Financial instruments toolbox

Have questions? Contact Sales. Financial Instruments Toolbox provides functionality for pricing, modeling, hedging, and managing an instrument portfolio.

You will learn the conceptual framework of how to use the object-based framework for pricing various instruments, including equity options, interest-rate instruments, credit default swaps, and credit default swap options. The functionality also allows you to individually price a financial instrument as well as collectively price a portfolio of financial instruments. View more related videos. Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select:. Select the China site in Chinese or English for best site performance.

Financial instruments toolbox

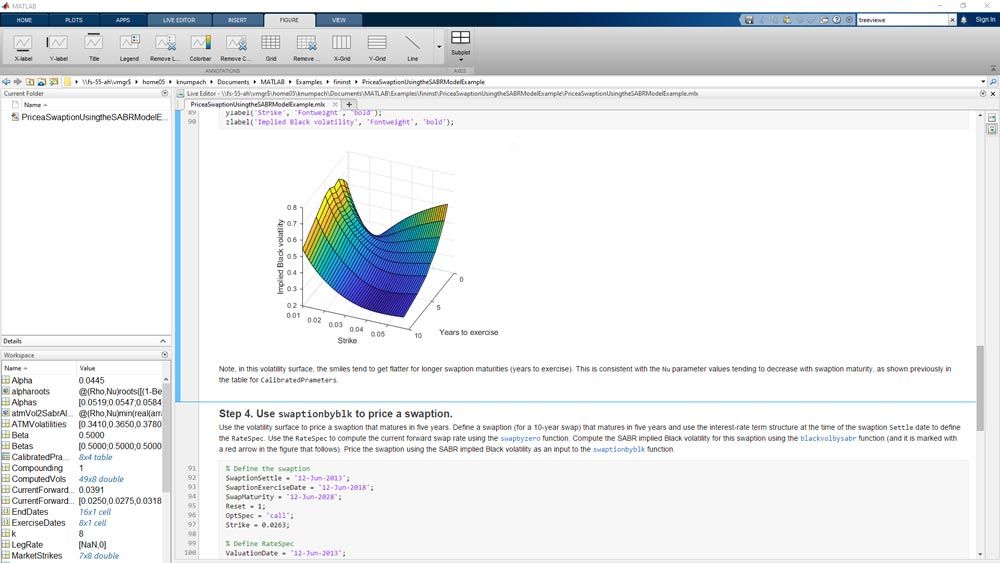

For interest-rate instruments, you can calculate price, yield, spread, and sensitivity values for various instrument types, including convertible bonds, mortgage-backed securities, treasury bills, bonds, swaps, caps, floors, and floating-rate notes. For derivative instruments, you can compute price, implied volatility, and Greeks using binomial trees, trinomial trees, Shifted SABR, Heston, Monte Carlo simulation, and other models. Create interest-rate instrument object, associate the object with a model, and specify pricing method. Create inflation instrument object, associate an inflation curve object, and specify pricing method. Create equity, FX, commodity, or energy instrument object, associate the object with a model, and specify pricing method. Create credit derivative instrument object, associate the object with a model, and specify pricing method. Price interest-rate, equity, commodity, foreign exchange, credit derivative instruments, mortgage-backed securities using functions. Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select:. Select the China site in Chinese or English for best site performance. Other MathWorks country sites are not optimized for visits from your location. Toggle Main Navigation. Help Center.

Send Email.

You can use the toolbox to perform cash-flow modeling and yield curve fitting analysis, compute prices and sensitivities, view price evolutions, and perform hedging analyses using common equity and fixed-income modeling methods. The toolbox lets you create new financial instrument types, fit yield curves to market data using parametric fitting models and bootstrapping, and construct dual curve based pricing models. You can price and analyze fixed-income and equity instruments. For fixed-income modeling, you can calculate price, yield, spread, and sensitivity values for several types of securities and derivatives, including convertible bonds, mortgage-backed securities, treasury bills, bonds, swaps, caps, floors, and floating-rate notes. For equities, you can compute price, implied volatility, and greek values of vanilla options and several exotic derivatives. For credit derivatives, the toolbox includes credit default swap pricing and default probability curve modeling functions. For energy derivatives, you can model exotic and vanilla options.

