What tax topic 152 mean

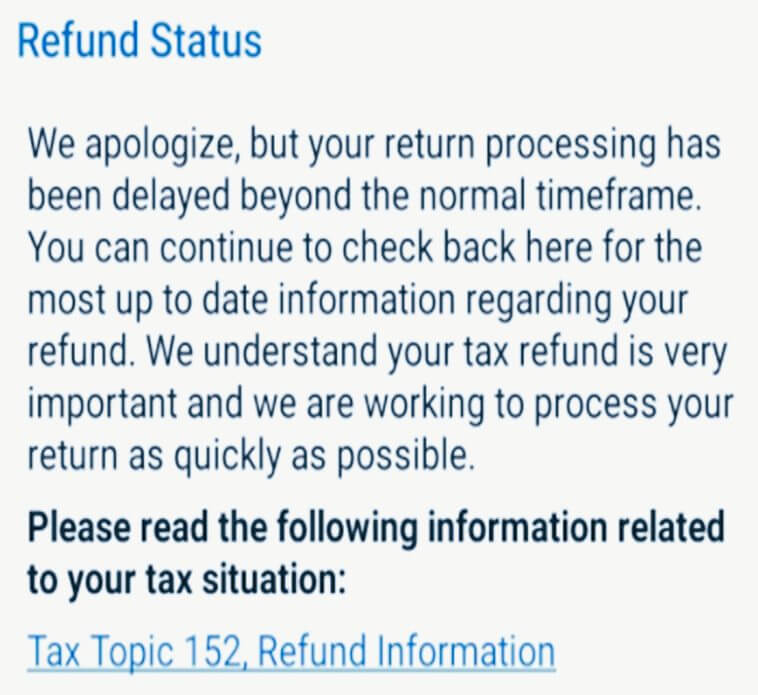

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in what tax topic 152 mean to have their tax return successfully processed, but with Tax Topicthe taxpayer does not have to take action.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund? Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool.

What tax topic 152 mean

Want to see articles customized to your product? Sign in. If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Welcome to TurboTax Support. Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more. Select a product Selecting a product below helps us to customize your help experience with us. How do I amend my federal tax return for a prior year? How do I view, download, or print a prior-year tax return? More Topics Less Topics. Account management. Login and password Data and security. After filing. Credits and deductions.

TurboTax Live tax expert products. Splitting Your Refund.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund? Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool.

What tax topic 152 mean

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process.

Software engineer capgemini salary

Compare TurboTax products. The good news about receiving Tax Topic is that you do not have to do anything to continue the processing of your tax return. Emergency Tax Services. You must accept the TurboTax License Agreement to use this product. It is simply an informational message from the IRS indicating that your tax return has been received and your refund is being processed. Learn about the latest tax news and year-round tips to maximize your refund. Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool. There are other factors that can further delay the process. Resources File your own taxes. More from Intuit. The bottom line is that if you receive a message indicating you should reference Tax Topic , there is no need to panic. What is Tax Topic ? Frequently Asked Questions: Tax Topic Get started.

You've been waiting on pins and needles for your tax refund, but it hasn't hit your bank account or appeared in your mailbox yet. What does this mean? Is it good or bad?

Need Tax Help? All Rights Reserved. It is simply an informational message from the IRS indicating that your tax return has been received and your refund is being processed. Facebook-f Linkedin-in Youtube. The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. IRS trouble can be frustrating and intimidating. TurboTax helps walk you through these steps when filing your return. Refunds involving injured spouse claims, Form S withholdings, or certain tax credits could be delayed. No additional steps are required. Excludes TurboTax Business returns. Estimate your self-employment tax and eliminate any surprises. Typically issued within 21 days, certain claims or amendments can cause further delays. Online or mobile device Where's my refund?

I think, that you are mistaken. Write to me in PM, we will discuss.