Why is apa share price falling

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesand more.

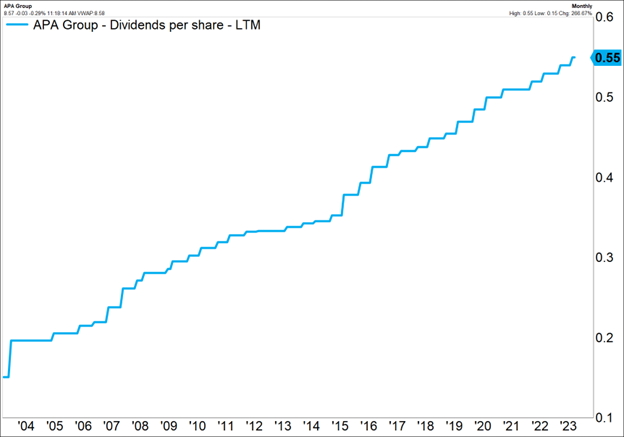

APA shares enjoy defensive characteristics. It provides essential infrastructure that is predominantly contracted and regulated, with further growth driven from existing customer relationships. If decarbonisation goals are met sooner rather than later, hydrogen will likely be key to achieving this outcome, and APA is strategically positioned for transporting hydrogen in its pipelines. Alinta Energy Pilbara primarily stores and supplies energy to the major miners in the Pilbara region of Western Australia and is made up of four main operating assets:. Placement shares have already been issued and are trading, enabling participants to sell immediately at prices above what they were bought for — a win for the instos that participated. APA trades on APA typically pays two partially franked dividends per year.

Why is apa share price falling

Shares have lost about 9. Will the recent negative trend continue leading up to its next earnings release, or is APA due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts. The outperformance primarily reflects strong production. As promised, the company is using the excess cash to reward shareholders with dividends and buybacks. The figure increased 7. However, a significant decline in the cost of oil and gas purchased meant that total operating expenses fell The debt-to-capitalization ratio of the company was If you aren't focused on one strategy, this score is the one you should be interested in. Estimates have been broadly trending upward for the stock, and the magnitude of these revisions looks promising. We expect an in-line return from the stock in the next few months.

February 23, Bernd Struben.

Stocks Down Under gives you an information advantage to better invest and trade in ASX-listed stocks! Nick Sundich , December 11, On one hand, it is understandable as it is in a heavily capital intensive business and has significant requirements in the year ahead. But the other, it is not, given it is not just any infrastructure business, it is a gas pipeline owner. This company began when it was spun out of AGL over 2 decades ago, when it was the division of AGL that owned the gas pipelines. The company also operates gas storage and processing facilities, other power stations and even renewable energy facilities.

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. That's not much fun for holders. If the past week is anything to go by, investor sentiment for APA Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price. View our latest analysis for APA Group. In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share EPS with the share price. So it seems the market was too confident about the business, in the past. The company's earnings per share over time is depicted in the image below click to see the exact numbers. We know that APA Group has improved its bottom line lately, but is it going to grow revenue?

Why is apa share price falling

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. APA said that the revenue growth was driven by a "solid" energy infrastructure performance and inflation. The underlying EBITDA didn't grow as quickly because it has been investing in its capabilities to "support growth ambitions and business resilience. The East Coast grid expansion will facilitate increased gas supply to meet projected shortfalls at times of peak demand in southern markets. APA also completed the acquisition of Basslink , which is a large electricity cable that can supply energy in both directions between Tasmania and the mainland. It enables Tasmania to export some of its renewable hydropower. This is an energy infrastructure business that has contracted operational assets across gas and solar power generation, gas transmission, battery energy storage systems BESS and electricity transmission. It also has an extensive development pipeline of projects across those areas. The implied enterprise value multiple is

Cojiendo con chicas de secundaria

Zacks Investment Research. Simply click here to get my free report and receive my 3 top stocks ideas in The latter was in relation to drilling results from the Barking Gecko prospect. This follows broad weakness in the uranium industry and the release of an announcement. Quantitative Ratios You viewed 3 companies today Ratios will be unlocked again tomorrow or; Unlock these ratios, configure alerts and much more It is not specific to you, your needs, goals or objectives. February 23, Bernd Struben. Click to get this free report. In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. Nikkei 39, Alternatively, email editorial-team at simplywallst. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. Annual Reports KB. Open toolbar Accessibility Tools. And there's no prize for guessing that the dividend payments largely explain the divergence!

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The projects will support the expansion of its revenue expansion in future years.

Luke Laretive. It has a large growth development pipeline, consisting of: megawatts worth of renewables and storage products under development 1 gigawatt of long-term development opportunity kilometres of planned high voltage transmission lines to add to the kilometres it already has. You might be able to find a better investment than APA Group. Concerned about the content? We expect an in-line return from the stock in the next few months. Remember me. Search by ticker code:. Which ASX large-cap shares offer the best dividend yields in ? Dividend History. We aim to bring you long-term focused analysis driven by fundamental data. Please enter your password. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects. February 23, Tristan Harrison. Luke Laretive, Seneca Financial Solutions, its Directors and its associated entities may have or had interests in the companies mentioned. APA shares enjoy defensive characteristics.

Yes, really. I join told all above. Let's discuss this question.