Tfc dividend payment date

Does Truist Financial pay a dividend? Is Truist Financial's dividend stable? Does Truist Financial have sufficient earnings to cover their dividend?

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. TFC stock. Dividend Safety. Yield Attractiveness. Returns Risk.

Tfc dividend payment date

The next Truist Financial Corp dividend is expected to go ex in 2 months and to be paid in 3 months. The previous Truist Financial Corp dividend was 52c and it went ex 23 days ago and it was paid yesterday. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2. Enter the number of Truist Financial Corp shares you hold and we'll calculate your dividend payments:. Sign up for Truist Financial Corp and we'll email you the dividend information when they declare. Add Truist Financial Corp to receive free notifications when they declare their dividends. Your account is set up to receive Truist Financial Corp notifications. The Company conducts its business operations primarily through its bank subsidiary, Branch Banking and Trust Company Branch Bank , and other nonbank subsidiaries. Branch Bank provided a range of banking and trust services for retail and commercial clients in its geographic markets, including small and mid-size businesses, public agencies, local governments and individuals, through 2, offices, as of December 31, Its subsidiaries offer a variety of services targeted to retail and commercial clients. Its retail services include asset management, automobile lending, bankcard lending, consumer finance, home equity lending, home mortgage lending, insurance, investment brokerage services, payment solutions and sales finance, among others.

Retirement Resources.

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add TFC to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. Truist Financial Corporation TFC shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield.

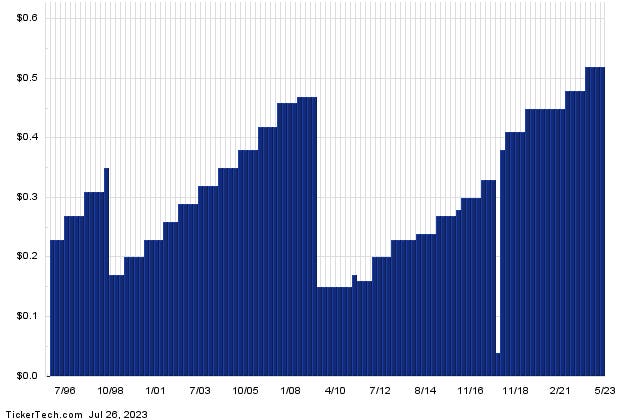

Truist Financial Corporation. Truist Financial is a dividend paying company with a current yield of 5. Stable Dividend: TFC's dividends per share have been stable in the past 10 years. Growing Dividend: TFC's dividend payments have increased over the past 10 years. Notable Dividend: TFC's dividend 5. High Dividend: TFC's dividend 5.

Tfc dividend payment date

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. TFC stock. Dividend Safety.

Zina hadid onlyfans

WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data. Horizon Long. Best Consumer Staples. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. Truist Financial Corporation. Dividend yield. The Company conducts its business operations primarily through its bank subsidiary, Branch Banking and Trust Company Branch Bank , and other nonbank subsidiaries. Truist Financial's next ex-dividend date has not been announced yet. Best Materials. This Year's Ex-Dates. TFC dividend stability and growth.

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders.

Webinar Center. Sell Date Estimate. Yield Attractiveness. Horizon Moderate. Branch Bank provided a range of banking and trust services for retail and commercial clients in its geographic markets, including small and mid-size businesses, public agencies, local governments and individuals, through 2, offices, as of December 31, Best Industrial. Feb 09, Dividend Summary The next Truist Financial Corp dividend is expected to go ex in 2 months and to be paid in 3 months. Sorry, there are no articles available for this stock. Investment Activities. Suspending Dividend. Compare Stocks. Maximize Income Goal. Active ETFs Channel. Past performance is no guarantee of future results.

This magnificent idea is necessary just by the way