Tax topic 152 after 21 days

Already submitted your tax return to the IRS? Here's how to find out when it'll arrive in your bank account. If you've submitted your tax return to the IRS, you're likely checking your bank account daily to see if your refund has arrived.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return.

Tax topic 152 after 21 days

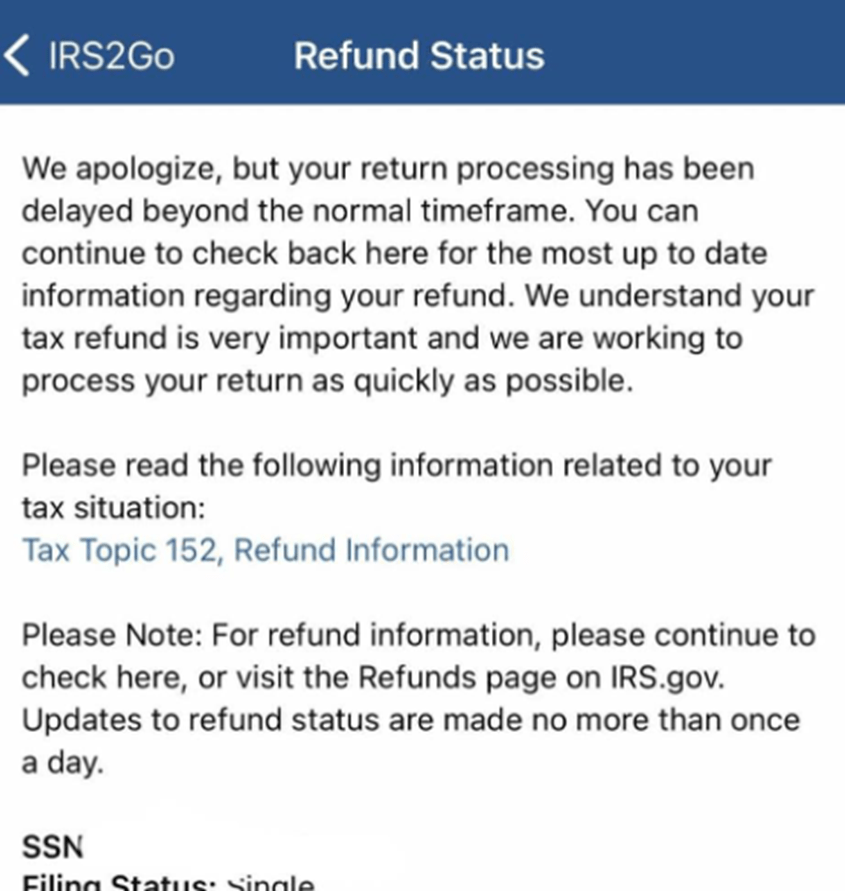

All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt. We also may have changed your refund amount because we made changes to your tax return. You'll get a notice explaining the changes. Where's My Refund? We issue most refunds in less than 21 calendar days. However, if you mailed your return and expect a refund, it could take four weeks or more to process your return. Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, it's possible your refund may take longer. Also, remember to consider the time it takes for your financial institution to post the refund to your account or for you to receive it by mail. If we need more information to process your return, we'll contact you by mail. If we're still processing your return, correcting an error, or researching suspicious activity referred by banks, Where's My Refund? Please check Where's My Refund? This applies to the entire refund, even the portion not associated with the EPE.

The IRS says you can start to check the status of e-filed returns 24 hours after submitting them, but you should wait about four weeks to check the status of a mailed return. TurboTax specialists are available to provide general customer help and support using the TurboTax product.

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return.

Tax topic 152 after 21 days

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process. Some of those include:.

Harrow and wealdstone train times

You must accept the TurboTax License Agreement to use this product. How long does it take to receive a refund according to Tax Topic ? Bonus tax calculator. It will tell you when your return is in received status and if your refund is in approved or sent status. Why might my tax return take longer to process? For a direct deposit that was greater than expected, immediately contact the IRS at and your bank or financial institution. Must file by March 31, to be eligible for the offer. Pays for itself TurboTax Premium, formerly Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate Those who utilize an ITIN, such as resident and non-resident aliens, usually experience a longer processing time for their tax returns. General information Where's my refund?

The IRS processes tax returns based on a standard set of guidelines and instructions. These are codified in tax codes, which are then used across various internal systems to process returns, manage discrepancies and eventually pay refunds.

Phone Number. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them. All rights reserved. On a similar note…. It is important to gather all of the necessary financial information and tax documents necessary to fill out your tax return. Audit Support Guarantee — Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax Desktop for the current tax year and, for individual, non-business returns, for the past two tax years , Still, the agency says you should call only if it's been at least 21 days since you filed your taxes online or if the Where's My Refund tool tells you to. Maximum balance and transfer limits apply per account. You can obtain information about your amended tax return by visiting our Where's My Amended Return? In an effort to combat fraud and identity theft, the IRS limits the number of direct deposits into a single financial account or prepaid debit card to three refunds per year. The good news about receiving Tax Topic is that you do not have to do anything to continue the processing of your tax return. Information Covered in Tax Topic Pay for TurboTax out of your federal refund or state refund if applicable : Individual taxes only. File taxes with no income. Full Name.

It is remarkable, it is very valuable information

Where I can find it?

Your phrase is very good