Hourly tax calculator

California has the highest top marginal income tax rate in the country. Cities in California levy their own sales taxes, but do not charge their own local income taxes. You hourly tax calculator withhold more than your earnings. Please adjust your.

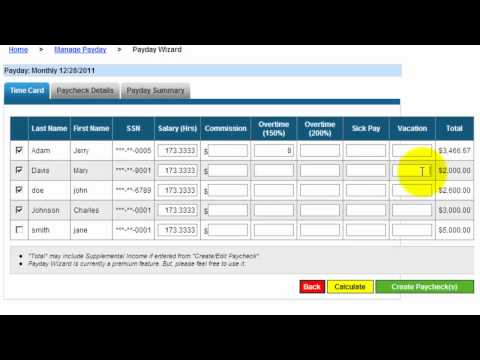

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year Next, divide this number from the annual salary.

Hourly tax calculator

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U. To be exempt, you must meet both of the following criteria:. Here's a breakdown of the income tax brackets for , which you will file in And, here's a breakdown of income tax brackets for , which you will file in When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It's important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn't.

Bonus Calculators Find out how much your bonus will be taxed.

See where that hard-earned money goes - with UK income tax, National Insurance, student loan and pension deductions. More information about the calculations performed is available on the about page. To start using The Hourly Wage Tax Calculator, simply enter your hourly wage, before any deductions, in the "Hourly wage" field in the left-hand table above. In the "Weekly hours" field, enter the number of hours you do each week, excluding any overtime. If you know your tax code you can enter it, or else leave it blank.

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return. The more taxable income you have, the higher tax rate you are subject to. To learn how to manually calculate federal income tax, use these step-by-step instructions and examples. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax.

Hourly tax calculator

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations.

Bar juan sanchez alhaurin el grande

The furlough scheme was due to be replaced by the Job Support Scheme in November , but the furlough scheme has been extended and the Job Support Scheme may be introduced later in the year. Alternatively, your employer might provide you with a cash allowance such as a car allowance which increases your take-home pay. Select state. What Is Conservatorship? If you use salary sacrifice to receive childcare vouchers, enter the amount you receive each month into the Childcare vouchers field. It's important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn't. Overtime can be entered separately. I'm an Advisor Find an Advisor. Luckily, there is a deduction for the part of FICA taxes that your employer would normally pay. This only affects hourly rate and overtime calculations.

All residents and citizens in the USA are subjected to income taxes.

All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. For instance, a single person living at home with no dependents would enter a 1 in this field. As of. Please adjust your. Wondering what your yearly salary is? You can read more about the thresholds and rates used by The Tax Calculator on the about page. Resident in Scotland? If you don't know your tax code, simply leave this blank. If you started your undergraduate course before 1st September , or you lived in Northern Ireland, your loan will be repaid under "Plan 1". Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. Your job probably pays you either an hourly wage or an annual salary. The new W4 asks for a dollar amount. Here's a breakdown of the income tax brackets for , which you will file in Sandwich Is. Do you receive any taxable benefits?

It is remarkable, very useful piece