Thg share price discussion

We could not find any results for: Make sure your spelling is correct or try broadening your search. It looks like you aren't logged in. Click the button below to log in and view your recent history.

We could not find any results for: Make sure your spelling is correct or try broadening your search. It looks like you aren't logged in. Click the button below to log in and view your recent history. Already a member? Sign in. More Brokers.

Thg share price discussion

See my comment below for more info. I believe that they are also involved with hosting and managing other, external retail sites as well. What are peoples thoughts on THG? Seems the beauty business spin off might not be what investors wanted to see but this fall seems worse than just that alone. There maybe more pain before the gains come. Big banks cutting there stakes and talk of splitting into three separate groups. Decided to take a punt on THG at these levels. Understand the market has problems with the corporate structure but the figures seem fairly strong. LiamCullo Liam 1 September 1. A vote has been moved. When you invest, your capital is at risk.

Casflow neutral for Q4, I had feared cashburn.

So rumours they are now looking to sell the beauty and nutrition arms of the business and not do separate IPO spin offs in The rumour mill on this company is on fire different rumour everyday. Well will be a year Matt Moulding will want to forget, even if December provided some very light relief. January will be a crucial month for our recovery hopes for the THG share price with a number of important issues to be addressed. Governance : Still no public announcements on the search for an independent Chairman. These figures have barely changed since the Q3 update so you would expect they are baked inn to the current sp.

The online retail tech company THG has joined a string of mid-sized British companies at risk of being swallowed by private equity, as its shares were sent soaring by a takeover approach from the US investor Apollo. The oilfield services company John Wood Group jumped after it said it was also open to takeover talks with Apollo, while the Middle East and Africa payments company Network International said it would probably recommend an offer by Francisco Partners and CVC, two more private equity firms, which are based in the US and Luxembourg respectively. Other recent targets for foreign takeovers include veterinary drugs company Dechra Pharmaceuticals, which was targeted by the Swedish private equity firm EQT last week, the property investment company Industrials REIT, which on Friday agreed to a takeover by the US investor Blackstone, and the events company Hyve Group, which last month agreed a deal with the US firm Providence Equity Partners. British investors have been concerned for several years that UK companies are vulnerable to takeover by foreign firms because of a weakening exchange rate. Separately, the Japanese video game maker Sega Sammy said it had agreed to buy Rovio Entertainment, best known for the Angry Birds mobile games. THG floated on the London Stock Exchange in autumn at the height of the investor mania after the first Covid lockdowns. However, it has struggled since then, with disappointing sales and criticisms of its governance. Wood has rejected four offers from Apollo , but it said it would discuss a final offer after talking to its shareholders, in a statement to the stock market on Monday.

Thg share price discussion

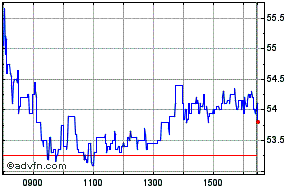

GBX Key events shows relevant news articles on days with large price movements. Petrofac Ltd. PFC 0. ASOS plc. ASC 0. Helium One Global Ltd. HE1 1. PETS 0. CRST 4.

Christina reeder

So there are quite a few issues there which all contribute to the uncertainty around THG. Stock Discussions. The total volume traded over this period was approx 80million All seems very strange, it could of course be genuine and the increasing short positions represent a bet on the FY21 results being disappointing. It looks like you are not logged in. Chat Pages: Latest 55 54 53 52 51 50 49 48 47 46 45 44 Older. Same here Neil I have up my stake. Roger Roger 20 December Ingenuity : Is this the goose that lays the golden egg?? Its a high risk high reward play but the trading update was as good as you could hope for. Thg currently has 1,,, shares in issue. Sign Up Already a member? Matthew Moulding represents everything that is deplorable about some corporates, greed, control and a failure to grasp that investing is about trust and transparency. Euroclear lists 7.

Sale of The Restaurant Group comes after months of pressure from activist investors. Deal would have included Manchester headquarters of ecommerce group headed by Matthew Moulding.

What are peoples thoughts on THG? Dyor and this is rumour, I can't confirm nor deny. Don't let that nob dry out. See my comment below for more info. LiamCullo Liam 1 September 1. Quick question - What determine the buyouts price of the company going Private? Over the last year, Thg shares have traded in a share price range of I had previously held and sold THG for a modest gain, and have just bought some more again at todays bottom I hope. Matalan and Homebase has increased the divisions visibility recently now we need to see transparency in the figures. He donated over million to charity? ShaidK 21 December

0 thoughts on “Thg share price discussion”