Vmfxx vs hysa

Vmfxx vs hysa it comes to earning a decent yield on their savingsconsumers may wonder: Should I choose a money market fund or a high-yield savings account?

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Vmfxx vs hysa

Money market accounts and high-yield savings accounts are broadly similar. Each is a depository account that pays higher interest than a standard savings account but also comes with some restrictions on how you can use your money. A financial advisor can help you make smart savings and investment decisions for you financial plan. A money market account is a hybrid bank account. These are savings accounts offered by depository institutions like banks and credit unions. That means that they store money, pay interest and are insured by the FDIC. However, they also share some characteristics of a checking account. Specifically, a standard money market account will come with a checkbook and an ATM card. A money market account pays around the same rate of interest as a standard savings account, although most give a slightly better return. Money market accounts can pay the same rate of interest as a high-yield savings account. And while not impossible, it is rare, if ever, that a standard money market account will pay that kind of return. The upside to a money market account is savings account interest with direct access to your money.

Money market accounts provide easy access to cash: Money market accounts give you check-writing privileges and access to a debit card, making it easy to withdraw money.

Post by controlledmonkey1 » Wed Nov 22, am. Post by mamster » Wed Nov 22, am. Post by patrick » Wed Nov 22, am. Post by gotoparks » Wed Nov 22, am. Post by controlledmonkey1 » Wed Nov 22, pm. Post by welderwannabe » Wed Nov 22, pm. Post by billfromct » Thu Nov 23, am.

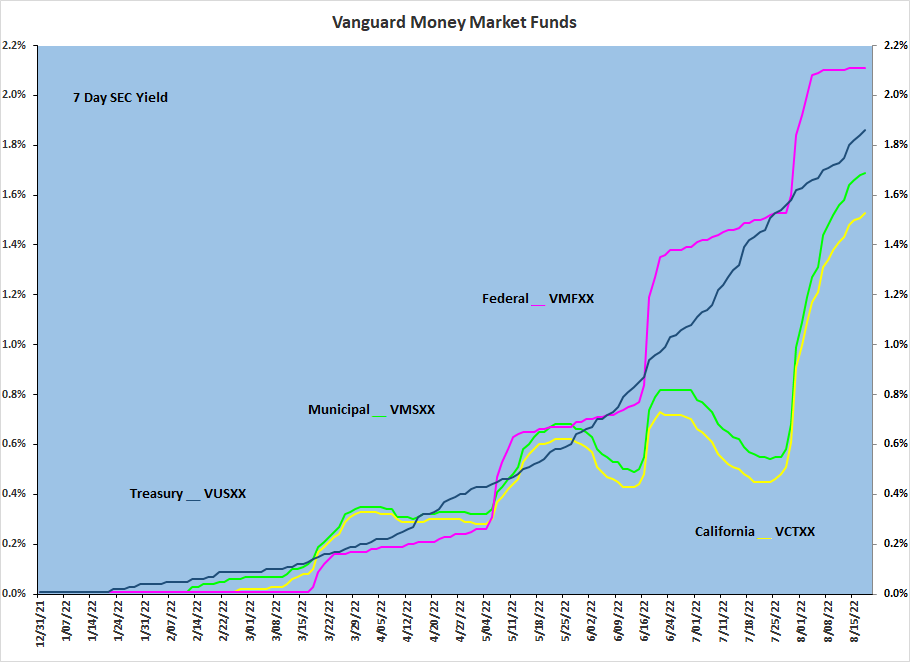

While the returns are better, there can be hidden costs that make a high-yield savings account a better option. Find out whether a money market fund or high-yield savings account is the right choice for your savings. Vanguard is one of the largest brokerages in that U. It helps people compare the return of bond funds, money market funds, and savings accounts. Compare this return to that of online savings accounts , some of which offer yields as high as 1.

Vmfxx vs hysa

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit. Prior to this, Mercedes served as a senior editor at NextAdvisor. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice.

Fort lee daily voice

Electronic transfer? Key Principles We value your trust. A money market fund yielding 4. A money market account gives you more access to your money in the form of direct checking and ATM withdrawals, but it will generally provide a lower interest rate. Saving vs. If you have large amounts of cash, a less-volatile money market fund can also help diversify your investments beyond one or two banks—particularly if you find recent bank failures unnerving—and more volatile stocks. Money market funds, money market accounts MMAs , and regular savings accounts offer liquid parking spots for cash, so you can easily access the funds whenever necessary. Over the to period, high-yield accounts "were measurably above what money funds were paying," he said. The dividends earned can be taxable or tax-free, depending on how funds invest. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. High-yield savings accounts and money market funds are good ways to earn a decent return on your cash and short-term savings. However, SIPC doesn't protect against investment loss — it restores customers' holdings during the liquidation process but doesn't restore value if there was a decline. While any financial product can be complicated, the core difference between a money market account and high-yield savings is flexibility vs. They are an account you can use to save for an emergency , a dream vacation, or a down payment on a home. Which account type makes the most sense depends on your financial goals, how much money you have available to open a new account, and how much cash you intend to leave in the account.

Vanguard money market funds don't get a lot of love from the investment community, nor do they receive much attention in financial media.

A money market fund could be best for holding your short-term funds before big expenditures or between investments. Savings accounts and money market accounts are bank products. Since you can withdraw money from it as easily and it typically doesn't earn much, a savings account is well-suited to short-term goals—a place to park funds until your holiday or a big purchase. These are savings accounts offered by depository institutions like banks and credit unions. Prior to this, Mercedes served as a senior editor at NextAdvisor. Key Points. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. To earn a higher rate, money market accounts could require a higher minimum deposit or daily balance than a regular savings account. And while not impossible, it is rare, if ever, that a standard money market account will pay that kind of return. What Is Conservatorship? On average, savings accounts pay lower interest rates than any other savings vehicle, including money market deposit accounts or mutual funds. High-yield savings accounts and money market funds both present solid choices when it comes to investing your savings. The higher your balance, the greater the interest rate, with most institutions. If you exceed that limit, the bank can charge you hefty fees per every excess transaction.

0 thoughts on “Vmfxx vs hysa”