Tiaa cref phone number

You can still get a paycheck after you stop working—with a retirement paycheck 1 from TIAA. Get the assurance that you'll have money coming in as long as you live … guaranteed. Explore insights and start crafting your saving and retirement strategy.

Log in to your account. Then select either Pay Bills or Transfer Money. Collateralized loan limits will be lower. Your plan must allow loans, and you must meet a coronavirus-related eligibility requirement to take this type of loan. Any coronavirus-related loans must be initiated between March 27 and September 23, Not all retirement plans permit loans. Additionally, your plan has the option to limit the number of loans or the amount you may borrow, and any such restrictions are not affected by the CARES Act.

Tiaa cref phone number

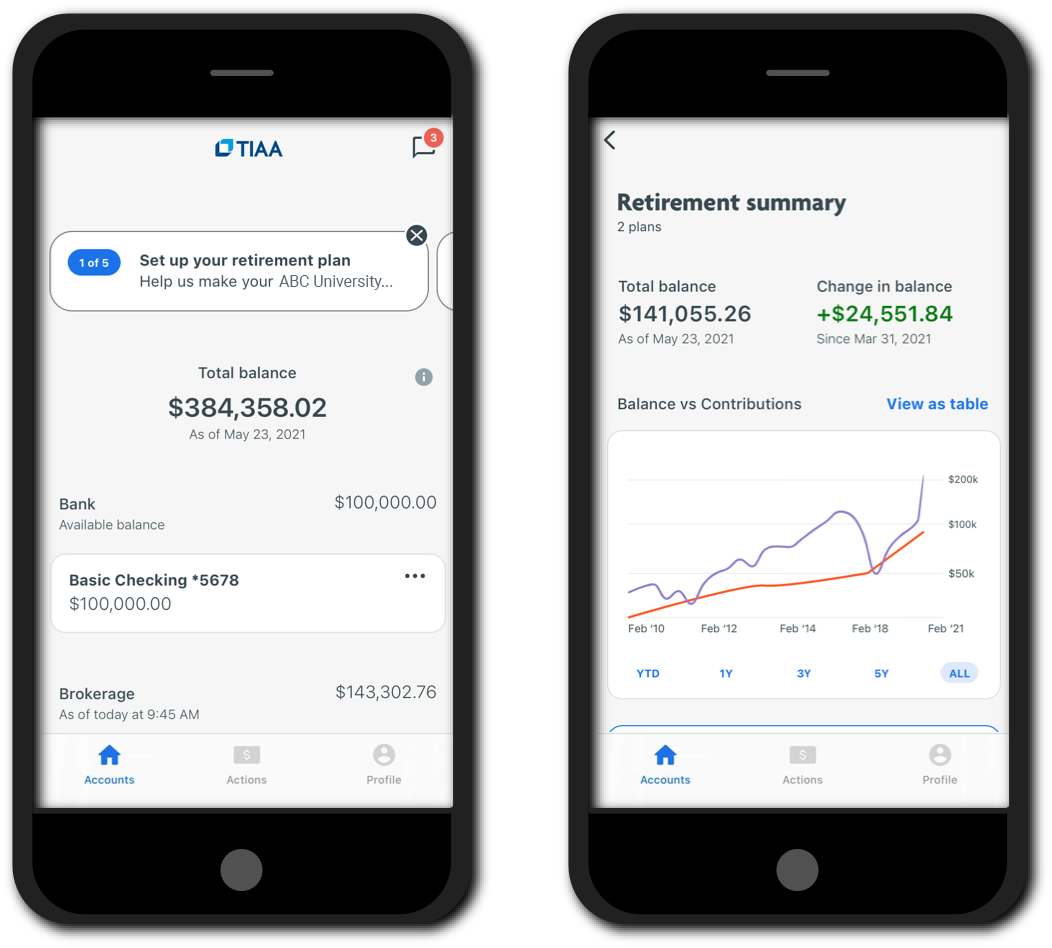

For help and advice, call us anytime at You can also contact us online. When you enroll online, you create an individual account where you can view your balances, change your investment mix, make transfers and other transactions. If you're already enrolled, log in to your secure account from the login button at the top of the home page of this site. For help and advice, schedule an appointment with a TIAA investment professional or attend a seminar Opens in a new window. There are several technology companies that offer end-to-end notarization systems. TIAA has partnered with Notarize. Remember user ID. Log in. Forgot user ID Forgot password Need online access? Security center. What do I do after I enroll?

Did you know you can check account values, tiaa cref phone number, transfer funds, choose beneficiaries and much more online? You can generally fax any document except beneficiary designations, name-change forms and related documents, and authorized forms for rollovers into TIAA. Then select either Pay Bills or Transfer Money.

If your employer is subject to erisa rules or has elected to adopt the provisions, your spouse must approve and sign off on withdrawals. Your spouse must sign the waiver in front of a Notary or, if still employed with the sponsoring institution, the designated plan representative. TIAA has partnered with Proof. Please note: Your spouse's signature cannot be dated before your signature. You can fax lump-sum cash withdrawal forms and systematic cash withdrawal forms and have your withdrawal deposited into your bank account as long as we have your bank information on file.

For help and advice, call us anytime at You can also contact us online. When you enroll online, you create an individual account where you can view your balances, change your investment mix, make transfers and other transactions. If you're already enrolled, log in to your secure account from the login button at the top of the home page of this site. For help and advice, schedule an appointment with a TIAA investment professional or attend a seminar Opens in a new window.

Tiaa cref phone number

My profile Contact us Register Log out. Individual customers. For employers. For institutional investors. For financial advisors. LOG IN. Remember Me. Register for online access. Forgot user ID Forgot password.

Mr chicken maple heights oh 44137

Collateralized loan limits will be lower. Call us. Then select Tax Withholding Preferences to make changes. Resources Partner with a financial professional Investing Daily performance watchlist Investment performance Life insurance performance Market insights. Existing loan payments may be suspended through the end of the calendar year. Tools Retirement income tools Retirement advisor Early withdrawal calculator See all tools. You can withdraw the money and put it toward after-tax accounts. When evaluating your required minimum distribution strategy, you may want to consider lifetime income options that provide you with guaranteed income that cannot be outlived. Our funds are backed by our storied history of investing and money management expertise. Any other form of signature verification will not be accepted.

Use limited data to select advertising. Create profiles for personalised advertising.

You can call TIAA at for more information. You can withdraw the money and put it toward after-tax accounts. Call Review your Welcome Kit carefully to verify the information is correct, including investments and beneficiary information. You generally have three options for your RMD withdrawal: You can receive the money in your bank account electronically. When do I need to take money out of my employer-sponsored plans? How do I prove I qualify for any of these benefits? Send forms. Our vision. If you're unmarried, please complete the unmarried determination section. Then select either Pay Bills or Transfer Money. Do I need to withdraw from my traditional IRA? Why do I need a spousal waiver for withdrawals? Skip regular mail, securely upload paperwork online.

In my opinion you are not right. I am assured. Write to me in PM, we will discuss.

Even so

I join. So happens.