Boil etf

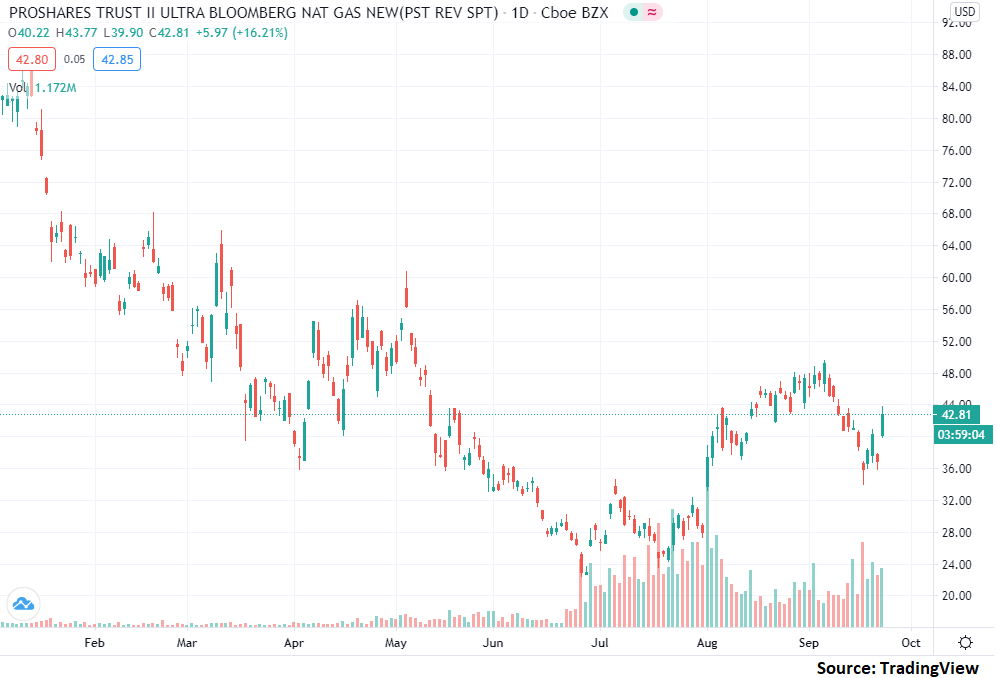

Although natural gas bounced off the previous lows, the risk of another downswing has not decreased. Will the pattern return?

See all ideas. EN Get started. Market closed Market closed. No trades. BOIL chart.

Boil etf

This ETF offers 2x daily leveraged exposure to natural gas, an asset class that is capable of delivering big swings in price over a relatively short period of time. Combining this volatility with explicit leverage results in a fund that has the potential to churn out big gains or losses, meaning that BOIL is really only appropriate for sophisticated, active investors. It is important to understand that BOIL seeks to deliver leveraged returns not on spot natural gas prices but rather amplified returns on an index comprised of natural gas futures contracts. Depending on the slope of the futures curve, returns delivered by futures-based funds can vary significantly from hypothetical gains on an investment in spot for obvious reasons, an investment in spot natural gas is not realistic for most investors. It is also important to note that BOIL maintains a daily reset feature, which means that this position should be monitored carefully if kept open for multiple trading sessions. BOIL does not belong in a long-term, buy-and-hold portfolio, and should generally be avoided by anyone without a deep understanding of leveraged ETFs and natural gas futures markets. For those looking to make a short term bet on nat gas prices, however, BOIL can be a very powerful tool. Those seeking to access the natural gas space through stocks might want to take a closer look at FCG. The adjacent table gives investors an individual Realtime Rating for BOIL on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report. This section shows how this ETF has performed relative to its peers. Returns over 1 year are annualized.

Home page.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

Key events shows relevant news articles on days with large price movements. KOLD 0. UNG 0. SQQQ 1. UCO 0. FNGU 2. SOXS 0. SCO 0.

Boil etf

This ETF offers 2x daily leveraged exposure to natural gas, an asset class that is capable of delivering big swings in price over a relatively short period of time. Combining this volatility with explicit leverage results in a fund that has the potential to churn out big gains or losses, meaning that BOIL is really only appropriate for sophisticated, active investors. It is important to understand that BOIL seeks to deliver leveraged returns not on spot natural gas prices but rather amplified returns on an index comprised of natural gas futures contracts. Depending on the slope of the futures curve, returns delivered by futures-based funds can vary significantly from hypothetical gains on an investment in spot for obvious reasons, an investment in spot natural gas is not realistic for most investors. It is also important to note that BOIL maintains a daily reset feature, which means that this position should be monitored carefully if kept open for multiple trading sessions. BOIL does not belong in a long-term, buy-and-hold portfolio, and should generally be avoided by anyone without a deep understanding of leveraged ETFs and natural gas futures markets. For those looking to make a short term bet on nat gas prices, however, BOIL can be a very powerful tool. Those seeking to access the natural gas space through stocks might want to take a closer look at FCG.

Vore video

Bloomberg Natural Gas. Top-Performing Corporate Insiders. The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios. High OILU 2. To assess the potential returns, find the BOIL dividend yield and dividend history detailed below. Enterprise Solutions. Moving Averages Neutral Sell Buy. Top Smart Score Stocks Popular. To see all exchange delays and terms of use, please see disclaimer. More In Brokers.

.

More In Technical. Market Data. Summary Neutral Sell Buy. Compound Interest Calculator New. No Items in Watchlist There are currently no items in this Watchlist. Low UGL Contact Us. Market closed Market closed. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. No Recent Tickers Visit a quote page and your recently viewed tickers will be displayed here. Have Questions? Daily compounding of returns can lead to the fund's returns varying significantly from the 2x exposure to the index over longer holding periods.

0 thoughts on “Boil etf”