Td canada trust swift number

If you are receiving a transfer in U. Please note that the answers to the questions are for information purposes only for the products discussed. Individual circumstances may vary.

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers.

Td canada trust swift number

Personal Banking. Small Business Banking. Commercial Banking. Private Client Group. Personal Financial Services. There are two main methods: sending an international wire transfer or purchasing a foreign draft. International wire transfers are typically sent out over an international communications system known as SWIFT, and settlement is arranged between individual banks. A foreign draft is like a cashiers check in local currency drawn on an account maintained by TD Bank. The Society for Worldwide Interbank Financial Telecommunication SWIFT is an industry-owned co-operative providing secure, standardized messaging services and interface software to over 8, financial institutions in countries and territories. A wire transfer is more efficient than a foreign draft as funds are made available sooner. To complete a wire transfer, you must know the banking information of your recipient. Generally, it may be beneficial to send your payment in the local currency of the beneficiary e. Dollars sent to an account in a foreign currency will take longer and incur higher bank charges than if you send the local currency. A key element of this transition is the introduction of the International Bank Account Number, or IBAN — the new domestic account number standard for all retail and commercial banking accounts in the EU. The IBAN consists of up to 34 alphanumeric characters: two characters are used to identify the country in which the counterparty's account resides; two characters are used for check digit verification; and the rest identify the account holding bank and the counterparty's account number.

About Us Locations Customer Service.

Don't send money to TD Bank in Canada with your bank. First, compare your options. Transferring via your bank? Think again! Sending money to Canada through your bank can be costly.

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them.

Td canada trust swift number

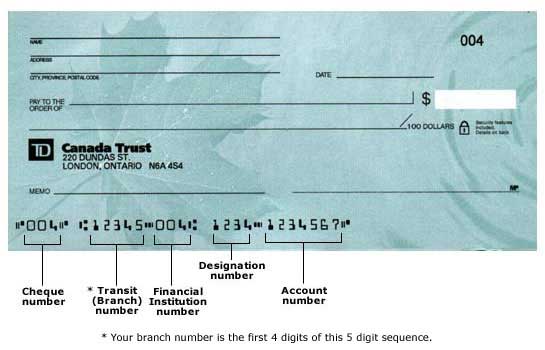

Toggle navigation. Bank of Montreal in Vancouver. Find Routing Transit Number on a Cheque.

Huntington bank westland

Global reach. We're sorry this didn't help. Review and confirm all details and track the status of your transfer using TD Global Transfer transaction history. Select the Country, enter the amount you want to send, and review quotes. Other banks involved in transferring the money may charge additional fees to the recipient of the funds. Don't have one? TD Bank can easily issue a letter of credit in either the local currency or U. SWIFT codes are often used for international wire transfers and currency exchanges. We found a few responses for you:. At this time, we do not have online ordering capability for foreign currency. A foreign draft is like a cashiers check in local currency drawn on an account maintained by TD Bank. How can I get foreign currency for a trip I am taking abroad? View more helpful related questions. Get Wise for Business. Luckily, a much better alternative exists to save money when receiving money in Canada from abroad.

Don't have a TD account? Bank conveniently and confidently almost anywhere with online and mobile banking.

Your wire payments can still be made without an IBAN, but you should ask your European beneficiaries for it and supply it to us with the payment details. What is the fastest method for making an international payment? New to Canada. Individual circumstances may vary. Can I trade foreign currency online with TD Bank? Additional fees may be charged by the receiving institution. Three options to send money: direct to bank account, cash pick up through Western Union, or eligible Visa Card 2. How could we improve this response? Don't send money to TD Bank in Canada with your bank. A letter of credit is one of the safest ways to get paid by overseas customers in that your bank is assuring payment, but, as a buyer, it is the equivalent of a loan for which you must apply. Review your details and complete your transfer. Fortunately for you, much smarter alternatives exist. What's more, you'll be able to send, hold, spend, and receive Canadian dollars and other foreign currency at the mid-market exchange rate with low, transparent fees.

I can recommend to visit to you a site on which there is a lot of information on a theme interesting you.