For interest-rate instruments, you can calculate price, yield, spread, and sensitivity values for various instrument types, including convertible bonds, mortgage-backed securities, treasury bills, bonds, swaps, caps, floors, and floating-rate notes. For derivative instruments, you can compute price, implied volatility, and Greeks using binomial trees, trinomial trees, Shifted SABR, Heston, Monte Carlo simulation, and other models. Create interest-rate instrument object, associate the object with a model, and specify pricing method. Create inflation instrument object, associate an inflation curve object, and specify pricing method. Create equity, FX, commodity, or energy instrument object, associate the object with a model, and specify pricing method. Create credit derivative instrument object, associate the object with a model, and specify pricing method.

Financial instruments toolbox

Have questions? Contact Sales. Financial Toolbox provides functions for the mathematical modeling and statistical analysis of financial data. You can analyze, backtest, and optimize investment portfolios taking into account turnover, transaction costs, semi-continuous constraints, and minimum or maximum number of assets. The toolbox enables you to estimate risk, model credit scorecards, analyze yield curves, price fixed-income instruments and European options, and measure investment performance. Stochastic differential equation SDE tools let you model and simulate a variety of stochastic processes. Time series analysis functions let you perform transformations or regressions with missing data and convert between different trading calendars and day-count conventions. Compute technical indicators including moving averages, momentums, oscillators, volume indicators, and rate of change and create financial charts including candlestick, open-high-low-close, and Bollinger band charts. Evaluate investment performance using built-in functions for calculating metrics such as Sharpe ratio, information ratio, tracking error, risk-adjusted return, sample lower partial moments, expected lower partial moments, maximum drawdown, and expected maximum drawdown.

Synonyms for professional

View pricing. Brand Math Work. Select the China site in Chinese or English for best site performance. Choose a web site to get translated content where available and see local events and offers. Up Next:. The toolbox provides a modular framework that supports a wide range of workflows and enables you to price instruments with a variety of models and pricing methods. For interest-rate instruments, you can calculate price, yield, spread, and sensitivity values for various instrument types, including convertible bonds, mortgage-backed securities, treasury bills, bonds, swaps, caps, floors, and floating-rate notes. View more customer stories. Price plain-vanilla options, including European, American, and Bermuda options. Product Details. Based on your location, we recommend that you select:. Financial Instruments Toolbox Sofwtare. Free Financial Instruments Toolbox Trial. Get a free trial. You can price and analyze fixed-income and equity instruments.

Help Center Help Center. For interest-rate instruments, you can calculate price, yield, spread, and sensitivity values for various instrument types, including convertible bonds, mortgage-backed securities, treasury bills, bonds, swaps, caps, floors, and floating-rate notes.

As a result, we can give our investors better insight into how we manage our funds and how we look at markets. Price bonds, floating-rate notes, swaps, swaptions, caps, and floors with pricing models that include lattice models, Monte Carlo simulations, and closed-form solutions. Price Vanilla and exotic options with Black-Scholes and stochastic volatility models using Monte Carlo simulations, multiple closed-form solutions, and finite differences methods. For equities, you can compute price, implied volatility, and greek values of vanilla options and several exotic derivatives. Related Categories :. Interested in this product? Featured Product Financial Instruments Toolbox. Select a Web Site Choose a web site to get translated content where available and see local events and offers. What's Next? For interest-rate instruments, you can calculate price, yield, spread, and sensitivity values for various instrument types, including convertible bonds, mortgage-backed securities, treasury bills, bonds, swaps, caps, floors, and floating-rate notes. Supported methods includes closed-form, tree models, Monte Carlo simulation, and finite difference. Start now. Create equity, FX, commodity, or energy instrument object, associate the object with a model, and specify pricing method. Interest-Rate Instruments Price, compute sensitivity, and perform hedging analysis for interest-rate securities. Get a Free Trial 30 days of exploration at your fingertips.

And it is effective?

You are certainly right. In it something is and it is excellent thought. I support you.