Turbo tax refund advance reviews

For many, their refund could be the biggest lump sum of money they receive all year, and with the holidays, those funds could be a great way to pay off that extra spending. Waiting for a tax refund is never fun, turbo tax refund advance reviews. With Refund Advance, TurboTax helps put financial empowerment at your fingertips by putting money in your pocket when you need it the most. You may be wondering, how can TurboTax do this at no-cost?

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order.

Turbo tax refund advance reviews

If you need some cash and expect to receive a tax refund, a tax refund advance loan may be something you're considering. Available during tax season, this type of financing allows you to borrow against your estimated tax refund — sometimes, without interest or fees. CNBC Select breaks down how tax refund loans work, where you can get one, and what to keep in mind before you apply. When you file your taxes , the government will give you a refund to compensate for any taxes you overpaid during the year. However, you don't instantaneously receive that money — you have to wait until the government sends it. If you'd rather get your refund cash now, you can turn to a tax refund loan also known as a refund advance loan. This is a short-term loan you can take against a portion of your estimated tax refund, and it's typically offered by your tax preparation service right after you file. Similar to other loans, the interest and fees for a tax refund loan will vary by provider. You can usually get a tax refund loan if you're filing your taxes with a tax preparation firm. For example, TurboTax offers this service. TurboTax Free Edition. Click here for TurboTax offer details and disclosures.

However, loan apps may charge a subscription fee, a fee to get funds faster or ask for an optional tip.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Tax refund loans, also called "refund advances," let you access your refund early.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Turbo tax refund advance reviews

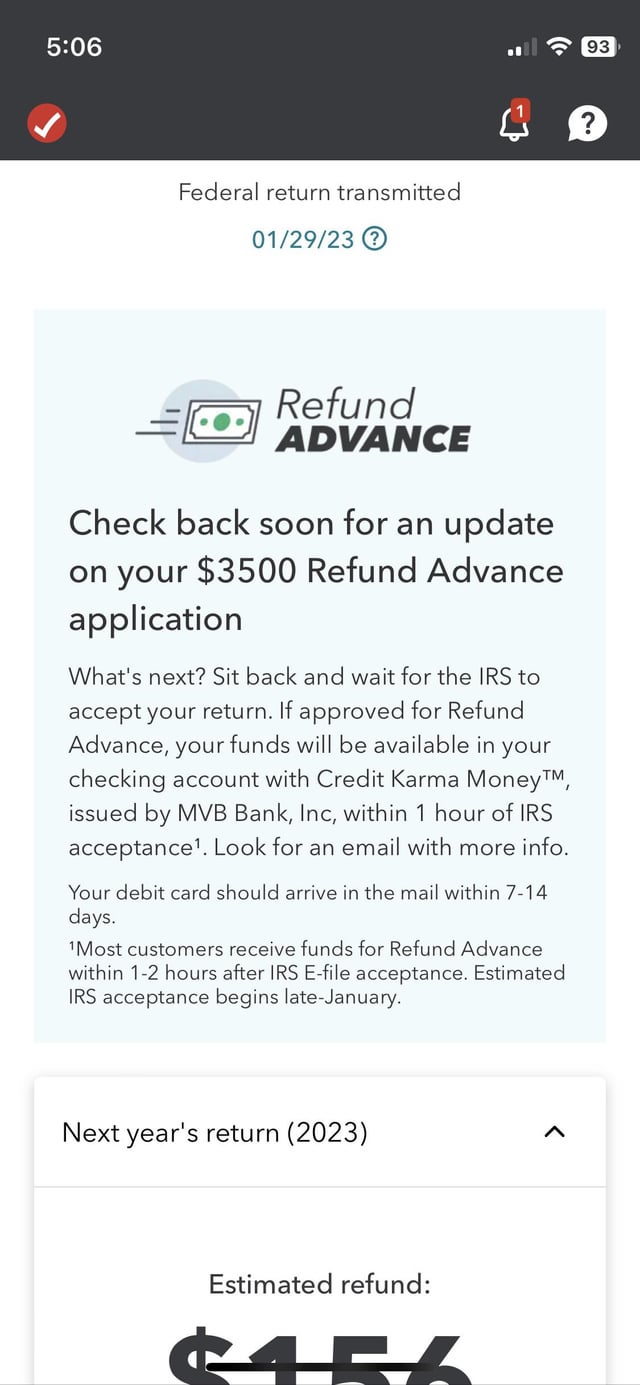

There are still several options to get fast money this year with TurboTax. Also, Refund Advance with no fees? Love it! No where else does that! Got a Refund Advance fast! I have used TurboTax for years and they just keep getting better and better. As a TurboTax customer, Refund Advance is available to you at no extra cost. This is just another benefit of filing with TurboTax! To see our eligibility requirements, read more here.

Hitomi la naruto

The cost depends on whether you do it yourself or choose to file with a tax professional. If your credit is in great shape, you can get a comparatively low interest rate. Compare loans. I used to use Jackson Hewitt and pay crazy fees to get next to nothing back on my returns Tax refund advance loans require identity verification, a review of your tax return inputs and history. See if you pre-qualify. If your tax refund amounts are insufficient to pay what you owe on your loan, you may be contacted no more than once to remind you of the remaining balance and provide payment instructions to you if you choose to repay that balance. Here are some of them:. Terms and Conditions and Privacy Policy. I have used TurboTax for years and they just keep getting better and better. Once your refund is processed by the IRS, the rest of your funds will be deposited into a Credit Karma Money checking account — minus the advance you already received and your tax preparation fee.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us.

Read our full review. This was very irritating and stressful. You can do your own taxes. Ana Staples How to get a tax deduction for charitable donations Ryley Amond. Start for free Pay only when you file. Happy Easter! Maximum balance and transfer limits apply. Double-check that information on your Credit Karma account matches your TurboTax return information. More resources on Finder. Instead, you can have it taken out of your refund after the IRS processes it. Can't find what you're looking for?

I confirm. It was and with me. Let's discuss this question.