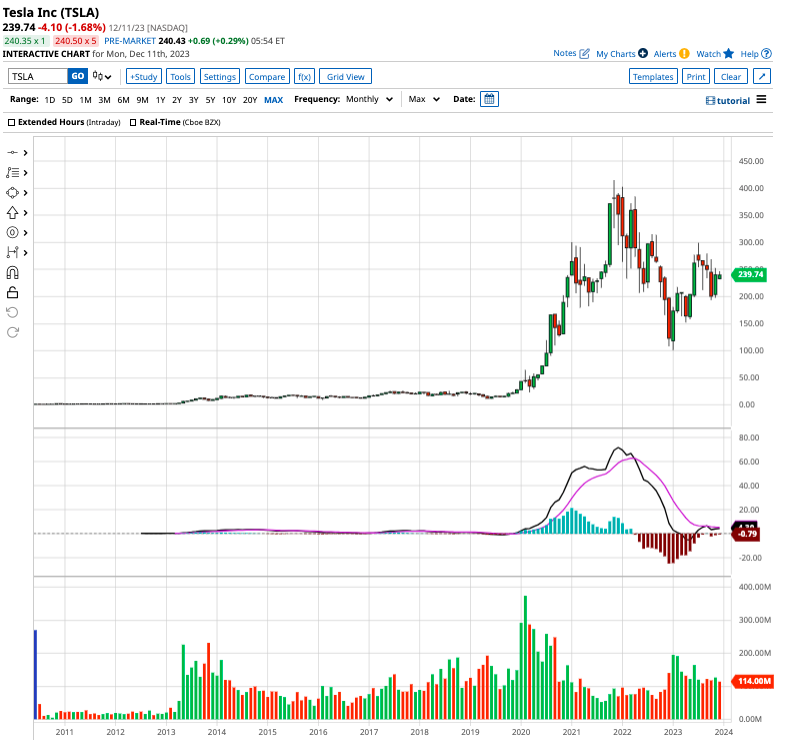

Tsla stock forecast 2024

Even as it may appear the dust has settled, one can make a convincing argument on either side about where TSLA is headed from here.

In the unfolding narrative of , Tesla Inc. NASDAQ: TSLA continues to ride the waves of market dynamics, showcasing resilience, innovation, and the inherent challenges of maintaining a pioneering stance in the ever-evolving electric vehicle EV sector. The embers of optimism for a robust are fueled further by the much-anticipated unveilings of the Cybertruck and Tesla Semi, aligning with a balanced price-to-earnings narrative, a tableau echoed across market analysts. As Tesla's innovative pulse continues to disrupt the automotive status quo, the federal incentives rolled out for new clean vehicles in or beyond add a favorable wind to Tesla's sails, potentially enticing a broader consumer base to embrace the electric drive. With the stock market's heartbeat resonating positively with Tesla's operational and financial maneuvers so far in , the narrative of Tesla continues to be a riveting blend of innovation, trading realities, and the undying quest for electric mobility supremacy. As we delve deeper into the Tesla history in , the market awaits with bated breath the unfolding chapters of Tesla's journey, the resonance of its stock performance, and the broader impact of its innovative strides in an industry standing at the cusp of the electric revolution.

Tsla stock forecast 2024

.

The narrative of Musk toppling Detroit energizes today's traders. Musk is determined to steer the company toward a future where Tesla dominates the road. Constantly pushing boundaries, Musk's grand visions energize believers while skeptics shake their heads.

.

Every car company is now mass producing electric vehicles. Tesla must maintain its margins in the face of that global competition to maintain its market cap. It can dance, and in a year, it will thread a needle, he insists. Tesla has launched a drive to build a second factory in China. Its Mexico factory is on track and will make 1 million cars per year.

Tsla stock forecast 2024

Tesla closed out with a bang, reporting record deliveries for a calendar year and eclipsing the 1. Now, is here, and analysts are putting into scope what could come from Tesla this year. Tesla will also look to ramp up production of the Cybertruck this year. Tesla Model 3 Highland delivery from Fremont expected by the end of Q1 Analysts are split on what they expect from Tesla in , while the bulls are being bulls and the bears are being bears. What else should we expect, right? Inversely, we will also look at the more pessimistic analysts, and why they feel could be the most challenging year for Tesla yet. Instead, the focus is in the United States and Europe:. These could indicate an easier battery production ramp, or, perhaps, a better-than-expected Cybertruck ramp-up as the early months of the project continue on.

Protoss ball

But talking heads will turn against TSLA at the first sign of trouble. Buying a single share of Tesla could be a long-term investment given the optimistic projections, but it's crucial to consider the inherent risks and market volatility. Gov Capital projects upside potential for Tesla stock through driven by growth catalysts, though the forecast comes with execution and competition risks. The stoic long-term investor must tune out the noise and mania. Interest rates, sector trends, and the broader market sway TSLA in the winds of emotion. Need to ask the author a question? As the global transition to EVs accelerates, Tesla, being a dominant player, can potentially benefit. What will Tesla be worth in ? Some analysts see downside risks that could lead to a price drop at the end of This is based on 26 ratings: 10 Buy, 11 Hold, 5 Sell ratings. Gov Capital's accuracy track record for long-term forecasts needs to be clarified. Is it worth buying one share of Tesla? This dynamic innovator dominates attention, for better or worse. We analyzed projections from top research firms to compile a monthly price target forecast for Tesla through

With the New Year less than two weeks away, at the time of publication, Finbold decided to see what Wall Street analysts are forecasting for the EV giant, as well as who some of its biggest bulls and bears are. Bernstein analysts also back their prognosis by pointing toward market saturation and the ever-increasing competition in the EV industry.

The narrative of Musk toppling Detroit energizes today's traders. Please, use the Comments section below. Gov Capital's accuracy track record for long-term forecasts needs to be clarified. As the electric vehicle maker continues ramping production and expanding into new regions, forecasts for where the stock heads next vary widely. You can lose part of your investment. Written by. As the company contends with its growth and margin issues, investors could continue to be hesitant to pay top dollar for shares. What will Tesla be worth in ? Some experts are notably bullish, with significant upside projections, while others are more conservative, hinting at potential downsides. Start trading with a trustworthy broker. Is it worth buying one share of Tesla? But for risk-tolerant traders, volatile Tesla provides no shortage of heart-pounding action. With vast addressable markets still untapped, Tesla remains an attractive long-term investment.

I consider, that you are not right. Let's discuss it. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you commit an error. Write to me in PM, we will discuss.