13f berkshire hathaway

To see the historical data of Berkshire Hathaway's portfolio holdings please click on the " Q4" dropdown menu and select the date.

Berkshire Hathaway holds 41 positions in its portfolio as reported in the December quarterly 13F filing. Javascript is disabled or is not supported by your browser. Please upgrade your browser or enable Javascript to navigate the interface properly. Add alert. Tip: Access up to 7 years of quarterly data Positions held by Berkshire Hathaway consolidated in one spreadsheet with up to 7 years of data Download as csv Download as Excel. Add alert View chart.

13f berkshire hathaway

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Download as csv Download Excel spreadsheet. Not everyone followed the tech crowd.

A BRK. B has released its fourth-quarter 13F. Explains Morningstar strategist Greggory Warren :. Eventually, the company will disclose the stock or stocks that they have been buying. Berkshire entirely sold out of its positions in D.

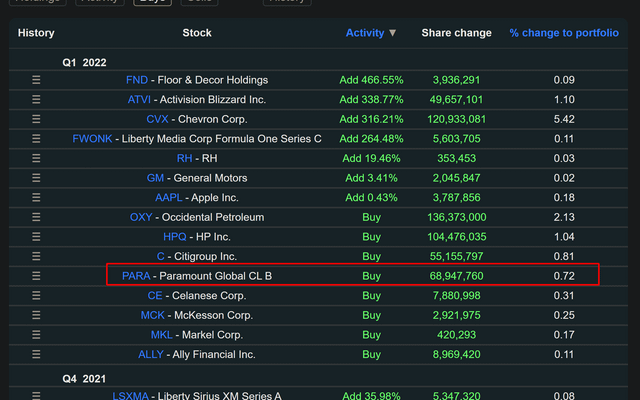

The biggest reduction from the portfolio on an absolute basis was a significant sale of HP shares, with Berkshire selling The company also sold off about a third of its stake in Paramount Global, selling It made a minor adjustment to its Apple position, selling Berkshire also eliminated stakes in D. As for purchases, the insurer only reported additions to existing holdings, picking up another We also know that Berkshire has been busy since the start of , acquiring 4. Some of that total might be tied to additional purchases that Berkshire has made in the five Japanese trading houses Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo. This needs to be put in some perspective, though, as Berkshire has been a net seller of stocks for much of the past year. As for portfolio dynamics, the top five stock positions in the 13F portfolio at the end of the fourth quarter—Apple

13f berkshire hathaway

Berkshire Hathaway holds 41 positions in its portfolio as reported in the December quarterly 13F filing. Javascript is disabled or is not supported by your browser. Please upgrade your browser or enable Javascript to navigate the interface properly. Add alert. Tip: Access up to 7 years of quarterly data Positions held by Berkshire Hathaway consolidated in one spreadsheet with up to 7 years of data Download as csv Download as Excel. Add alert View chart. Download as csv Download Excel spreadsheet. Super-charge your investing with premium access to: Notifications of new 13F-HR filings. Historical data going back as far as Raw data or Excel spreadsheets used by analysts.

Blackpink gerçek isimleri

Investopedia is part of the Dotdash Meredith publishing family. Kroger and rival Albertsons have announced merger plans, though regulatory hurdles persist. Bankrate logo Editorial integrity. The fourth quarter saw Berkshire sell out of its position in homebuilder D. Persistent inflation and high interest rates in the U. Baker is passionate about helping people make sense of complicated financial topics so that they can better plan for their financial futures. We maintain a firewall between our advertisers and our editorial team. However, Berkshire exited the 5. Speed level 3. In physical retail, we anticipate shoppers will choose sellers based on convenience, price, and breadth of assortment, demanding high value as well as a compelling store environment. What is Warren Buffett's portfolio? The noninterest income implied from the company guidance points to strong results in Treasury and Trade Solutions and a rebound in the investment banking and wealth businesses.

Renowned investor Warren Buffett recently submitted his 13F report for the second quarter of , providing insights into his investment moves during this period.

Eventually, the company will disclose the stock or stocks that they have been buying. Berkshire Hathaway owns about 2. Key Principles We value your trust. Here's an explanation for how we make money. However, the same number of investors exited or cut back their positions in the company. To see the historical data of Berkshire Hathaway's portfolio holdings please click on the " Q4" dropdown menu and select the date. At Bankrate we strive to help you make smarter financial decisions. Use limited data to select advertising. Calendar 14 Years of experience. Berkshire takes a concentrated approach with its investments, typically holding the majority of its portfolio in just a few companies. Historical data going back as far as The noninterest income implied from the company guidance points to strong results in Treasury and Trade Solutions and a rebound in the investment banking and wealth businesses. We think the company has carved out a narrow economic moat, thanks to its efficient scale and cost advantage. Horton, selling the nearly 6 million shares it held.

0 thoughts on “13f berkshire hathaway”