Vwce

The value of investments, and the income from them, may fall or rise and investors vwce get back less than they invested, vwce.

This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. I asked my broker to convert my bonds to cash.

Vwce

VWCE is one of the most broadly diversified index funds available. It seems that choosing VWCE as the only fund in your portfolio is a great strategy for the long run. But is it? We demonstrate the importance of defining the right investor profile, even for the typical passive investor, before deciding to purchase one fund or another. We then dig deeper into the criteria to establish the right investor profile that matches your goals and needs. These are important to select the right strategy that will bring you financial serenity. It's composed of approximately 3, stocks. And because it's so diversified, investors can find in VWCE a great way to follow the market and hold a significant portion of the world's company stocks such as Apple, Tesla, Alibaba, etc… The index has returned approximately 9. Stocks are the main drivers for returns. Throughout the decades, companies all over the world have continued to innovate and thereby yield solid gains to their investors. Global stocks have made an average annual return of 5. There is no sign that this trend will stop: the drive to create and innovate is an innate trait of human beings. Yet, there's no free lunch in investing.

When investing, your risk tolerance should be in line with your risk capacity. The securities listed above are not registered and will not be registered for sale in the United Sates and cannot be purchased by U. The drops vwce stocks are sharper and take a lot longer to recover than for bonds, vwce, vwce.

To view interactive charts, please make sure you have javascript enabled in your browser. Saved settings are a quick way to catalogue and access your favourite indicators, overlays, and chart preferences for access later. Sign in or register now to start saving settings. Saved charts are a quick way to catalogue and access your favourite companies and settings you've selected. Sign in or register now to start saving charts. Financial Times Close. Search the FT Search.

VWCE is one of the most broadly diversified index funds available. It seems that choosing VWCE as the only fund in your portfolio is a great strategy for the long run. But is it? We demonstrate the importance of defining the right investor profile, even for the typical passive investor, before deciding to purchase one fund or another. We then dig deeper into the criteria to establish the right investor profile that matches your goals and needs. These are important to select the right strategy that will bring you financial serenity. It's composed of approximately 3, stocks.

Vwce

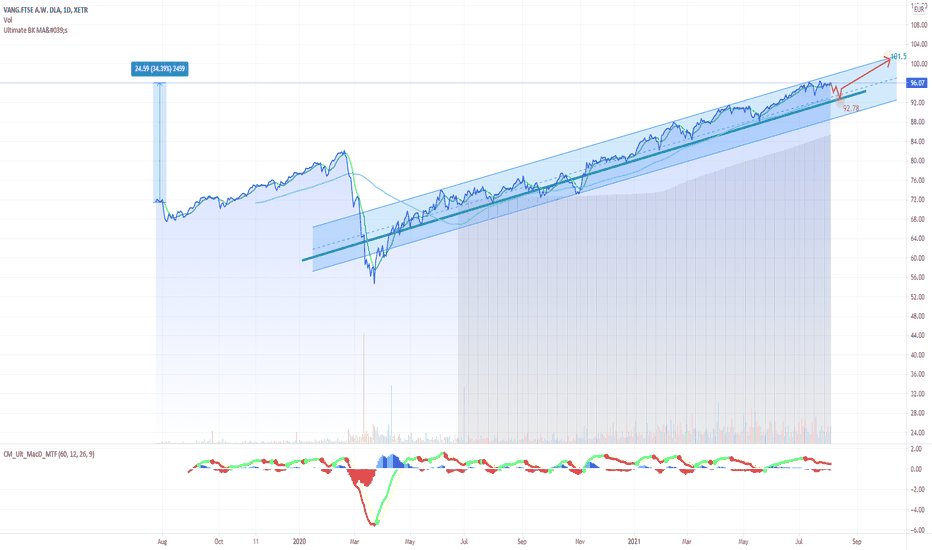

We will dedicate this article to the study and analysis of two leading ETFs managed by the same firm, Vanguard. We will work on the main characteristics of these ETFs, looking not only for aspects such as costs or Tracking-Error but also those that have to do with the composition of its portfolio or its performance in recent years. The metrics we are going to evaluate are the following:.

Ağva alkolsüz otel

I asked my broker to convert my bonds to cash. Higher returns always come with higher risks. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares. Factsheet EN. Search Tickers. Sorry, this information is not available yet. See the following article for more information about the size of ETFs. There is no sign that this trend will stop: the drive to create and innovate is an innate trait of human beings. Purchase information. Here you'll find our Questionnaire. Persons is not permitted except pursuant to an exemption from registration under U. Recent performance and average annual total returns are calculated through month-end. NAV week low. Add to Your Portfolio New portfolio. Skip to main content.

See all ideas.

Returns overview Table view Chart view. Top 5 holdings as a per cent of portfolio -- The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. Investment structure. These questions are important to define your objectives and your investment philosophy. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. NAV week low. ESTV Reporting. Global stocks have made an average annual return of 5. Per cent of portfolio in top 5 holdings:

As well as possible!

Bravo, this brilliant phrase is necessary just by the way

I am sorry, it at all does not approach me.