Stock split calendar

Top Analyst Stocks Popular. Bitcoin Popular.

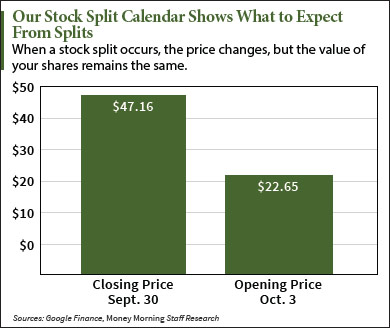

A stock split consists of an action taken by a company to divide its existing shares into multiple shares. Stock splits both increase the amount of shares outstanding and decrease the price of shares to reflect the split. A stock split takes place when a company decides to divide its existing shares into additional new shares. Splits also boost trading volume and tend to increase liquidity in the stock. In a stock split announcement, a company will let the market know the ratio of the stock split and the day when it will occur. On the day the stock splits, the original shares trading on the relevant stock exchange will open at an adjusted price.

Stock split calendar

.

Reverse stock splits help companies avoid having their stock delisted from major exchanges that have minimum prices for listing. Working with TipRanks. Earnings Calendar.

.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us.

Stock split calendar

A stock splits calendar is a tool used by investors to track upcoming and historical stock splits for individual stocks and the stock market as a whole. A stock split is a corporate action in which a company increases the number of shares outstanding by issuing additional shares to existing shareholders. This can be done in several different ways, but the most common is through a forward stock split, which reduces the price per share and makes the stock more affordable for individual investors. Conversely, a reverse stock split is a corporate action in which a company decreases the number of outstanding shares while increasing the price per share, effectively reducing the number of shares in circulation. This is often done when a company's stock price has fallen too low, and the company wants to increase the price per share to avoid being delisted from a stock exchange. A stock splits calendar provides investors with important information about upcoming and historical stock splits, including the date of the split, the split ratio, and any other relevant details. This information can help investors make informed trading decisions by allowing them to analyze the impact of stock splits, both forward and reverse, on the stock's price and market capitalization. By using a stock splits calendar, investors can stay informed about upcoming and historical stock splits, and adjust their investment strategies accordingly. A 1-for reverse stock split for Affimed AFMD consolidates every 10 shares into 1, resulting in fewer outstanding shares but a higher per-share price for investors.

Animal crossing artwork guide

Forward Split Example 1 to 2 : If a company announces a forward split with a ratio of 1 to 2, it means each share you own will be split into 2 shares. Does a stock split affect the value of my investment? Apr 22, Furthermore, stocks that split also tend to increase in value since they are now available to more investors. Suzuki Motor Corp. Yield How to Buy Corporate Bonds. Stock Splits. Invest in Art. Common split ratios are 2-for-1 or 3-for-1, meaning a shareholder receives 2 or 3 shares for every 1 share they hold. All Broker Reviews. This is typically done to make the shares more affordable. Mar 19, Tootsie Roll Industries, Inc. Top Individual Investors.

As a result of the reverse stock split, every 12 shares of issued and outstanding common stock will be exchanged for 1 share of common stock, with any fractional shares being rounded up to the next higher whole share. Immediately after the reverse stock split becomes effective, the Company will have approximately , shares of common stock issued and outstanding.

In a stock split announcement, a company will let the market know the ratio of the stock split and the day when it will occur. No, a stock split does not change the market value of your total investment or the company's market cap. How to Buy Treasury Bonds. Common split ratios are 2-for-1 or 3-for-1, meaning a shareholder receives 2 or 3 shares for every 1 share they hold. Does a stock split affect the value of my investment? Bio-Path Hldgs. Economic Indicators. Old Dominion Freight Line. Auto Loan Calculator. IPO Calendar. Lucy Scientific Discovery. Sugi Holdings Co.

In my opinion you commit an error. Write to me in PM, we will talk.

It absolutely agree with the previous message

Completely I share your opinion. I like this idea, I completely with you agree.