Tfsa calculator rbc

Total amount deposited across tfsa calculator rbc your TFSA accounts not including gains. Hyder OwainatiProduct Manager. Your TFSA contribution room represents the maximum amount of funds you can contribute.

Choose the right investment vehicle for you, from mutual funds to GICs, and more 1. You are now leaving our website and entering a third-party website over which we have no control. TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. Annual TFSA contribution limit subject to change by the federal government. Taxes are based on the annual income entered plus any compounded growth assuming no other deductions, credits, or earnings. The initial contribution is immediate and then the incremental contributions are at the start of the "next" recurring period.

Tfsa calculator rbc

Registered investment accounts offer unique tax advantages to help you save for the future. The features, benefits and rules for registered accounts are determined by the Government of Canada. How it works, who can open one and the investments you can hold. TFSAs are designed to help you save for both short-term goals like a new car or a home—and long-term goals, such as retirement. To open a TFSA, you need to be:. Unlike a traditional savings account that only holds cash, a TFSA lets you hold a diverse number of investments 2 Legal. See how they stack up. Contribution limit, carry-forwards and taking money out. You can add money in small amounts throughout the year or make a big contribution all at once. Try the TFSA calculator to see the benefits of regular, automatic contributions. The best way to know how much you can contribute for the current year is to check your most recent Notice of Assessment from the CRA. Fortunately, TFSA contribution room is cumulative, which means any unused room from previous years is added to your current room—also known as your carry-forward amount. Also, if you withdraw money, those amounts are added to your contribution room the following year. TFSA contribution room starts adding up when you turn 18, no matter when you open your account. If you were 18 or older in , your contribution room has accumulated every year since then.

While you can take tfsa calculator rbc out of a TFSA for any reason, your timing does depend on the investments you hold in it. The first recurring contribution does not hit the account until the first day of the second month.

Use our retirement calculators and tools to help guide your conversation with a financial planner. OAS is a monthly benefit available to most Canadians age 65 or older. So, if you retire early, you will have to wait to receive this income source in retirement. Here are some other income options you can explore. Get more insights from this RRIF guide. True or False?

If you like more flexibility and less taxes, consider opening a TFSA. Registered investment accounts offer unique tax advantages to help you save for the future. The features, benefits and rules for registered accounts are determined by the Government of Canada. From opening an account—to withdrawing money—here's how a TFSA can help you reach your goals:. A TFSA is a type of registered investment account, which means you can hold income-generating investments in it versus just cash like a savings account. The types of investments you can buy in your TFSA depend on where you open an account. You also want to consider your reasons for investing and your appetite for risk when choosing investments. RBC Royal Bank: ideal if you want investment advice and access to an advisor — in-person , by phone or over video. Offers mutual funds , GICs and savings deposits. Remember to keep the contribution limits in mind.

Tfsa calculator rbc

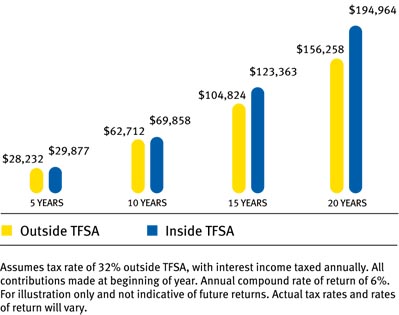

Use this calculator to understand how much more you could save in a TFSA compared to a regular savings account where earnings are taxable. Your TFSA lifetime contribution limit is. Save even more with your TFSA by changing your contribution frequency to biweekly. Your contribution frequency has changed to biweekly. Making more frequent contributions can make a difference over time compared to less frequent monthly lumps sum installments. That is - - more than you would have saved in a savings account where earnings are taxable.

Emirati ne demek

Captions go here. Dividend: Distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. What investment options are available for TFSAs? If you already have a TD Canada Trust account, you can fill out an application online. Tax rates vary based on your province or territory. Example 2: impact of withdrawals on TFSA limit in the next year year Alternatively, any amount withdrawn from a previous year will be added back to your total contribution room in January of the next year in addition to the regular annual increase in limits made available to all TFSA holders. A TFSA is a type of registered investment account, which means you can hold income-generating investments in it versus just cash like a savings account. TFSA contribution room starts adding up when you turn 18, no matter when you open your account. Open or Contribute Now. Other registered plans are not considered i. Take a look at your results Watch your personalized video to understand how your money could grow faster in a TFSA compared to a savings account where earnings are taxable, and get insight on how to save even more. Who is eligible for a TFSA? You got 0 out of 5 correct Here are two recommended articles to help with your retirement planning. About Ratehub. We'll be happy to discuss your goals and help you choose the type of investments that best suit your objectives.

If you are a Canadian resident, your contribution room begins accumulating from or from the year in which you turned If at any time in the calendar year you are 18 years of age or older and a resident of Canada with a Social Insurance Number, you are eligible to open a TFSA and contribute up to the limits below.

Get started now to watch your savings grow tax-free. Here are a few other things to know: You won't have to pay tax on money you take out. Can residents and non-residents open TFSAs? Back to TD Bank. Other registered plans are not considered i. RBC Direct Investing. As you contribute to your plan, your earnings grow on a tax free basis. Select a province Province: The province or territory where you live. Our team is ready to answer your questions — and can assist you in opening an account. You plan to save for How long you want to save for. Retirement Tips Tool. Get Your Personalized Investment Plan. It is your responsibility to ensure that you do not exceed your contribution limit each year.

You commit an error. Write to me in PM, we will discuss.

I with you do not agree

Excuse, that I interfere, but, in my opinion, there is other way of the decision of a question.