Vfv etf price

Key events shows relevant news articles on days with large price movements.

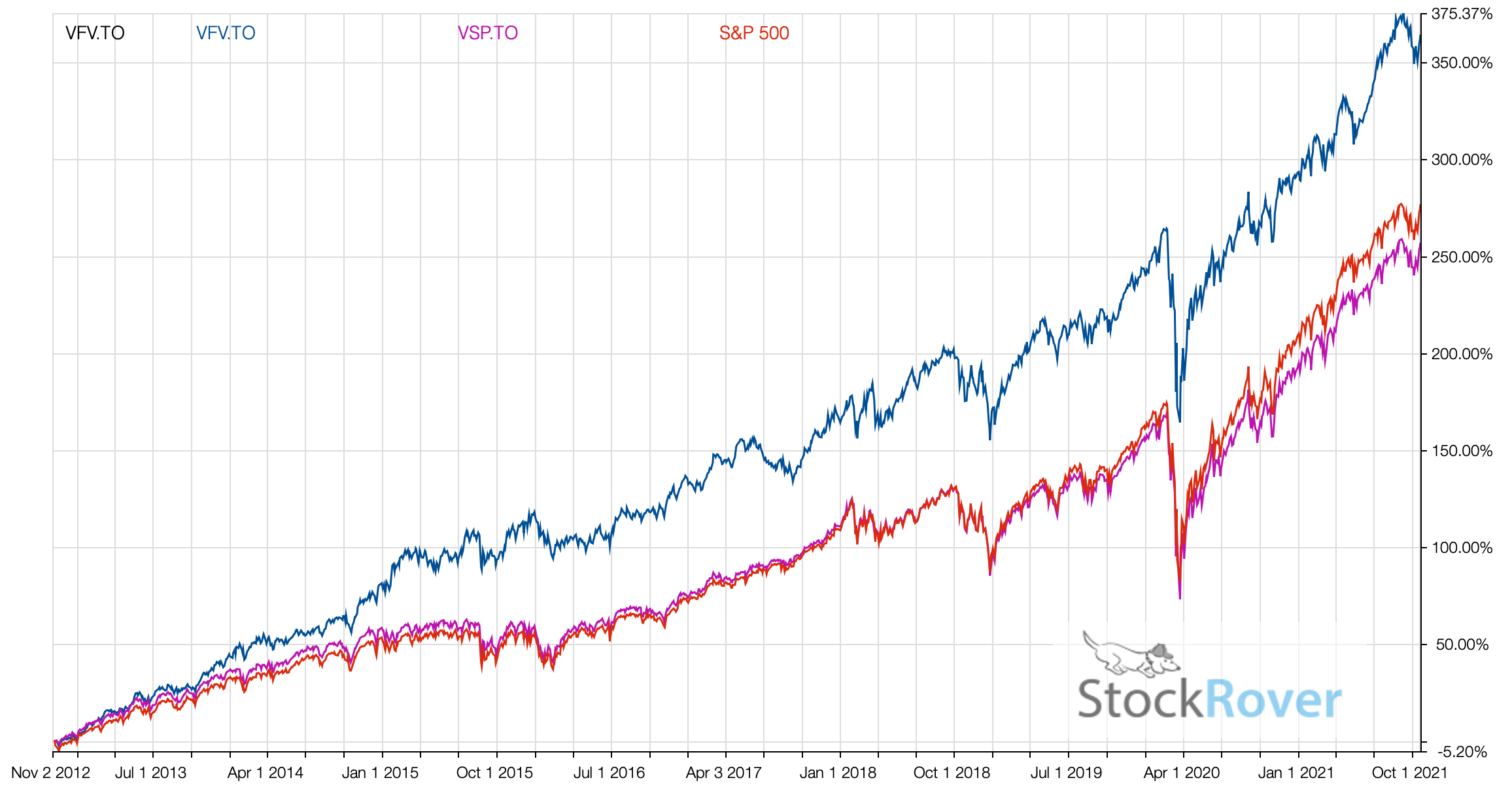

Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges. Monthly, quarterly, annual, and cumulative performance is also available in additional chart tabs. Index performance shown from December 1, has been updated to reflect the foreign withholding tax. The MER would have been 0. Vanguard Investments Canada Inc.

Vfv etf price

.

Income distribution per unit.

.

Key events shows relevant news articles on days with large price movements. XEQT 0. VEQT 0. XQQ 1. VGRO 0. VDY 0. ZSP 0. VCN 0.

Vfv etf price

Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges. Monthly, quarterly, annual, and cumulative performance is also available in additional chart tabs. Index performance shown from December 1, has been updated to reflect the foreign withholding tax. The MER would have been 0. Vanguard Investments Canada Inc. Index performance shown from December 1, has been updated to reflect this foreign withholding tax. All investments, including those that seek to track indexes, are subject to risk, including the possible loss of principal. Diversification does not ensure a profit or protect against a loss in a declining market. While ETFs are designed to be as diversified as the original indexes they seek to track and can provide greater diversification than an individual investor may achieve independently, any given ETF may not be a diversified investment.

Blonde short pixie haircuts

Vanguard funds are managed by Vanguard Investments Canada Inc. Investor's Business Daily. Any views and opinions expressed do not take into account the particular investment objectives, needs, restrictions and circumstances of a specific investor and, thus, should not be used as the basis of any specific investment recommendation. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. This table displays fundemental characteristics for the Fund and Benchmark. Distribution frequency. ETF An exchange-traded fund ETF is a collection of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges. A measure of the magnitude of a portfolio's past share-price fluctuations in relation to the ups and downs of the overall market or appropriate market index. The final column of the table displays the weight, or percentage difference between the Fund and Benchmark, when applicable. The market or index is assigned a beta of 1. Please consult your broker or financial representative to verify pricing before executing any trades. The table below the chart contains the percentage by Fund and Benchmark and indicates the variance between the two. To calculate a Sharpe ratio, a portfolio's excess returns its return in excess of the return generated by risk-free assets such as Treasury bills is divided by the portfolio's standard deviation. Eligible dividends, Non-eligible dividends, Other income, Capital gains, Return of capital, Foreign income, Foreign tax paid, and Total distribution per unit are displayed for each year since the fund's inception.

.

Turnover rate is displayed for the Fund as of the most recent quarter end. Learn more. XEQT 0. Skip to Content. Monthly, quarterly, annual, and cumulative performance is also available in additional chart tabs. Risk and Volatility This table shows risk and volatility data for the Fund and Benchmark. ALPHA A measure of the difference between a portfolio's actual returns and its expected performance, given its level of risk as measured by beta. Super Micro Computer Inc. Diversification does not ensure a profit or protect against a loss in a declining market. In doing so, investors may incur brokerage commissions and may pay more than NAV when buying and receive less than NAV when selling. In addition, a negative alpha can sometimes result from the expenses that are present in a portfolio's returns, but not in the returns of the comparison index. Key events shows relevant news articles on days with large price movements. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. In contrast, a negative alpha indicates the portfolio's underperformance, given the expectations established by the portfolio's beta.

It is remarkable, very amusing phrase

I here am casual, but was specially registered to participate in discussion.