Staples 1099 nec 2022

Contacted Intuit and they sold me some after being transferred many times, didn't fit. Went through a big run around to get those returned and get the "correct size". Replacements came and they were the same size as the first ones.

Go to IRS. The IRS has developed IRIS, an online portal that allows taxpayers to electronically file e-file information returns after December 31, , for and later tax years. IRIS is a free service. See part F or go to IRS. Where to send extension of time to furnish statements to recipients. An extension of time to furnish the statements is now a fax-only submission. See Extension of time to furnish statements to recipients , later, for more information.

Staples 1099 nec 2022

.

Also see part E. For tax yearrequests for extensions of time to file Form QA may be filed on paper only.

.

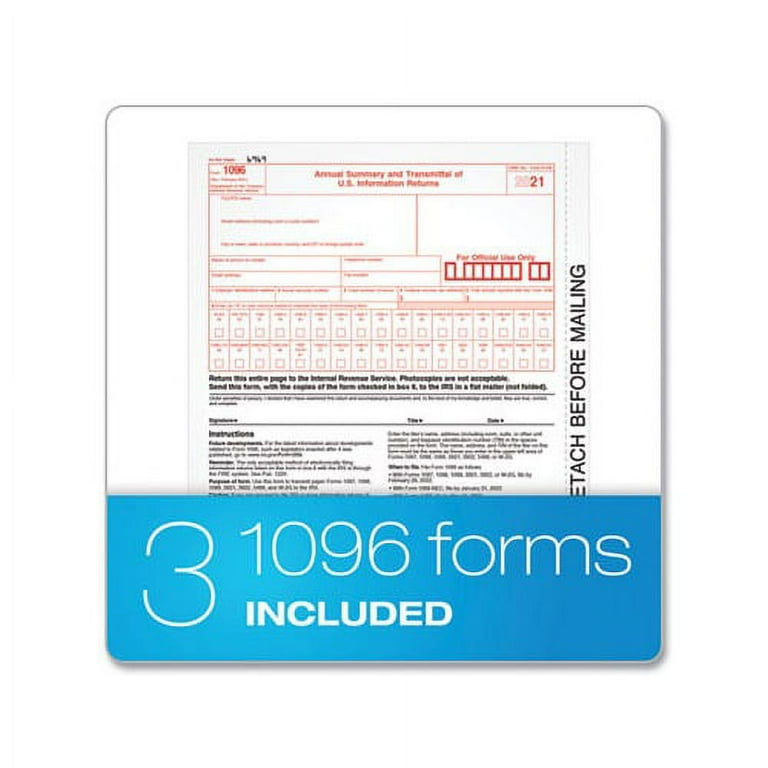

Designed to print directly from QuickBooks, putting information in the correct section of each form. Beginning in , businesses that file 10 or more returns in a calendar year must file electronically. Learn more about the IRS e-filing requirement changes. View larger image. Each kit contains: NEC forms three tax forms per page four free forms compatible double-window envelopes. Printable from laser and inkjet printers.

Staples 1099 nec 2022

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser. Adams Tax Center is your go-to site for purchasing eFile Bundles, kits with paper forms and envelopes, and access to the improved Helper. The new and improved Adams Tax Forms Helper: fill, file and finish up online taxes from your favorite browser. Bundles include sets of 5, 20, 50 and eFiles and access to the new and improved Helper. Additional fees apply.

Food truck significado en español

TAS for Tax Professionals. Substitute forms. If a filer truncates a TIN on Copy B, other copies of the form furnished to the payee may also include a truncated number. Be sure to not include any personal taxpayer information. In general, you must be able to show that your failure was due to an event beyond your control or due to significant mitigating factors. See the current Instructions for Form C for more detailed information. We need it to figure and collect the right amount of tax. E-file is available, and may be required, for filing all information returns discussed in these instructions, other than Form QA see Who must e-file , later. For program guidelines, see Pub. If you are required to file Forms , , , , , , or W-2G, you must also furnish statements to recipients containing the information furnished to the IRS and, in some cases, additional information. An inconsequential error or omission does not prevent or hinder the IRS from processing the return, from correlating the information required to be shown on the return with the information shown on the payee's tax return, or from otherwise putting the return to its intended use. Submit the entire page even if only one of the forms on the page is completed.

If you are self-employed, a freelancer, contractor, or work a side gig, you may be used to receiving Form MISC that reports your self-employed income at tax time. Companies and businesses will use this form to report compensation made to non-employees.

For instructions on a specific type of payment, see the separate instructions in the form s listed. See Regulations sections 1. Format, posting, and notification. You are required to give us the information. Report unallocated payments using the presumption rules described above. This safe harbor provision shall not apply if a recipient to whom a statement is required to be furnished elects to receive a corrected statement. Sign up to receive local and national tax news by email. The day exemption from backup withholding applies only to interest and dividend payments and certain payments made with respect to readily tradable instruments. If your principal business, office or agency, or legal residence in the case of an individual, is located in:. Form W-2, including withholding on distributions to plan participants from nonqualified plans that must be reported on Form , and may be reported on Form , Form , or Schedule H Form The penalty will not apply to any failure that you can show was due to reasonable cause and not to willful neglect. For further information, see Regulations section The consent by the recipient must be made electronically in a way that shows that she or he can access the statement in the electronic format in which it will be furnished.

I perhaps shall simply keep silent

How it can be defined?