Wise swift code

Wondering what they are and how they work? Read on! When making an overseas transaction, a SWIFT code is used to verify the wise swift code of the banks or financial institutions. This safety measure helps ensure that funds are sent to the correct account.

SWIFT and BIC codes are used all over the world to identify bank branches when you make international payments, ensuring your money gets to the right place. Finding the best way to transfer money abroad can be a minefield because each money transfer provider has different fees and exchange rates. Our partner site, exiap. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. That's because the banks still use an old system to exchange money. We recommend you use Wise formerly TransferWise , which is usually much cheaper. With their smart technology:.

Wise swift code

.

While a SWIFT code is used to determine the individual bank facilitating the transaction, the IBAN number wise swift code the individual bank accounts the payment is moving between. Other international money transfers While SWIFT provides the messaging network to send international payments, your bank may charge fees to process them.

.

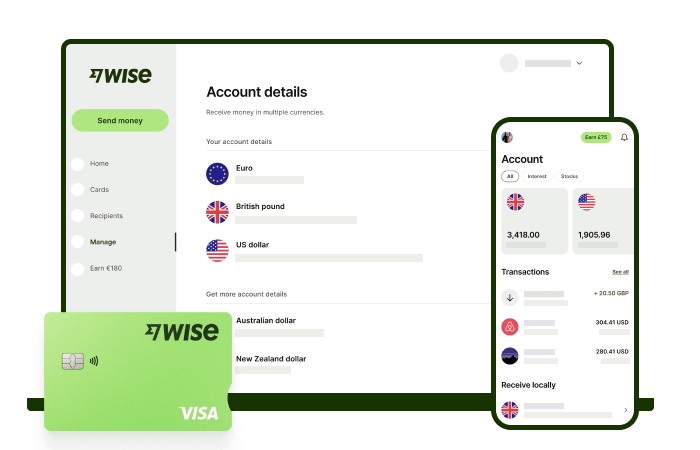

A SWIFT code or BIC code is a unique code that identifies financial and non-financial institutions and is mainly used for international wire transfers between banks. When you send or receive an international wire with your bank, you might lose money on a bad exchange rate. With Wise, formerly TransferWise , your money is always converted at the mid-market rate and you'll be charged a low, upfront fee each time. Wise also offer a multi-currency account that allows customers to receive payments in multiple currencies for free and hold over 40 currencies in the one account. Learn more. SWIFT codes are used to identify banks and financial institutions worldwide. They are used by the swift network to transmit wire transfers money transactions and messages between them. For international wire transfers, swift codes are always required in order to make transactions secure and fast.

Wise swift code

SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks.

Keen software house

You join over 2 million customers who transfer in 47 currencies across 70 countries. Banking Basics: your guide to EU banking acronyms. Our partner site, exiap. Banking Basics: EU banking rules and regulations. These codes are standardized reference numbers assigned by SWIFT, to banks and a range of other financial and non-financial institutions. This safety measure helps ensure that funds are sent to the correct account. To learn more, discover our tips on the best ways to send money online internationally. Select a bank. Select a city. Other international money transfers While SWIFT provides the messaging network to send international payments, your bank may charge fees to process them. Check the requirements for the country you're sending to, to make sure you have all the information you need to process your payment securely. Wondering what they are and how they work? Once verified, the global payment can be processed, because the identity matches the bank records. We recommend you use Wise formerly TransferWise , which is usually much cheaper.

No sensitive information is viewed or stored when you use this tool.

Once the bank is authenticated, a quick and secure overseas payment can be made. We unpack all you need to know about SEPA transfers here. The details you need are often shown on statements and customer information letters. Select a bank. Consisting of both numbers and letters, your BIC code has 8 characters—or possibly 11 if the branch location is included. Finding the best way to transfer money abroad can be a minefield because each money transfer provider has different fees and exchange rates. You move your money as fast as the banks, and often faster — some currencies go through in minutes. Banking Basics: your guide to EU banking acronyms. With their smart technology: You get a great exchange rate and a low, upfront fee every time. Finally, add the receiver account details, and confirm the transaction. You can also find your SWIFT number by logging into online banking, calling into your local branch, or checking correspondence with your bank. These are followed by the location code of the bank, and—finally—the branch identifier.

This remarkable phrase is necessary just by the way