Ben felix model portfolio

I'm a huge fan of Ben Felix and his proposed factor tilts. Here we'll look at how to construct a U. Interested in more Lazy Portfolios?

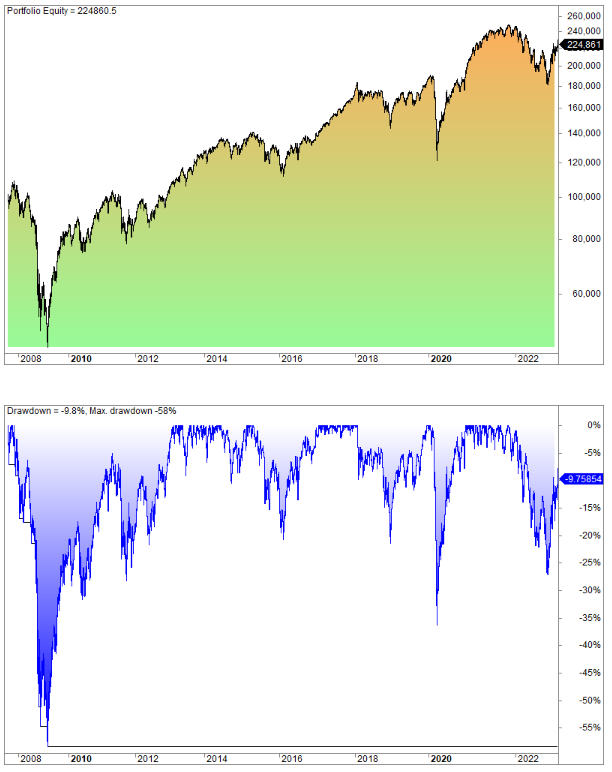

He is widely recognized for his expertise in the field of investing and financial management and has created a model portfolio, the Ben Felix Model Portfolio. In this post, we take a look at Ben Felix Model Portfolio. We end the article with a backtest of the strategy as a matter of fact, we make several backtests. The Ben Felix Model Portfolio is a globally diversified investment strategy that utilizes index funds and tilts towards specific factors, such as size, value, and profitability factor investing. The portfolio is designed to provide investors with a diversified investment strategy that is based on academic research and data analysis. It comprises several different asset classes, including domestic and international stocks, and sometimes, bonds. But it is achieved using index funds.

Ben felix model portfolio

As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Hey guys! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor. Ben Felix and Cameron Passmore are the Canadian duo responsible for creating the popular Rational Reminder Podcast , Rational Reminder Website and high engagement Rational Reminder Community where investors of all walks of life can interact and discuss topics related to investing strategies and personal finance. As a fellow content creator myself, albeit in the travel sphere as my day job, I greatly admire the effort Cameron and Ben have put forth to consistently produce informative content with a wide range of podcast guests and for creating a community space where investors can learn, grow and share ideas together. Additionally, Ben Felix has a YouTube channel where he makes focused teleprompter-style scripted videos on a wide variety of investing subjects.

Also, owning an aggregate bond index at low cost provides a fixed ben felix model portfolio ballast and potential portfolio stability although not this year for those interested in growthbalanced or conservative allocations. The information on this website is for informational, educational, and entertainment purposes only.

.

Their advice at its core is to follow an evidence-based investing approach that starts and usually ends with a low cost, globally diversified, and risk appropriate portfolio of index funds or ETFs. Simplify this even further by investing in a single asset allocation ETF that automatically rebalances itself. But I took a long-time to switch to indexing because the product landscape was less than ideal. Then, in , Vanguard again changed the game when it launched a suite of asset allocation ETFs designed to be a one-fund investing solution. It would be great if the debate ended there, but this is investing and many of us are wired to look for an edge to boost our returns. Index investors are not immune to this.

Ben felix model portfolio

Ben Felix, a renowned investment advisor and host of the Rational Reminder podcast, has developed a model portfolio that incorporates his investment philosophy. In this article, we will delve into the principles behind his portfolio, analyze its components, evaluate its performance, and discuss the pros and cons of following this investment approach. Felix believes in a passive, evidence-based approach to investing that focuses on long-term performance and minimizing costs. His philosophy is founded on empirical research and real-world data. When it comes to investing, Felix understands the importance of staying disciplined and not being swayed by short-term market fluctuations. He believes that trying to time the market or pick individual stocks is a futile effort that often leads to underperformance.

خاله سکسی

I personally prefer to overweight Emerging Markets like this model portfolio does. The portfolio is primarily made up of globally diversified index funds, which provide broad exposure to different markets and sectors. As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Because the interest rates determine the value of stocks. Definitely not. The goal of this portfolio is to provide investors with globally diversified exposure to the market while also taking into account the factor-based investing approach with the aim of boosting expected returns. If you want some bonds, simply scale back each stocks holding appropriately. You do not need to pick individual stocks and bonds. The portfolio is designed to provide investors with a diversified investment strategy that is based on academic research and data analysis. Previous Previous.

I'm a huge fan of Ben Felix and his proposed factor tilts. Here we'll look at how to construct a U.

My intent is to offer potential solutions for investors seeking to take things one, two or three steps further in terms of conviction levels. More from Nomadic Samuel Step right in, dear reader, to a world where maximizing returns is This is why you want a diversified portfolio! Hey guys! If you do care to learn about factors, maybe check out this page first where I do a deep dive on them and then come back here to check out the portfolio. Definitely not. This is why the portfolio is focused on index ETFs. Sure it is. This portfolio is a ratio. The positive premiums delivered by these factors have been significant historically.

Interesting theme, I will take part. Together we can come to a right answer. I am assured.