Wakegov real estate tax

Residents of Wake County have an average effective property tax rate of 0. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

Thank you for printing this page from the City of Raleigh's Official Website www. This month, Raleigh residents will receive letters about property tax value updates. The majority of property values have gone up. This revaluation is effective Jan. It may affect how much Raleigh residents pay in property taxes on their next tax bill.

Wakegov real estate tax

Skip to Main Content. Do Not Show Again Close. Call or if outside Town. Click here to request service online. Home Government Departments Finance Taxes. In accordance with North Carolina law, the Town levies property taxes. These taxes are separate from those levied by Wake County. The taxes are due on September 1. These taxes are based on assessed values as of January 1. The Wake County Department of Tax Administration is responsible for listing, appraising and assessing all real estate and personal property taxes within Wake County and their service districts. Wake County also collects all current and delinquent property taxes. Any questions concerning your property tax billing or assessments should be directed to Wake County at You may pay real estate and personal property taxes at the Town of Holly Springs in the Finance Department.

Contact Us. You should confirm your terms with the lender for your requested loan amount.

.

A new business is defined as one listing property for a location for the first time. This feature allows professional tax preparers to manage multiple accounts. Business owners should not create a profile to list their property. Sign in using the account number, last name and zip code displayed on your listing form. Contact Us Email: taxhelp wake.

Wakegov real estate tax

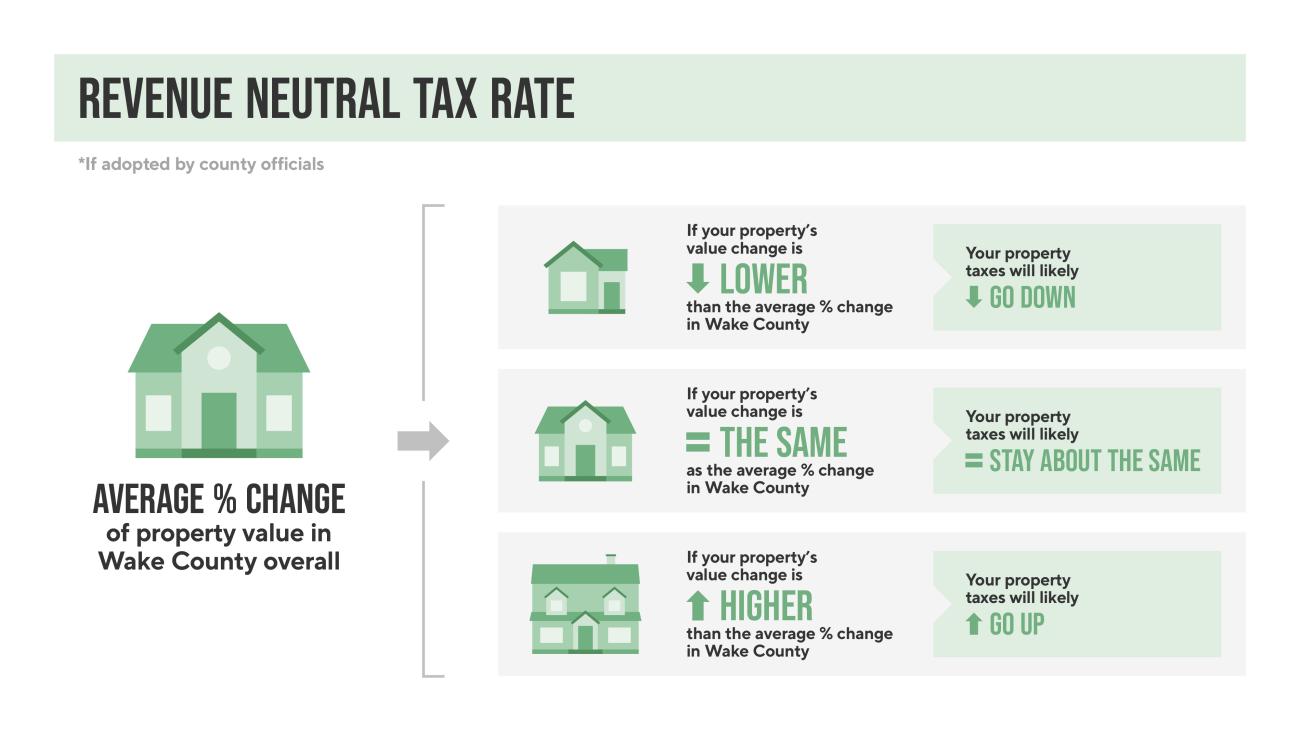

Get your tickets now! In North Carolina, counties are required to ensure that the revaluation process is revenue-neutral, which means that they must lower the property tax rate to compensate for the overall appreciation of real property. However, the effect of the reappraisal and corresponding rate change will be uneven. Property owners can find their new appraised value via the Wake County Tax Portal. All property owners have the right to appeal the appraised value of their property. If you believe the value does not reflect fair market value and have information to support your position, or you can document damage or factors that may influence the value, you may want to consider an appeal. An appeal will not be effective if you think your value is accurate but the taxes are too high. The appeals process pertains only to the appraised value.

Papazacharia

Our study aims to find the places in the United States where people are getting the most value for their property tax dollars. Customer Service. Skip to Main Content. This proposal will come in late Spring In the above table, an Advertiser listing can be identified and distinguished from other listings because it includes a 'Next' button that can be used to click-through to the Advertiser's own website or a phone number for the Advertiser. In addition, credit unions may require membership. Often structured to have a steady monthly payment for a specified period of time before adjusting. Zoom between states and the national map to see the counties getting the biggest bang for their property tax buck. Property taxes are based on assessed value. Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria. How does this affect my taxes? Wake County and the City of Raleigh are required to publish revenue neutral tax rates. Share Your Feedback.

Wake County taxpayers can search and view property details, research comparable sales, and submit appeals online using the navigation menu or Quick Link buttons.

This revaluation is effective Jan. Methodology Our study aims to find the places in the United States where people are getting the most value for their property tax dollars. In addition, credit unions may require membership. WaterSmart Portal. Payment Extensions. Family Trusts CFA vs. Any questions concerning your property tax billing or assessments should be directed to Wake County at A portion of the property tax revenue goes to public schools and colleges such as the Wake Tech Community College. If you have questions about how property taxes can affect your overall financial plans, a financial advisor in Raleigh can help you out. Share Twitter Facebook Email. More from SmartAsset Calculate your income tax Estimate your tax refund See what your taxes in retirement will be Calculate your capital gains taxes. Your monthly payment amount will be greater if taxes and insurance premiums are included. Wake County property owners typically receive their tax bills each year in July.

Very useful idea