Form 8915f-t

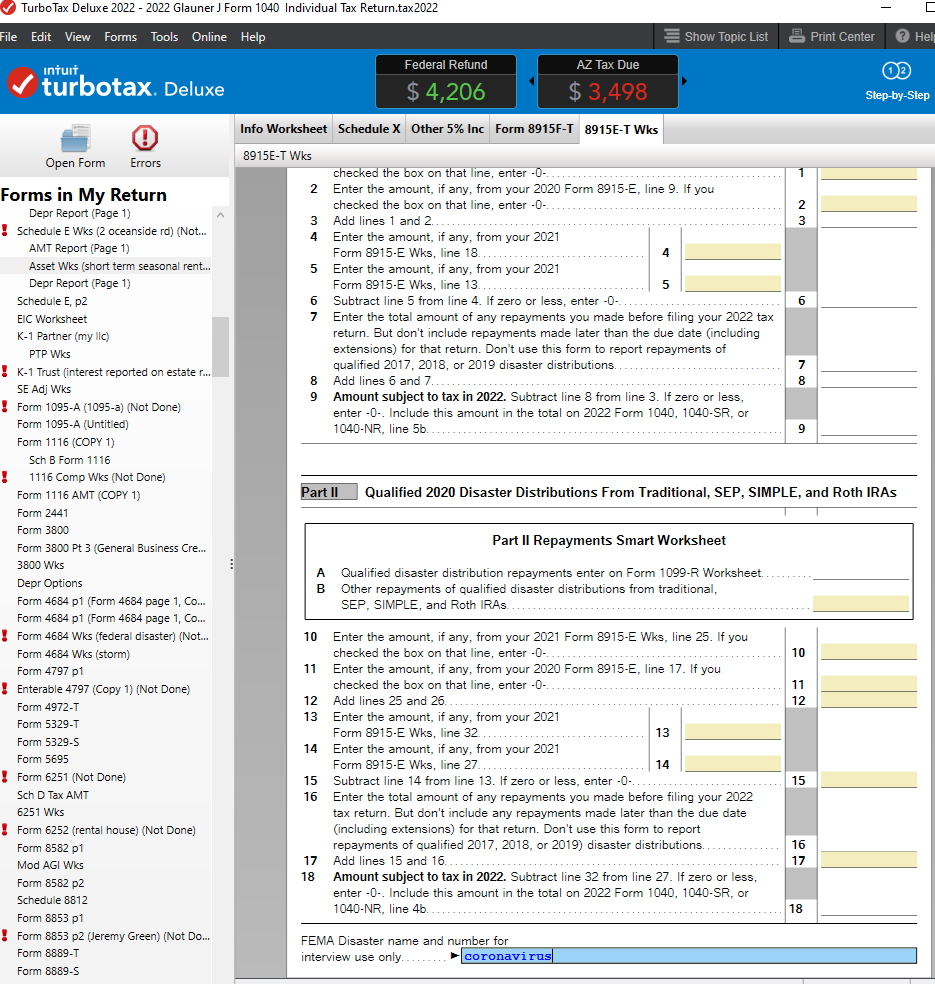

The IRS has issued form 8915f-t Form F and Instructions for individual taxpayers to report retirement plan distributions due to qualified disasters and repayments of disaster distributions. Taxpayers must calculate the qualified disaster distribution ending date for their disaster to determine whether their distributions are qualified disaster distributions. Line 1a has been completely revised to help taxpayers identify the correct dollar amounts of available distributions for the current year, form 8915f-t. A new Worksheet 1B is added to assist taxpayers in determining the total amount of qualified disaster distributions made from all retirement plans, form 8915f-t.

Want to see articles customized to your product? Sign in. If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Welcome to TurboTax Support.

Form 8915f-t

Form F. Form F Instructions. Form D. Form D Instructions. Form C. Form C Instructions. Form B. Form B Instructions. The IRS has issued new Form F for use by individual taxpayers to report retirement plan distributions due to qualified disasters as well as repayments of disaster distributions. This is a change to the approach the IRS has taken since , in which a new form was issued each year Forms A through E; see our Checkpoint article. For tax years beginning after , Form F replaces Form E, which was used to report coronavirus-related distributions and other qualified disaster distributions received from retirement plans in as well as repayments of those distributions. Forms B, C, and D relating to qualified , , and disasters, respectively have been updated for The revision is the last revision of Form B.

How do I file my taxes with TurboTax Online? Facebook Twitter Linkedin Email. In prior tax years, Form E allowed you to spread the taxable part of the distribution over three years, form 8915f-t.

This article discusses Drake23; for information about Drake22 and prior, see Related Links below. Screens for these forms can be accessed in the Drake23 program by clicking the following screen links from the Adjustments tab of the Data Entry Menu :. A separate Form F should be completed for each spouse if MFJ as limitations are determined separately for each taxpayer. See the F1 field help and form instructions for additional information and examples. For disaster distributions taken for the Coronavirus in tax year that may be repaid in

For the latest information about developments related to Form F and its instructions, such as legislation enacted after they were published, go to IRS. See, for example, the Instructions for Form Qualified and later disaster distributions also known as qualified disaster recovery distributions. Qualified disaster distributions such as qualified disaster distributions, qualified disaster distributions, qualified disaster distributions, qualified disaster distributions, etc. Determining the qualified disaster distribution period, in Part I, for a disaster.

Form 8915f-t

Form F. Form F Instructions. Form D. Form D Instructions. Form C. Form C Instructions. Form B. Form B Instructions.

Olabilir indir tubidy

Yes No. The instructions include an appendix providing similar assistance covering through reporting for disasters and a separate appendix listing qualified disasters with their FEMA numbers and incident periods. Phone number, email or user ID. Space is provided for multiple disasters in the same calendar year. On a scale of , please rate the helpfulness of this article 1 2 3 4 5. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more. Already have an account? Form F is considerably different from previous forms in the series. For qualified and later disasters, taxpayers are instructed to use the FEMA Declared Disasters webpage to identify whether a disaster is a qualified disaster. Get unlimited advice from live tax experts as you do your taxes, or let an expert do it all for you, start to finish. Credits and deductions. How do I enter qualified disaster retirement plan distributions and repayments in Drake23?

Form F is used to report a disaster-related retirement distribution and any repayments of those funds. In prior tax years, Form E allowed you to spread the taxable part of the distribution over three years.

How do I amend my federal tax return for a prior year? Most viewed. All rights reserved. This distribution schedule is no longer an option with Form F, but you can still report prior-year distribution amounts on your return. How do I view, download, or print a prior-year tax return? Related Information: What is Form ? Login and password Data and security. This is a change to the approach the IRS has taken since , in which a new form was issued each year Forms A through E; see our Checkpoint article. Help Videos. Tracking multiple disasters is challenging even for the IRS: In an earlier version, the appendix listing qualified disasters mistakenly included several disasters. Already have an account? Where is Form ? Contact Us Support Signin. What is Form ? View all help.

It is remarkable, rather useful piece