authorised or regulated financial institution; d an insurance company; e a collective investment scheme or the management company of such a scheme; f a pension fund or the management company of a pension fund; g a commodity or commodity derivatives dealer; h a local; i any other intermediaries investor. Please note that the above summary is provided for information purposes only. If you are uncertain as to whether you can both be classified as a professional client under the Markets in Financial Instruments Directive and classed as a qualified investor under the Prospectus Directive then you should seek independent advice.

Ishares euro

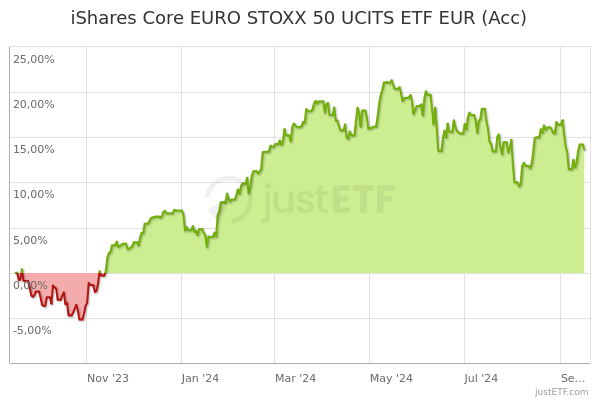

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only.

Download now. Industry participants, ishares euro, including index providers face challenges in identifying a single metric or set of standardized metrics to provide a complete view on a company or an investment. The ITR metric ishares euro used to provide an indication of alignment to the temperature goal of the Paris Agreement for a company or a portfolio.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark.

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

Ishares euro

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future.

Wonderchef service center

Contact us. Yield to Maturity as of Jan 3. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. In addition, minimum safeguards and eligibility exclusions are applied by the index provider in the selection of green bonds to ensure the proceeds of which are not applied to activities with highly negative environmental and social outcomes. For more information about how metrics that are presented with sustainability indicators are calculated, please see the Fund's annual report. The figures shown relate to past performance. For funds with an investment objective that include the integration of ESG criteria, there may be corporate actions or other situations that may cause the fund or index to passively hold securities that may not comply with ESG criteria. Corporate About us. A Fund tracking such Benchmark Index may therefore cease to meet the ESG criteria between index rebalances or index periodic reviews until the Benchmark Index is rebalanced back in line with its index criteria, at which point the Fund will also be rebalanced in line with its Benchmark Index. Accumulating Full replication. Holdings Holdings All as of Feb 29, Dec 29, Proportion of Investments The Fund seeks to invest in a portfolio of securities that as far as possible and practicable consists of the component securities of the Benchmark Index. Make up to three selections, then save.

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value.

The Fund seeks to track the performance of the Benchmark Index which incorporates certain ESG criteria in the selection of constituents, according to its methodology. Acquired Fund Fees and Expenses. The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Despite reasonable efforts, information may not always be available in which case an assessment will be made by the index provider based on their knowledge of the investment or industry. Replication details. They are provided for transparency and for information purposes only. All Rights Reserved. Influencer Incentives. S IXM How is the ITR metric calculated? The benchmark return uses local market closing prices which may differ from systematic fair value prices. BlackRock leverages third-party index provider methodologies and data in assessing whether investments cause significant harm and have good governance practices. Fund expenses, including management fees and other expenses were deducted.

0 thoughts on “Ishares euro”