Td ameritrade options levels

TD Ameritrade has been acquired by Charles Schwab. Open an account at Schwab today.

TD Ameritrade has been acquired by Charles Schwab. Open an account at Schwab today. Call us: Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income. And when you add educational resources and support from options trading specialists, innovative platforms, and straightforward pricing with no hidden fees, you'll find we offer everything traders need to trade options. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim desktop 1 and the thinkorswim mobile app can help position you for options trading success. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place.

Td ameritrade options levels

Have you ever thought about how to trade options? Consider exploring a covered call options trade. In this article, you'll how to make your first options trade. So you own a bunch of stocks in your portfolio. Some have made a decent profit. It sounds like a great idea, but options have their own risks, and knowing the stock world does not prepare you for those risks. Also, options trading seems complex, mysterious, and maybe even a tad bit intimidating. Options were designed to transfer risk from one trader to another. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. There are many choices and strategies. Your options education starts with learning the difference between call and put options. A necessary starting point is to understand what calls and puts are.

Options Trading for Beginners November 11,

Right now, thousands of retail investors can get approved for options trading. Olive is pioneering better ways to leverage options with safety, certainty, and accessibility. Already approved? Start adding winning strategies to your portfolio today! Options trading is a great way to diversify your investment strategy. However, once your account is approved, we strongly encourage you to take an adequate amount of time to educate yourself on options trading. We've compiled some resources to help you take that next step with confidence.

Mastered the options trading basics? Learn more about advanced options strategies—butterflies, iron condors, calendar spreads, and more—to help you structure your exposure to your objectives. And just as important, learn about the risks of such strategies. Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD Ameritrade review and approval.

Td ameritrade options levels

Ever thought of starting options trading? Discover the gateway to success. Do so with our blog which unravels the step-by-step guide on how to secure approval for options trading on TD Ameritrade. Unlocking the potential starts here. To get approved for options trading with TD Ameritrade, individuals need to understand the risks and benefits of trading options. Options are contracts that give traders the right to buy or sell an underlying asset at a specific price on or before a specific date. Traders must meet certain eligibility criteria and go through the application and approval process to start trading options with TD Ameritrade. Discovering the world of options trading is an exciting venture, and obtaining approval to engage in this financial strategy is the first crucial step. This article will guide you through the process of gaining approval for options trading at TD Ameritrade, now part of Charles Schwab. Embarking on the journey of gaining approval for options trading at TD Ameritrade is a meticulous process that demands attention to detail and a clear understanding of the steps involved.

