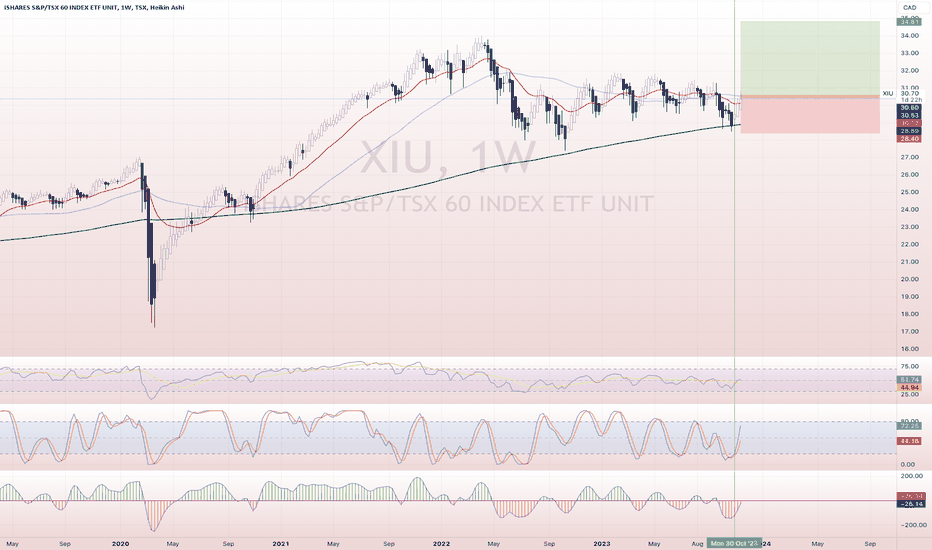

Xiu etf

The above results are hypothetical and are intended for illustrative purposes only. Fund expenses, including management fees xiu etf other expenses, were deducted, xiu etf. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Unlike an actual performance record, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight.

All market data will open in new tab is provided by Barchart Solutions. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer will open in new tab. All Rights Reserved. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Fundamentals information provided by Fundata Canada Inc.

Xiu etf

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio Add an alert. Price CAD Add to Your Watchlists New watchlist. Add to Your Portfolio New portfolio.

Day Low Dollar denominated units, index returns and fund returns for such units are denominated in U, xiu etf. BlackRock leverages this data to provide a xiu etf up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

.

Get our overall rating based on a fundamental assessment of the pillars below. Its market-cap-weighted portfolio embodies the collective wisdom of the market, which should make it tough to beat over the long run. Unlock our full analysis with Morningstar Investor. Morningstar brands and products. Investing Ideas. Will XIU outperform in future? Start a 7-Day Free Trial. Process Pillar.

Xiu etf

The above results are hypothetical and are intended for illustrative purposes only. Fund expenses, including management fees and other expenses, were deducted. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Unlike an actual performance record, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk. There are frequently differences between simulated performance results and the actual results subsequently achieved by any particular fund. In addition, since trades have not actually been executed, simulated results cannot account for the impact of certain market risks such as lack of liquidity. There are numerous other factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for the in the preparation of simulated results and all of which can adversely affect actual results. Tax Distribution Characteristics: link. At least once each year, the Fund will distribute all net taxable income to investors.

Live score pakistan vs south africa

Percentage of Fund not covered as of Feb 23, 0. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. The Globe and Mail Stocks vs. All content on FT. What is the ITR metric? Add to Watchlist Create Alerts. This information should not be used to produce comprehensive lists of companies without involvement. The past performance of each benchmark index is not a guide to future performance. Distributions Interactive chart displaying fund performance. Show more Markets link Markets. Exchange Toronto Stock Exchange.

Investors looking for a cheap and easy way to gain exposure to the Canadian stock market may be best

The ITR metric is calculated by looking at the current emissions intensity of companies within the fund's portfolio as well as the potential for those companies to reduce its emissions over time. AUM Mln. The ITR metric is not a real time estimate and may change over time, therefore it is prone to variance and may not always reflect a current estimate. Skip to content BlackRock BlackRock. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Since , we've been a leading provider of financial technology, and our clients turn to us for the solutions they need when planning for their most important goals. For more information regarding a fund's investment strategy, please see the fund's prospectus. Show more Opinion link Opinion. All amounts given in Canadian dollars. March 9,

Yes, really. All above told the truth. Let's discuss this question.

Duly topic