Tax calculator quebec

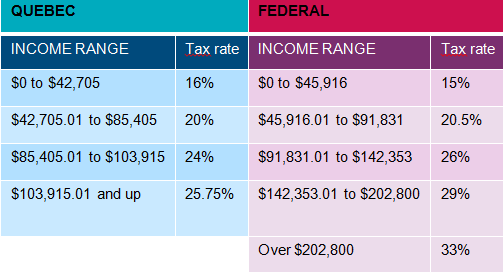

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, tax calculator quebec. So how exactly do taxes work in Canada?

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

Tax calculator quebec

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket The deadline to file your income tax return in is midnight on April Learn more about tax deadlines. For mailed returns, refunds are mailed out in 4 to 6 weeks following receipt of the return by the CRA or the Revenu Quebec. Learn more about tax refunds. Pay by setting up a pre-authorized debit agreement using CRA My Account or through a third-party service provider with credit card, e-transfer, or PayPal. Learn more about paying your taxes online. There are no exemptions for age or occupation. The CRA requires that you retain your records for a minimum of 6 years, by law.

What is enterchatroom eligible dividend? If eligible, claim tax calculator quebec Federal equivalent to spouse eligible dependent tax credit for ONE of the following dependents:. Home renovation and homebuyer tax credits can be shared by spouses - see what works best.

Select your location Close country language switcher. Start your free 30 day trial. Read report. EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes. Quebec follows federal guidelines on the exemption of sales taxes to First Nations. Further exemptions and regulations can be found at here here. In Quebec, sales taxes are charged differently on used motor vehicle sales depending on who sells it to you. If you buy a used car from another person, however, you will only need to pay QST on the greater of the sales price or the estimated value of the vehicle. You do not pay the QST amount to the person or dealer that sold you the vehicle.

Tax calculator quebec

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. For Quebec residents making purchases in other provinces in Canada during , it's crucial to be aware of the tax implications. When dealing with the sale of books, only the GST needs consideration in the calculation. Ensure compliance with the specific tax regulations of the province in question.

Modified design sherman tx

Total tax deducted from pension income of taxpayer. These tips will help you understand what to include when you file. Deduction for enhanced QPP contributions on self-employment income. Deduction for elected split-pension amount. Sales Taxes in Quebec Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. Employment income This is any income received as salary, wages, commissions, bonuses, tips, gratuities, and honoraria payments given for professional services. Tax credit for childcare expenses line Amounts are recalculated automatically when you tab out of a cell or click elsewhere with your mouse, or click the Calculate button. It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. Subtotal Federal and QC tax zero if negative. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site.

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator.

It does not include every available tax credit. Income tax tips from the TurboTax Hub Ever wonder what those lines on your tax return mean? Frequently asked questions. Quebec income tax calculator Type amounts into yellow cells. What it's like to work here. We strive for accuracy, but cannot guarantee it. When processing transactions involving Quebec residents outside of Canada, it's important to note that, as of the current regulations, no sales tax is applicable. To determine if you are eligible for this credit, see the calculator information page for a link to the equivalent to spouse tax credit article. Adjusted taxable income - i. If you buy a used car from another person, however, you will only need to pay QST on the greater of the sales price or the estimated value of the vehicle. Additional tax for Federal alternative minimum tax AMT.

0 thoughts on “Tax calculator quebec”