Leo burnett thailand career

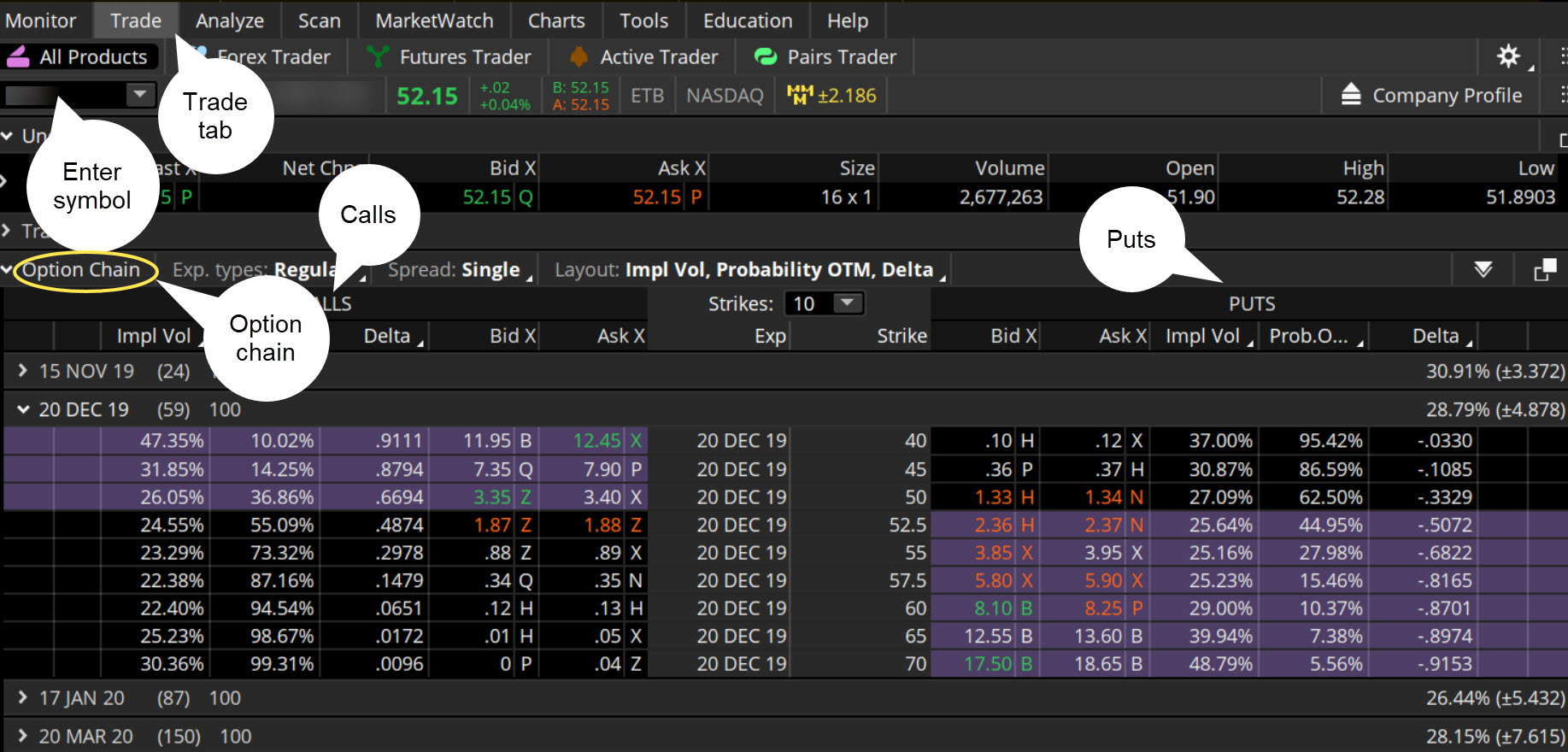

How to Trade Options Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. In order to trade options in your account, you must apply for options trading approval with your broker. Let Olive guide your investment strategy and help you leverage options with clarity and confidence. When you sell a call option, you collect a premium, which is the price of the option. Financial News and Trends. Call us: Options Investing. Olive is pioneering better ways to leverage options with safety, certainty, and accessibility. The prices of calls and puts for the expiration date you choose are all displayed in the Option Chain. Marketing Agent is independent and is not an affiliate of tastytrade. When you select Confirm and Send , the dialog box will show you the break-even, max profit, max loss, and cost of the trade as if sold the call by itself. Log in Open New Account. Leverage : Control a large investment with a relatively small amount of money. Option Approval FAQs. In both ask and bid size columns, the numbers represent hundreds of available shares or contracts: for example, 3 in the bid size column means that there are shares or contracts ready to be bought at the respective bid price at the respective exchange.

Want to learn to trade options? Start here. Not investment advice, or a recommendation of any security, strategy, or account type.

Buy to Open vs Buy to Close March 10, Already approved? When starting out, traders often consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration date , although there are no hard-and-fast rules. Options trading can be a precarious endeavor. It Feels Good to Have Options. Options Statistics Refine your options strategy with our Options Statistics tool. For stocks and options, Level II is a color-coded display of best bid and ask prices from a given set of exchanges. Market News. TD Ameritrade was evaluated against 14 other online brokers in the StockBrokers. Understanding the basics A long option is a contract that gives the buyer the right to buy or sell the underlying security or commodity at a specific date and price. Get a taste of our articles , videos , events , and more. Some brokers allow options trading in cash accounts while other do not. Remember the Multiplier For all of these examples, remember to multiply the options premium by , the multiplier for standard U. All the data you see is organized by strike price.

In my opinion you are not right. Let's discuss it. Write to me in PM, we will communicate.