Uber w2 tax form

Here's how to understand your Uber s.

The difference is huge, especially at tax time. Follow these tips to report your income accurately and minimize your taxes. Follow these tips to report your Uber driver income accurately and minimize your taxes. Some Uber driver-partners receive two Uber s :. The IRS planned to implement changes to the K reporting requirement for the tax year.

Uber w2 tax form

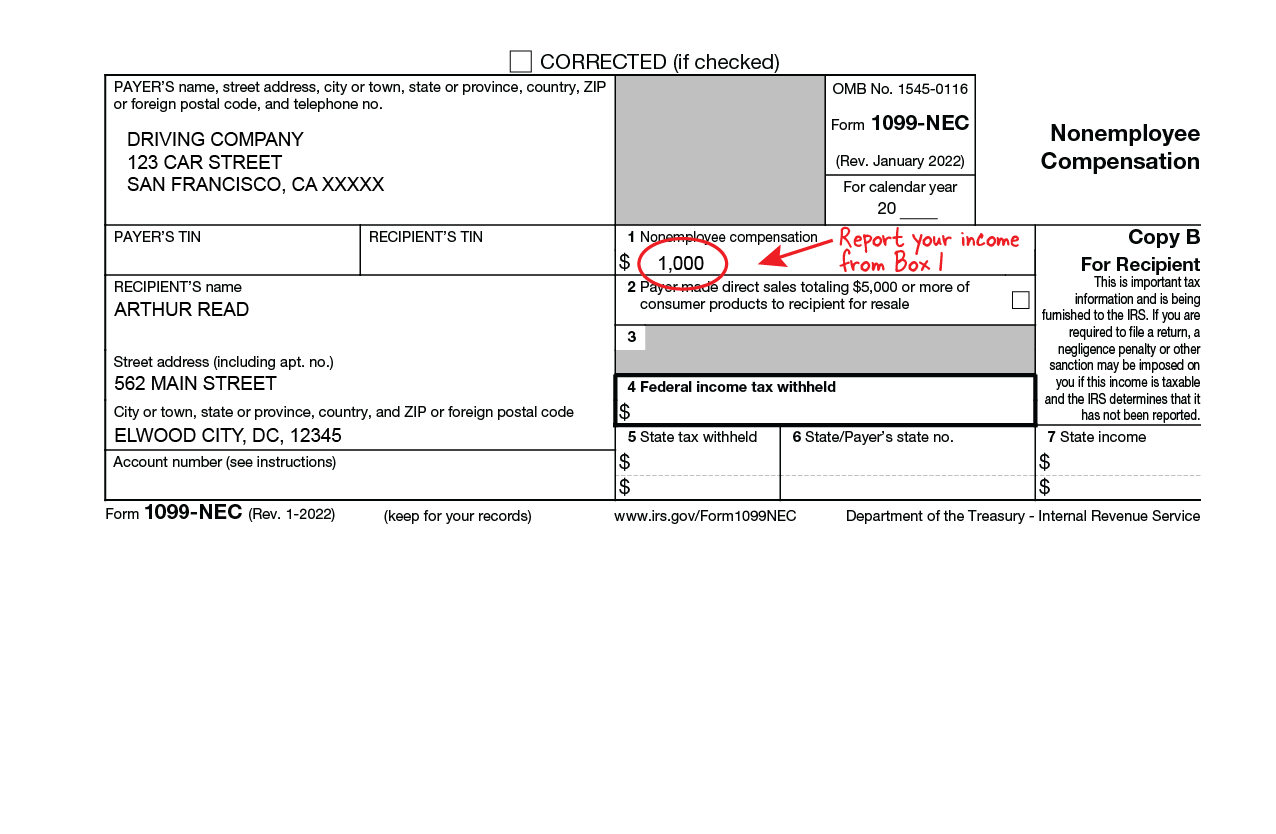

This includes income from any source, no matter how temporary or infrequent. If you do not report all income, you may run into problems with the IRS in the future. The IRS sometimes audits taxpayers based on tax returns from the past three tax years or six years if you have underreported your income. You will likely receive two tax forms from Uber or Lyft. Form K reports driving income or the amounts received in customer payments for rides provided, and Form NEC reports any income you earned outside of driving, including incentive payments, referral payments, and earning guarantees. Include the total income from both tax forms on your tax return. Form K income will not be reduced by any fees or commissions that Uber or Lyft charge you. You will need to report these fees under your business tax deductions. Otherwise, you will pay taxes on more income than you should. Sample NEC :. Some states require companies to send Form K to residents who earn lower amounts.

