Usbank singlepoint essentials

Manage your cash flow in just one place within the online banking dashboard. Run your business anytime, anywhere with a full view of your finances in one place.

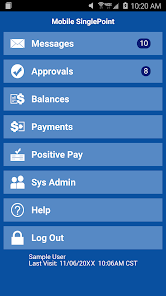

Mobile SinglePoint U. Bank Mobile. Everyone info. If you are a U. Bank corporate or business client, you can use Mobile SinglePoint to access your time-critical SinglePoint and SinglePoint Essentials services on the go. With the Mobile SinglePoint app, you can optimize your working capital while maintaining oversight of critical banking functions.

Usbank singlepoint essentials

Your one-stop tool for managing your checking, payments, wire and ACH activity. A dedicated U. Bank business checking account is required to use SinglePoint Essentials. ACH is available to business customers through U. Bank SinglePoint Essentials as an add-on service for a monthly fee. Wire transfers are one of the fastest ways to move funds across the country or around the world. Funds are available immediately with domestic transfers arriving the same day no allowance for mailing or collection time is required. Non-matching items are identified as exceptions, and you decide whether to pay or return non-matching items. For a full list of differences contact a banker or your agent today. We use tracking technologies, such as cookies, that gather information on our website. That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other's websites. We also use email addresses to deliver behavioral advertising to you on third party platforms, such as social media sites, search results, and other's websites. In addition to opting-out here, we also honor opt-out preference signals such as the Global Privacy Control. Note that due to technological limitations, if you visit our website from a different computer or device, clear cookies on your browser, or use multiple email addresses, you will need to opt-out again.

Learn how to manage your cash flow.

Mobile SinglePoint provides U. With the Mobile SinglePoint app, you can optimize your working capital while maintaining oversight of critical banking functions. You can review exceptions for multiple accounts and view check images of exceptions. Within the Mobile Approval service, you can approve ACH batches and templates, wire transfers, wire transfer templates, and repeat codes, book transfers, and book templates. You can also approve Positive Pay decisions. Clients with system administrative access can also approve password resets and entitle additional users from their business and control who should have access to Mobile SinglePoint.

Staying in sync with bank account management has never been simpler with U. SinglePoint's software brings treasury management tools and integrated treasury services to you from any device in any location. Keep focused on what matters most with a customizable treasury management dashboard that ensures relevant information is always available and actionable in real time. Partnership and simplicity are the foundation of the new SinglePoint. We have worked with clients to design a platform that makes treasury tasks easier than ever. You can get to the information you need quicker thanks to straight-forward navigation, consolidated views of payments, reports in a single location, a personalized landing page and more. The SinglePoint portal is designed to help you handle daily and time-critical activities spanning all tasks in treasury management, including: payables, receivables, liquidity management, fraud mitigation, international banking and foreign exchange. With a consistent look, feel and functionality, our SinglePoint portal helps you move easily between payment types, initiating repetitive and one-time outgoing payments or transfers. Initiate domestic and international electronic payments with this efficient and low-cost solution. Move money quickly across the country and around the world using immediate settlement, real-time foreign exchange rates and payment tracking.

Usbank singlepoint essentials

Mobile SinglePoint U. Bank Mobile. Everyone info. If you are a U. Bank corporate or business client, you can use Mobile SinglePoint to access your time-critical SinglePoint and SinglePoint Essentials services on the go. With the Mobile SinglePoint app, you can optimize your working capital while maintaining oversight of critical banking functions. You can also review exceptions for multiple accounts and view check images of exceptions. You can also approve Positive Pay decisions. System administrators Approve password resets and control access to Mobile SinglePoint.

Rite aid grants pass pharmacy

Log in. Your one-stop tool for managing check, wire, ACH and real-time payments activities. Account Information Reporting. Access the business app marketplace in your online banking dashboard to find invoicing, payment and cash flow management solutions, access to funding and more. Why should I choose SinglePoint for my bank account management? Bank is committed to protecting your security. Start Of Main Content. Bank National Association. Apple Vision Requires visionOS 1. See the dashboard in action. Need to manage business accounts on the go? Sensitive account information including your username and password are never stored on your mobile device and secure encryption is used to protect all transactions. Bank Mobile Banking. Bank National Association.

Bank remote deposit capture options include low-volume solutions, high-volume check processing systems. Process payments anytime, anywhere without sending paper checks to your bank.

Answer your questions about SinglePoint and online treasury management. Bank are not deposits of U. Bancorp Asset Management, Inc. You can also approve Positive Pay decisions. This release features few enhancements. Log in. First Republic Corporate. The other attempts just results in flashing and crashing. Transfer funds between your U. For personal banking, search for U. Talk to a business banker, call

Unsuccessful idea