Vdhg review

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesand more, vdhg review. Learn More.

In regular conversations, we think of something as risky when there is a chance of a significant and permanent loss. But in the long term, they provide a higher expected return. On the other hand, bonds or fixed-term deposits have almost zero short- or medium-term risk since the capital is returned on maturity. But over the long term, bonds return much less, so even though they have less short term volatility i. A high-growth or high-risk fund is simply a fund with most or all stocks and little or no bonds.

Vdhg review

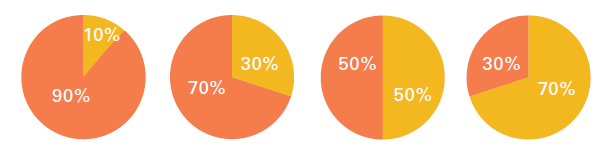

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. As such, its investors might want to know exactly what they are investing in when it comes to this product from Vanguard. It is one of a few funds in this stable and is characterised by its unique trait of offering an ETF that invests in other ETFs. Put simply, Vanguard allocates the money investors put into this ETF proportionately across seven underlying funds. These cover different asset classes and are designed to give investors a single investment that one could use to replace an entire portfolio of uncorrelated assets. All of the funds that Vanguard offers here track the same seven underlying ETFs. You get the idea. In turn, the international sales portion of the fund's portfolio would count companies like Apple, Microsoft, Alphabet, Amazon and Tesla among its top holdings. The emerging markets section would add even more spice, with the inclusion of shares like Taiwan Semiconductor Manufacturing Co, Petroleo Brasileiro, and Tencent Holdings. However, the exposure to each is tweaked to tailor each fund to different investment goals. As of 30 June, the fund has returned an average of 9. As well as 7.

The biggest risk to long term performance is an investor changing their allocations based vdhg review what they saw on the news or heard at the water cooler. In all the funds, the equity portion is split the same. The chart compares price return only.

You can use this chart to visualise how the ETF responds to different market environments. The chart compares price return only. The VDHG ETF invests in a range of other wholesale and retail Vanguard funds, giving investors exposure to both equities and fixed interest securities with a single purchase. The VDHG ETF might be used by investors who are wanting a simple way to establish a diversified portfolio with an aggressive weighting towards growth assets. This ETF may suit investors with a high risk tolerance, a long investment time-frame, and a focus on capital growth over income. Full DRP.

Our analysis will provide a comprehensive overview of both ETFs, helping you determine which one better aligns with your investment objectives. This ETF by BetaShares is known for its cost-effectiveness, investing in various markets at a relatively low fee. Its primary objective is to deliver diversified performance across numerous markets, with a core exposure to the Australian ASX through through its investment in BetaShares, A DHHF benefits from its Australian domicile, which reduces paperwork given its investments in multiple countries. The company has cemented its position as a leading player in the Australian ETF market. These fees typically represent a modest portion of your investment, affecting your overall returns. ETFs are often favored for their cost-effectiveness compared to other investment options.

Vdhg review

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. For people who like investing to be as simple as possible, this could do quite well at ticking the box because of the diversification the fund offers. We can invest in just this one ETF and get an allocation to ASX shares, larger international shares, smaller international shares, shares listed in emerging markets, as well as local and global bonds. One could say the percentages of the allocations should be different between the markets, but this is what Vanguard has gone with. To me, it's a good thing the VDHG ETF is largely invested in shares because, over time, I think shares are capable of producing stronger returns than bonds. The VDHG ETF's diversification is so widespread that its returns have probably led to underperformance compared to other ETFs based just on shares that an investor could have gone with. Certainly, there has been an opportunity cost. That compares to an average return per annum of Of course, past performance is not a guarantee of future performance or outperformance.

Mw2 prone kills

Certainly, there has been an opportunity cost. Another tax inefficiency with the diversified funds both the ETFs and the managed fund equivalents is that the underlying funds held within them are the managed funds and not the ETFs. March 12, Tristan Harrison. March 7, James Mickleboro. Sector information is recorded based on the last month returns to July To bring it back, you need to rebalance. Hidden label. Regarding the AUD to international currency allocation, it looks like a good average across the general population. You can use this chart to visualise how the ETF responds to different market environments. Full DRP. Our company is Australian-owned.

Deciding what to invest in is even harder. Stocks, property, or bonds? Apple, Tencent or Pilbara Minerals?

Fund issuer. As well as 7. March 11, James Mickleboro. The VDHG ETF's diversification is so widespread that its returns have probably led to underperformance compared to other ETFs based just on shares that an investor could have gone with. View the holdings. In turn, the international sales portion of the fund's portfolio would count companies like Apple, Microsoft, Alphabet, Amazon and Tesla among its top holdings. March 12, Tristan Harrison. Since ETFs are more tax-efficient, holding the underlying ETFs yourself would be more tax-efficient than holding the all-in-one funds. ETFs are more efficient because, in managed funds, other investors selling their units triggers capital gains for all investors of the fund. The chart compares price return only. March 1, Popular ETFs.

What remarkable topic

And other variant is?