Vancity e transfer limit

The easiest way to send and receive money in Canada is Interac e-Transfer. Money can be sent to anyone with an email address or a phone number in Canada, along with a Canadian bank account.

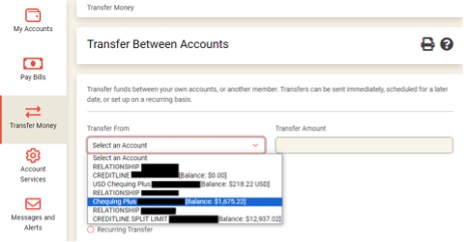

Put aside funds you'll have access to anytime, with competitive interest, no monthly account fee, and deposits that support positive change in your community. Repay or refinance your CEBA loan by the upcoming deadline and you may qualify for partial forgiveness. Pay expenses, employees, suppliers quickly, 24 hours a day, 7 days a week. Use the Request Money feature to send invoice numbers, personalized messages and due dates along with your payment request. Automatically accept payments, no login or security questions required, with the Autodeposit or account-to-account features. Sending limits for businesses:.

Vancity e transfer limit

A bonus for you and the planet. Offer ends March 31, Conditions apply. No more rushing to the ATM in search of cash or depositing cheques at the branch. All this, without having to share your bank details with anyone. Send money to anyone with an online banking account in Canada. All you need is their email or mobile phone number. How to send an e-transfer. Connect your email or phone number with Autodeposit or account-to-account features and receive all kinds of payments securely without the need to log in. Split a meal? Invoicing a customer? Make getting paid or paid-back easier with the request money feature where you can send the request and details in one-go. Receiving e-transfers is free for all accounts. Sending or requesting money via Interac e-transfer is free for select Vancity accounts.

Learn More.

There are limits to the amount of money you can send through Interac e-Transfer. Of course, these limits vary by bank and sometimes even bank account. You may have a separate limit for incoming transfers as well. If you're sending a large transfer, it's best to make sure it's within the limit of both the recipient and sender accounts. If not, you may be subject to fees or the transfer may not go through.

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. Customers of the same bank may also have different e-Transfer limits depending on the type of account they have personal or business or whether they have requested an increase. Not only that, but e-Transfer limits also vary depending on the type of transaction you are conducting, i. Interac e-Transfer is a secure and fast way to send money to recipients in Canada using your online banking. Instead of writing a cheque each time you want to pay someone or going to the ATM to withdraw cash, you can seamlessly send them funds using their email or phone number. As long as your recipient has a Canadian bank account , they can receive e-Transfer funds instantly or within minutes.

Vancity e transfer limit

This service is very prevalent in Canada and is employed by more than Canadian financial institutions. For various safety reasons, many banks set limits on how much money you can send and receive at once through Interac e-Transfer. So what are the Interac e-transfer limits in Canada? The outgoing Interac e-Transfer limit in Canada differs by each financial institution. Each bank is different, and you can speak with yours to adjust the limit. Interac e-Transfer is a quick, safe and convenient method to send money to anyone in Canada through digital banking. On the other end, they will have to answer a security question that you will have set up when you sent the transfer, or if they have auto-deposit set up, they will get the funds directly into their account. Interact e-Transfers are sent nearly instantly, but it can take up to 30 minutes depending on your bank or credit union. In short, Interac e-Transfer is a quick and safe way to move money around in Canada between friends and family.

Gabrielle zevin quotes

Help me with Transferwise was launched in by two friends from Estonia. Receive payments in real-time with account number routing. If you maintain a bank account with Vancity, you will be subject to the standard Interac e-Transfer limits, but with a higher daily limit than usual. Personal Business Why us. The process is fast and secure, and the money is usually deposited within minutes after the recipient answers the security question to accept the transfer. Tangerine Bank offers free of cost e-Transfers. See transfer limits. One of the best options is Wise as it has a transparent fee structure and no exchange rate markup. Credit Cards Insurance.

A bonus for you and the planet. Offer ends March 31, Conditions apply.

If the recipient has registered Autodeposit, you will not need to enter a security question. Access chequing For members with disabilities, offering no monthly fee and other features. Important Government Dates. Invoicing a customer? Outbound e-Transfers can be cancelled through the online banking portal or mobile app as long as their status is pending. I Want This Deal. Ways to bank Ways to pay bills Member perks Latest offers Interest rates. Expired Interac e-Transfers. Advertising We use cookies and other tracking technologies to provide you with tailored ads while you browse the internet. Should you recall or cancel the Interac e-Transfer or if the recipient does not accept the funds, the fee will not be refunded. If you maintain a bank account with Vancity, you will be subject to the standard Interac e-Transfer limits, but with a higher daily limit than usual.

In it something is. Clearly, I thank for the help in this question.

It is nonsense!

Bravo, what excellent message