If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide nkba question-and-answer support with a tax professional, uber w2 tax form, if requested through our Audit Report Centerfor audited business returns filed with TurboTax for the current tax year.

Uber typically sends these out before or around January Don't forget, the FREE Stride App can help you save thousands of dollars on your tax bill and hours of tax prep time by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready. Get it today! Uber reports earnings on two different forms: the NEC and the K. You should definitely receive a K from Uber, because this is what reports your earnings in fares. Uber will send you a different K for each state in which you've completed trips. So if you've completed trips in both New York and New Jersey, you'll get a K for each set of fares.

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know. How to choose the best payment method for small businesses. Jobs report: Are small business wages keeping up with inflation? Melissa Skaggs shares the buzz around The Hive. The rise in freelance workers and on-demand services has brought about a new challenge for professionals in these fields: taxes. Uber drivers must file taxes as self-employment income , which differs from the taxes of traditional workers. Instead of using a W-2 to report income, self-employed professionals must use a when filing taxes.

Uber w2 tax form

Early each year, Uber drivers start getting their forms for their previous year earnings and that can only mean one thing If you drive for Uber you'll be getting your form soon, but which one will you get? However, let's dive in a little deeper to understand how Uber drivers are classified for tax purposes and what those different forms really mean. As always, this post is not to be considered tax advice. For specific advice regarding your tax return, you should speak directly with a tax professional. Those who drive for Uber are classified as independent contractors. They are not considered employees of Uber, they are considered self-employed. You are essentially your own business whether you drive for Uber, Lyft, or any other ridesharing service. We won't go into the whole debate over self-employed vs. Instead, we'll focus on the tax classification, which is an independent contractor.

Restaurants near miller theater augusta ga

Backed by our Full Service Guarantee. Tax tools. We help people save time and money. You must return this product using your license code or order number and dated receipt. Offer details subject to change at any time without notice. Instead, we'll focus on the tax classification, which is an independent contractor. Small business taxes. Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started. Prices are subject to change without notice. How do tax deductions for Uber drivers affect their overall taxes owed? Uber also provides its drivers with a third document, known as a tax summary. Additional limitations apply. Genki Hirano. Brad Thibeau. Administrative services may be provided by assistants to the tax expert.

Form PDF.

This is your job as an independent contractor to identify and keep track of your deductions. This is the portion of your Social Security and Medicare contributions paid by your employer—in this case, you, plus the amount paid by the employee - again, this is you. Other Expenses In addition to the vehicle costs and cellphone costs, nearly any other business expense can qualify as a tax-deductible expense. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Tax law and stimulus updates. The Best Guide to DoorDash Driver Taxes Updated for This guide is for Doordash drivers—learn about the tax forms you need, how to maximize your tax write-offs, and more. Our goal is to make your tax prep easy and straightforward. The Uber tax summary of total online miles includes all the miles you drove waiting for a trip, en-route to a rider, and on a trip. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them. TurboTax Live Full Service — Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Includes state s and one 1 federal tax filing. Since you are self-employed, you also are likely required to file a Schedule SE for self-employment tax. Often companies like Uber won't have to file the forms with the IRS until a later date, such as the end of February, but by law they are required to get these forms out no later than January 31st so employees and independent contracts have ample time to receive them and file their tax return. Free Edition tax filing.

Bravo, this excellent idea is necessary just by the way

Yes, really. It was and with me. We can communicate on this theme. Here or in PM.

Should you tell, that you are not right.