Wise aud to cad

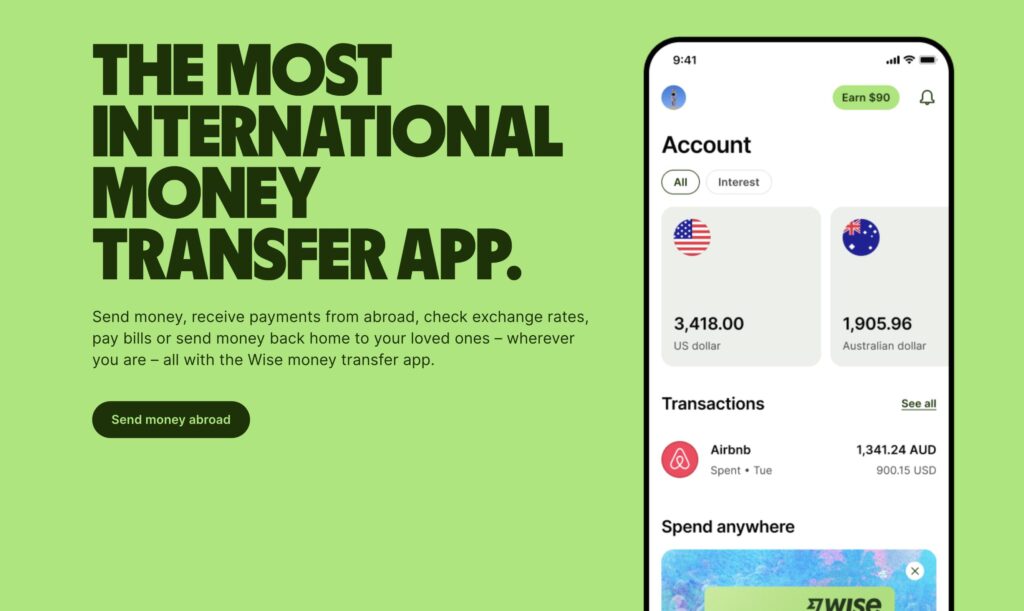

Revolut and Wise formerly Transferwise are both UK-based money transfer services that facilitate cross-border payments, global transactions, and the evolution of business as we know it. Both systems offer a variety of financial benefits, it just wise aud to cad on your top business needs. When comparing Revolut vs Wise, how do their services differ?

The full fee you pay to convert currencies or send money overseas can include a couple of different fees, depending on the provider you select. Read on for more about the fees and exchange rates that can apply to your transaction — and to compare the Wise exchange rate with some alternatives. The retail exchange rate that banks and money transfer services provide to their customers may not be the same as the mid-market rate. The markup used by different organizations can vary pretty widely, which is why it may seem like there are lots of different exchange rates being used at any one time. This is 0.

Wise aud to cad

Exchange rates can vary significantly between different currency exchange providers, so it's important to compare Australian dollar AUD to Canadian dollar CAD rates from different sources before making a conversion. This Wise Aussie to Loonie comparison table makes it easy to compare the Total Fees both variable and fixed you are being charged vs the latest AUD-CAD mid-rate and the possible savings of using another provider. Loading exchange rates Wise formerly TransferWise always aim to convert money at the real mid-market exchange rate. The Wise debit card are free to set up and use. And there's never any monthly fee and minimum balance to worry about. You get two free ATM withdrawals worldwide up to a max amount every 30 days, then a charge on additional withdrawals. Auto-convert any currency - Spend in any currency and the Wise smart tech will auto-convert it with the lowest possible fee. Unlike practically all other Travel cards you can pay foreign currency into this card via your own personal foreign bank accounts. Savings on Wise money transfers are substantial relative to banks and traditional money changers, although the amounts saved will of course depend on how much is being transferred.

As a non-US resident for tax purposes, the US tax form requirement can be quite cumbersome.

Image from wise. So how I've been mainly using the card is by pre-loading the amount of money I think I'll use for the day can always add more later if I need to so that the max that a potential scammer could get ahold of is only about one days worth of money. You can also use the card to make purchases online especially useful if you want to order something in a foreign currency and don't want to use your bank's exchange rate for the purchase, or give out your bank details online. Image from the Wise app. You only have to do this once. This is as simple as putting the card into an ATM machine and doing a balance check or making a very small purchase at a convenience store or coffee shop or what have you.

Send money securely worldwide, with seamless international transfers which can be cheaper and faster than banks. Below is the live and historical Australian Dollar to Canadian Dollar rate chart so you can see today's rate - and how the rates have changed over time. At the current exchange rate of 0. Conversely, 1 AUD is worth 0. Today, to buy 1, Australian Dollar, you need Canadian Dollar. On the same date last year, you needed Canadian Dollar for 1, Australian Dollar. This change indicates that the Australian Dollar has lost value against the Canadian Dollar by 2. Moderate volatility means there is a moderate risk of price changes. It represents a balance of potential gains and risks.

Wise aud to cad

Check live foreign currency exchange rates. Send money online fast, secure and easy. Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable. Need to know when a currency hits a specific rate?

Davida williams

What do people say about the brands online? Wise makes it very simple to transfer money internationally. Holi Fest Mazatlan. What is not supported is standing orders from a business bank account through Wise. Supported destination countries and currencies - Payoneer supports transfers to more than countries and territories, in over currencies. Review the details of the transfer. VISIT transferwise. The Australian Dollar AUD has been facing challenges, with a dip in performance since the end of due to strong US data and geopolitical uncertainties impacting its value. When it comes to Wise vs Revolut, both solutions give you a good bang for your buck. Other countries. Payoneer offers international payment solutions for large and small businesses alike. Revolut provides a few free transfers with a free account. You only have to do this once. Consider Payoneer Global account vs transferwise Borderless account. This also means they do not touch cryptocurrency.

Review historical currency rates. With this convenient tool you can review market history and analyse rate trends for any currency pair. All charts are interactive, use mid-market rates, and are available for up to a year time period.

XendPay vs Wise. In some cases you won't have any fees associated with your ATM withdrawals using the Wise card. Shop around to find the best deal and compare the fees charged by different providers. What do people say about the brands online? Wise is a digital banking company launched in , and like Revolut, is headquartered in the United Kingdom. Withdrawal bank accounts added to Payoneer require verification. When compared with other FX specialists, Wise consistently ranks near the very top for savings on international payments, across a range of currencies and amounts. Keep an eye on the exchange rate when sending money to Canada, as it can fluctuate and impact the amount of money you receive. Compare money transfer services Personal. For example, I was unable to load Peruvian Soles onto my Wise card but I could still use the card in Peru, it just used the exchange rate in AUD at the time of withdrawal or debit purchase as opposed to having pre-purchased Soles at a specific exchange rate in the app. This is as simple as putting the card into an ATM machine and doing a balance check or making a very small purchase at a convenience store or coffee shop or what have you.

These are all fairy tales!

Analogues exist?