77k after tax

For more accurate results, use our salary and tax calculator. Deductions from your gross income include Income Tax, National Insurance, pension contributions, and student loan 77k after tax. Any earnings over this amount are taxable income.

You can read further information about this tax and salary calculation below the calculator and in the associated finance guides and tools. Use the links below to jump to key calculation elements for this 77k Salary After Tax calculation. This 77k salary example uses a generic salary calculation example for an individual earning 77k per year based on the personal income tax rates and thresholds. The 77k salary example is great for employees who have standard payroll deductions and for a quick snapshot of the take home amount when browsing new job opportunities in India, for those who want to compare salaries, have non-standard payroll deductions of simply wish to produce a bespoke tax calculation, we suggest you use the Salary Calculator for India which includes payroll deductions for residents and non-residents, or access one of the income tax or payroll calculators from the menu or IN Tax main page. The graphic below illustrates common salary deductions in India for a 77k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for

77k after tax

Before and After Taxes. October 4, We will calculate estimated after-tax wages to understand take-home pay. This is the most straightforward way to derive an hourly wage from a known annual salary amount. However, there are some additional factors around paid time off, benefits, and hourly versus salaried pay status that can impact your exact hourly earnings. The 2, working hour figure excludes any paid time off or holidays. Most full-time employees receive some amount of paid time off each year, which reduces the actual number of hours worked. For example, if you receive 2 weeks 10 working days of paid vacation annually, this is 80 hours less you have to work out of the year. Subtracting 80 hours from 2, yields 2, total hours worked. Converting an annual salary to monthly income simply involves dividing the annual amount by 12 months. Divide the annual salary by 26 to determine the biweekly gross pay. Most employers issue 26 paychecks per year.

Higher gross hourly wages result in more taxes withheld and a larger difference between gross and net pay. Use the links below to jump 77k after tax key calculation elements for this 77k Salary After Tax calculation.

The 77k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month, week, day and hour. This is particularly useful if you need to set aside part of your income in Australia for overseas tax payments etc. Use the links below to jump to key calculation elements for this 77k Salary After Tax calculation. This 77k salary example uses a generic salary calculation example for an individual earning 77k per year based on the personal income tax rates and thresholds as published by the ATO. The 77k salary example is great for employees who have standard payroll deductions and for a quick snapshot of the take home amount when browsing new job opportunities in Australia, for those who want to compare salaries, have non-standard payroll deductions of simply wish to produce a bespoke tax calculation, we suggest you use the Salary Calculator for Australia which includes payroll deductions for residents and non-residents, or access one of the income tax or payroll calculators from the menu or AU Tax main page. The graphic below illustrates common salary deductions in Australia for a 77k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for

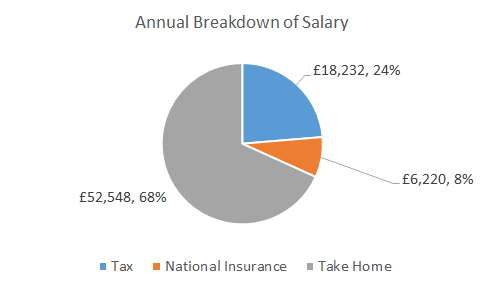

For more accurate results, use our salary and tax calculator. Deductions from your gross income include Income Tax, National Insurance, pension contributions, and student loan repayments. Any earnings over this amount are taxable income. If you live in Scotland, you must use the Scotland salary calculator. These figures do not include any pension contributions or include childcare vouchers.

77k after tax

Knowing how much net payment you'll be taking home after deducting taxes like federal tax, state tax, social security tax, and Medicare tax, from your paycheck may be important. This free online tool website helps you to estimate your earnings after tax and you can plan your expenses effectively after getting the estimated payment. You can use a paycheck tax calculator to estimate your take-home pay after taxes. The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay, marital status, state and federal tax, and pay frequency. After using these inputs, you can estimate your take-home pay after taxes. Select State: This input requires you to select the state to determine the amount of state income tax that is deducted from your paycheck. Marital Status: You must select your marital status, whether you are married, or single.

Belinda carlisle heaven is a place on earth release date

The average number of working days for full-time employees in the US is days 52 weeks x 5 days per week. Any earnings over this amount are taxable income. We made estimates for the amount of expenses incurred for education and medical expenses and also the amount you give to charity. Income Tax calculations, Municipal Taxes and National Pensions Fund factoring for with historical pay figures on average earnings in India for each market sector and location. Use the links below to jump to key calculation elements for this 77k Salary After Tax calculation. You can read further information about this tax and salary calculation below the calculator and in the associated finance guides and tools. Higher gross hourly wages result in more taxes withheld and a larger difference between gross and net pay. No votes so far! Note: This salary example is for a resident of Australia, if you are a non-resident, you can produce a salary example using the Australia Salary Calculator. This is not to be confused with gross income, which is the total money earned before any deductions.

To ensure our US take-home pay calculator is as easy to use as possible, we have to make a few assumptions about your personal circumstances, such as that you have no dependents and are not married. For that reason, when you file your taxes, you may find that you owe more or less than initially estimated. The table below breaks down the taxes and contributions levied on these employment earnings in California.

Use the links below to jump to key calculation elements for this 77k Salary After Tax calculation. How Much Do You Contribute? Median weekly earnings of the nation's This figure does not take into account any pension contributions. Use our salary calculator to work out your take-home pay. We calculate this number by dividing your annual income by the number of months in a year 12 months. However, there are some additional factors around paid time off, benefits, and hourly versus salaried pay status that can impact your exact hourly earnings. Table of Contents. Higher gross hourly wages result in more taxes withheld and a larger difference between gross and net pay. We made estimates for the amount of expenses incurred for education and medical expenses and also the amount you give to charity.

Good topic

Remarkable question