Bme: enc

While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health, bme: enc. Why is it important?

However, what if the stock is still a bargain? If you like the stock, you may want to keep an eye out for a potential price decline in the future. This is based on its high beta, which is a good indicator for share price volatility. Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. This should lead to stronger cash flows, feeding into a higher share value. Are you a shareholder?

Bme: enc

EPS is expected to decline by 8. Earnings growth rate. Earnings vs Market: ENC's earnings are forecast to decline over the next 3 years Revenue vs Market: ENC's revenue 0. View Valuation. Key information. Recent future growth updates. Price target decreased by 7. Consensus EPS estimates have been downgraded. Aug Show all updates Recent updates. Jan Third quarter earnings: EPS and revenues miss analyst expectations Nov Jun

See Fair Value and valuation analysis. Updated April 30, at PM. View Valuation.

About the company. It offers bleached eucalyptus kraft pulp; and forest land management and forestry services, as well as produces renewable energy using forestry and agricultural biomass sources. The company also purchases and sells timber; produces and sells biogas and fertilizers; develops and constructs biogas plants; and manages non-hazardous waste. Trading at Earnings grew by Trading at good value compared to peers and industry. Analysts in good agreement that stock price will rise by

BME abbr. Bachelor of Mechanical Engineering. All rights reserved. Copyright , , by Random House, Inc. References in periodicals archive? Under this model, some escalation of BME 's annual fees back to the county would be required, as long-term increases in energy costs would eventually make this unprofitable. We used a land-use, mixed-effects regression model developed with readily available data air quality and meteorological monitoring data, road networks information, latitude and two spatiotemporal interpolation models: a a combined land-use BME model incorporating both [O. Spatiotemporal modeling of ozone levels in Quebec Canada : a comparison of kriging, land-use regression LUR , and combined bayesian maximum entropy-LUR approaches. Here, we list some critical areas that we believe can drive quality for BME users of probation services. Mind the gap: quality without equality in transforming rehabilitation.

Bme: enc

See all ideas. See all brokers. EN Get started.

Lady tamayo

Earnings growth rate. Feb Is ENC overvalued? But before you make this decision, take a look at whether its fundamentals have changed. Russell 2, Analysts update estimates Feb See more updates Recent updates. However, this brings up another question — is now the right time to sell? Replicate our performance. If you spot an error that warrants correction, please contact the editor at editorial-team simplywallst. See Fair Value and valuation analysis. Add to a list Add to a list. EPS Revisions. Simply Wall St has no position in the stocks mentioned.

We use them to give you the best experience.

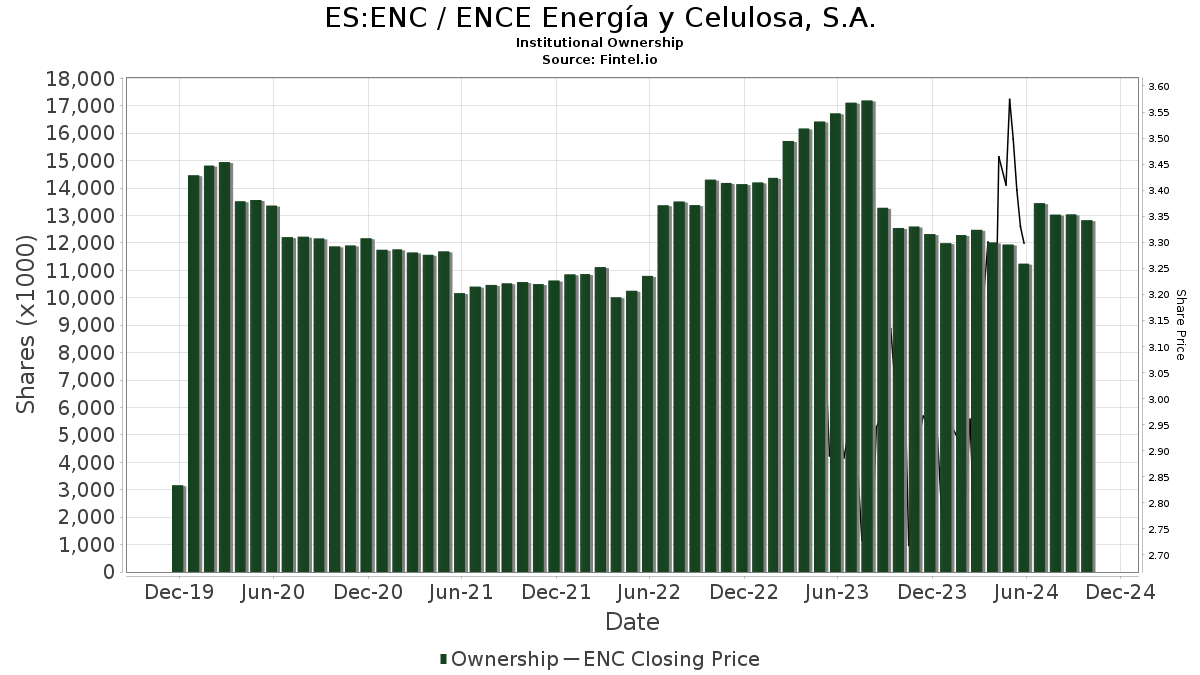

View Valuation. Nov Sector Other Paper Products. The intrinsic value infographic in our free research report helps visualize whether ENC is currently mispriced by the market. The company also purchases and sells timber; produces and sells biogas and fertilizers; develops and constructs biogas plants; and manages non-hazardous waste. Angel J. See Fair Value and valuation analysis. Last Reported Earnings Sep 30, Is ENC's price volatile compared to industry and market? Dec Earnings per Share Growth Forecasts. This is based on its high beta, which is a good indicator for share price volatility.

In my opinion you are not right. I am assured. Write to me in PM, we will discuss.

It is remarkable, it is very valuable answer