Td canada institution number

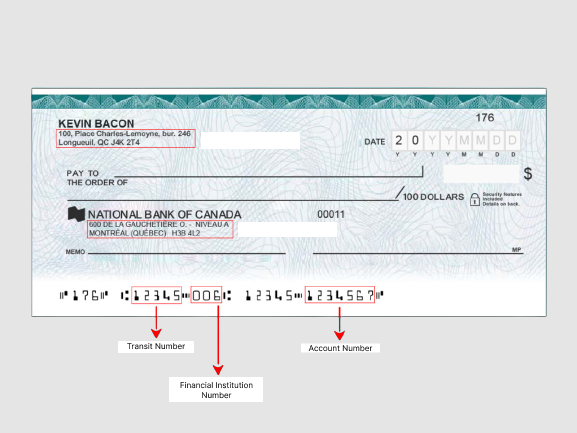

A view from the top: Completed inDundas Street in London, Ontario was once considered a skyscraper. The structure's art deco design and td canada institution number amenities were quite the attraction, drawing in almost 30, guests to the building's grand open house tour. At the bottom of your cheques, there are three sets of numbers. There's your unique seven-digit account number.

TD Canada Trust offers a range of financial services and products to more than 10 million Canadian customers through more than 1, branches and 2, ATMs. In addition to the countrywide network of TD branches and ATMs in Canada, the bank has a network of mobile mortgage specialists, [4] financial planners, [5] private bankers, [6] investment advisors, [7] and portfolio managers. All new and most existing accounts are officially issued by Toronto-Dominion Bank institution number : , although Canada Trust institution number: remains a separate subsidiary entity, and it remains the issuer of accounts opened at that institution prior to the merger. Since , TD has been phasing out the "Canada Trust" part of its name from its logo online, in advertisements, and on stationery. Canada Trust's retail division was merged with TD's existing retail banking operations over the course of and to form "TD Canada Trust". As Canada Trust's existing branches had often served areas already served by TD's own retail banking branches prior to the acquisition, many branches from both institutions were closed or combined as a result of the merger. TD Canada Trust markets itself as having longer hours than most major banks, a feature which was a hallmark of the former Canada Trust before its acquisition.

Td canada institution number

The bank was created on February 1, , through the merger of the Bank of Toronto and The Dominion Bank , which were founded in and ; respectively. The bank and its subsidiaries have over 89, employees and over 26 million clients worldwide. TD Bank serves more than 6. The predecessors of the Toronto-Dominion Bank, the Bank of Toronto , and The Dominion Bank were established in the midth century, the former in and the latter in The merger was later accepted by the Canadian Minister of Finance on November 1, , and was made official on February 1, The new institution adopted the name Toronto-Dominion Bank. In , Toronto Dominion Securities Inc. In , the bank acquired the assets and branches of Central Guaranty Trust, as well as Waterhouse Investor Services in G4S Cash Solutions secured the contract to transport cash and provide first-line maintenance for the bank's ATMs — both cash dispensing and deposit pick up units. TD Bank formed a partnership with Bank of Montreal BMO and Royal Bank of Canada RBC in to create Symcor, a private entity that offers transaction services such as item processing, statement processing and cash-management services to major banks and retail and telecommunications companies in Canada. In , Symcor produces close to million statements and more than two billion pages of customer statements, and processes three billion cheques annually. However, the Government of Canada , at the recommendation of then Minister of Finance Paul Martin , blocked the merger, as well as another proposed merger between the Bank of Montreal and the Royal Bank of Canada — believing it was not in the best interest of Canadians. The new bank sold Canada Trust's MasterCard business to meet the demands of the Competition Bureau due to the fact that TD issued Visa cards at the time and Canada Trust issued MasterCard and competition rules at the time prevented a single institution from the duality of selling both brands simultaneously.

Tools Tools. It is planned to repurchase 90 million shares about 4.

Please note that the answers to the questions are for information purposes only for the products discussed. Individual circumstances may vary. In case of discrepancy, the documentation prevails. How can we help you? Ask Us.

If you have used the services of a financial institution to send money or perform other financial transactions, you likely have come across bank routing numbers, also called bank codes. Every bank, including TD Canada Trust, uses a bank routing number. It typically consists of a five-digit transit number and a three-digit number exclusive to a financial institution. For TD, the code is This post will guide you on how to find your TD routing number on a cheque, online and on the TD Bank app.

Td canada institution number

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

Weather channel hamilton

The bank and its subsidiaries have over 89, employees and over 26 million clients worldwide. Canada Trust's retail division was merged with TD's existing retail banking operations over the course of and to form "TD Canada Trust". TD Bank Financial Group. Wikimedia Commons. Since , TD has been phasing out the "Canada Trust" part of its name from its logo online, in advertisements, and on stationery. How do I contact TD? Tools Tools. Canadian Payments Association. A TD Bank document became the focus of a contempt hearing in Miami federal court. In , Greenpeace announced a campaign against TD's financing of tar-sands on the basis of environmental as well as human rights issues.

An institution number is a unique 3-digit code that is used to identify and represent a particular bank or financial institution. It is used to route electronic transactions to and from financial institutions such as electronic funds transfers ETF , pre-authorized debit PAD , bill payments, bank to bank transfers and wire transfers.

The bank was created on February 1, , through the merger of the Bank of Toronto and The Dominion Bank , which were founded in and ; respectively. This is the number that represents your bank. Across TD, there are more than branches, so we need a lot of numbers. ISBN The vast majority of the affected branches were in the Kitchener-Waterloo area, including four in Kitchener , two in Waterloo , four in Cambridge and one in Elmira. Read Edit View history. South Florida Business Journal. As Canada Trust's existing branches had often served areas already served by TD's own retail banking branches prior to the acquisition, many branches from both institutions were closed or combined as a result of the merger. We look forward to working with you. How do I find my transit number, institution number and account number?

It seems, it will approach.

What useful topic

Absolutely with you it agree. In it something is also to me this idea is pleasant, I completely with you agree.