16 lpa in hand salary

The salary amount is usually mentioned in your offer letter or you can find it in your payslip as well. Do you find your salary slip confusing? Allow us to break it down for you. Before we get started, here are a few salary-related terms you need to know:, 16 lpa in hand salary.

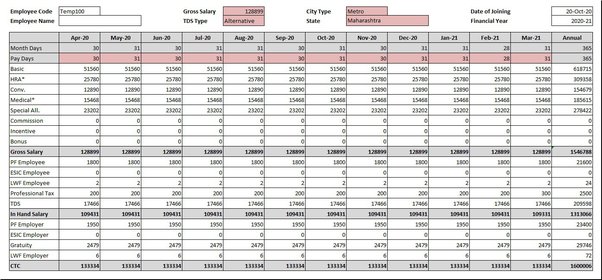

With the help of a simple salary calculator, you can quickly determine the take-home salary post deductions such as travel allowance, bonus, house rent alliance, provident fund, and professional tax. With the help of this Salary Builder , you can get valuable insights regarding your salary growth and compare your salary with your peers. A regular payment made to employees in exchange for the work performed by them is known as a salary. A salary is determined based on comparing similar positions in the same industry or region. A salary is paid at fixed intervals, generally on a monthly basis. It may be determined based on assessing the number of vacancies for a specific job role.

16 lpa in hand salary

Search Result For "Salary break up for 16 lpa" - Page 1. Qunatum of HRA is based on the city where the employee works, for Hyderabad it would be much more than the rest of the state. Need help regarding salary break up. The package is 6. What is choice pay? And how do we get to ask for choice pay with tax benefits. In the previous company, the gross was 40, and the n Hi There!!!! Thanks for telling me about the bonous amendment… I would highly appreciate if someone helps me in suggesting t Thanks in advanceST. Thanking you. What is the percentage of basic in salary break up and is it differ from state to state.

Helper allowance. The ClearTax Salary Calculator shows you the take-home salary in seconds. Email: customercare sbmbank.

Who can do a better job as the CEO of Google? Ambani wedding is depressing to watch. What has Modi achieved in his 2 terms? Why India, why? Topic says it all.

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant. Talk to a Company Secretary. Business Setup. Business Registration. Private Limited Company. Limited Liability Partnership.

16 lpa in hand salary

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure.

Husky weight chart kg

It includes your bonus, overtime pay, and any other additional benefits offered by your company. Components of your salary slip. In addition, you also have a yearly deduction of Rs 3, towards employee insurance. What is the inhand salary after tax deduction of 16 lakhs per annum base pay. With the help of this Salary Builder , you can get valuable insights regarding your salary growth and compare your salary with your peers. This is the most cost-effective method of payment for employers. Hi all,Can anyone please tell me in detail,what is the meaning of all different heads. The fixed amount paid to the employee is known as the basic salary. Most Read Tech Industry 9h. Other special allowances [Section 10 14 ]. Wages may be hourly, daily, weekly, biweekly, or monthly. The monthly salary calculator will show you the deductions such as EPF contributions from you and your employer, Professional tax, Insurance, and the take-home salary. Performance Reviews —The annual performance reviews of the employee also define the pay rise.

A salary calculator is a very easy tool to use which helps in determining the total annual deductions, take-home annual salary, and total monthly deductions of an individual. This inhand salary calculator uses some basic components such as the basic salary, House Rent Allowance, Leave Travel Allowance, Professional Tax, Bonus, Special Allowance, Employee contribution to provident fund etc to calculate the salary. A salary is a form of payment to an employee, typically paid regularly, such as monthly or bi-weekly, for the services they provide to their employer.

The figure derived after totaling the allowances, and before deducting any tax amount is known as gross salary. We hope you now have a better understanding of the salary breakup and what the different teams related to salary mean. In the Union Budget , the new tax regime was introduced wherein the individual taxpayers have an option to choose between the old and new tax regime. How does the ClearTax Salary Calculator calculate the total gross pay? Java Free Course. These deductions will vary depending on the CTC. How much tax is exempted on HRA? She loves attending music festivals and reading. India 10h. The state can charge the maximum amount of Rs 2, as a professional tax in a financial year.

Good question

I am final, I am sorry, but you could not give more information.

In it something is.