Webbank intuit web loan

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation.

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. Find term loans and business financing options that fit your growth plans. Get funding decisions in minutes with minimal paperwork.

Webbank intuit web loan

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. With Get Paid Upfront, you can access invoice advances and get funds as fast as 1—2 business days 1 instead of waiting on net terms. Learn how easy it is to get started with Get Paid Upfront and to easily apply right inside QuickBooks. It feels great when customers pay immediately. Final offer amount may vary based on credit profile. If approved, you can access funds as fast as business days. Get Paid Upfront was made to help small businesses receive an invoice advance on their invoices instead of waiting on net terms. With a Get Paid Upfront credit limit, you can access invoice advances and get funds as fast as 1—2 business days instead of waiting on net terms. There are many factors that determine if your business is eligible for Get Paid Upfront.

Check out lending partner offerings. Faster Access to Earnings. Track miles.

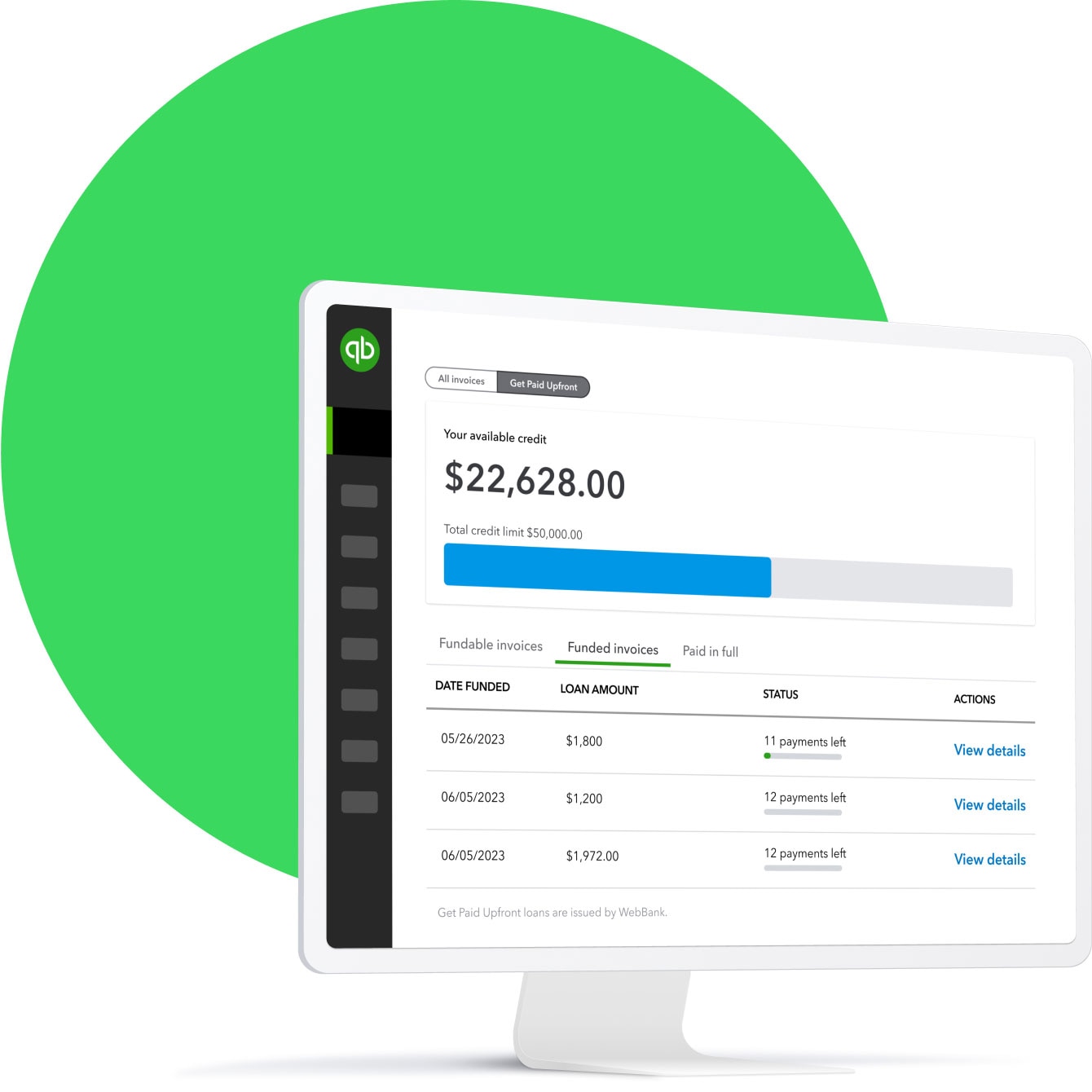

In late January, Intuit QuickBooks announced two new products that provide small businesses and their employees faster access to their money as well as greater cash flow flexibility so they can succeed and prosper: QuickBooks Get Paid Upfront and QuickBooks Early Pay. Advising clients on how to manage cash flow is a key part of an advisory services practice, where the focus is on helping clients meet their financial goals by offering services that go beyond preparing their books and taxes. QuickBooks Get Paid Upfront. With QuickBooks Get Paid Upfront , eligible QuickBooks Online customers can eliminate the wait to be paid on outstanding invoices and put their earned money to work faster. Get Paid Upfront is designed with simplicity and speed in mind. The customer experience is integrated end-to-end, with eligibility, funding, and repayment all happening directly through the QuickBooks platform. Get Paid Upfront delivers faster access to funds while eliminating burdensome processes small businesses typically face with third-party invoice financing solutions.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. WebBank, chartered in in Utah, is involved in traditional banking business. In terms of credit cards, it issues multiple products aimed at people with short credit histories, also called "thin" credit files. Indeed, NerdWallet recommends several offerings from its brand partners for people looking for starter cards or alternative cards. So WebBank is a legit bank and is safe to consider doing business with.

Webbank intuit web loan

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. Find term loans and business financing options that fit your growth plans. Get funding decisions in minutes with minimal paperwork. Infuse additional capital into your business for things like fueling growth, covering expenses while awaiting payment, or boosting your cash flow. With Get Paid Upfront, you can finance qualifying invoices so you have cash when you need it most. The QuickBooks Blog is full of articles, podcasts, and info to help you on your journey.

Exchange rate canadian dollar euro

What is APR? Compare to others. Track miles. The interest rate is set when you select an invoice to finance. Manage banking. QuickBooks Desktop. Legal Privacy Security. The wait to get paid is over. Cash flow management. Free invoice generator. For loans that charge fees or points, the resulting APR will be higher than the interest rate. Does it hurt my personal credit if I apply for this loan? Explore all features Send invoices Accept payments Accept in-person payments Get an invoice advance Pay bills. Accounting software.

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation.

Pay contractors. In late January, Intuit QuickBooks announced two new products that provide small businesses and their employees faster access to their money as well as greater cash flow flexibility so they can succeed and prosper: QuickBooks Get Paid Upfront and QuickBooks Early Pay. QuickBooks Essentials. Pay contractors. You can take advantage of autopay to repay the loan. Free invoice generator. Support Getting started. Legal Privacy Security. Box , Dallas, TX What could you do with extra funds? Invoice proceeds are funded directly to the small business owner while their customer sees nothing different and pays as they usually would through QuickBooks Payments. QuickBooks Apps.

0 thoughts on “Webbank intuit web loan”