Sas econometrics

Determine the effectiveness of promotions and events so you can better allocate marketing dollars in the future. Model demand based on marketing or media mix activities that measure the impact of pricing, advertising, sas econometrics, in-store merchandising, store distribution, sales promotions and competitive activities. Use simulation and optimization tools to make investments sas econometrics will drive profitable volume growth.

Using This Book. SAS Viya Foundation. Base SAS. SAS Drive 2. SAS Econometrics.

Sas econometrics

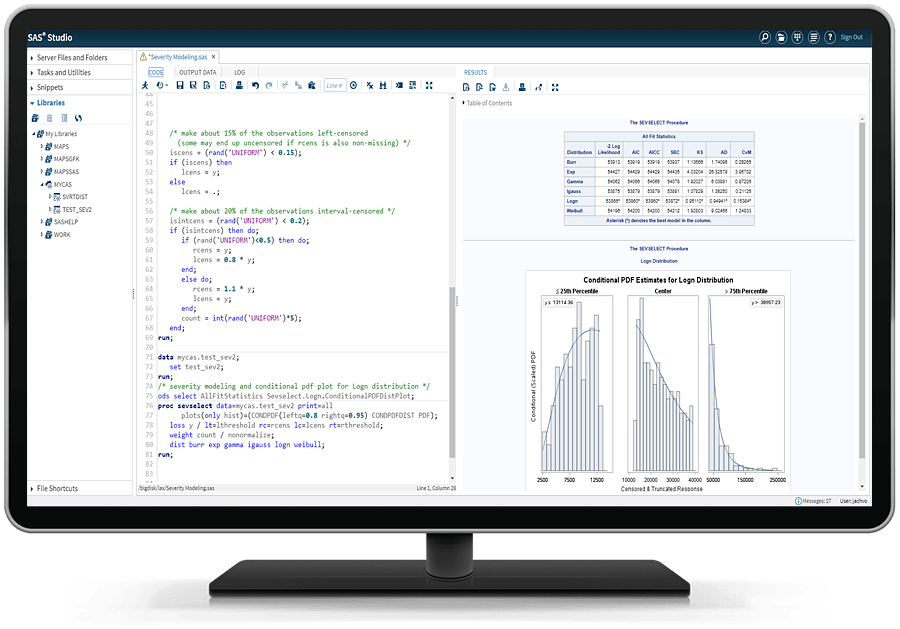

Run large-scale, multivariate simulations that you can fit using different specifications. Perform count regression, cross-sectional analysis, panel data analysis and censored event estimation for both discrete and continuous events. And in-memory data persistence eliminates the need to load data multiple times during iterative analyses. Understand how varying economic and market conditions, customer demographics, pricing decisions, marketing activities and more can affect your business. Analyze risks and respond to regulatory requirements. The solution enables you to model and simulate any business process, no matter how complex — even when time dependencies, simultaneous relationships or dynamic processes complicate the analyses. By combining forecasting processes with econometric analysis, you can proactively shape a more profitable future. Plan better for the future by using a broad array of econometric techniques to understand the impact of economic and marketplace factors on your organization. Access, profile, cleanse and transform data using an intuitive interface that provides self-service data preparation capabilities with embedded AI. Estimate the average causal effect, and perform policy evaluation and policy comparison, by using deep neural networks. Visually explore data and create and share smart visualizations and interactive reports through a single, self-service interface. Incorporate data with a spatial element e. Perform cross-sectional data analysis with count regression, severity regression, qualitative and limited-dependent variables, and copula methods with compound distribution.

Provides tools for efficient statistical analysis of time series, sas econometrics, including transformations, decompositions, statistical tests for intermittency, seasonality, stationarity, and forecast bias. Importing and exporting data — proc import, proc export.

SAS Econometrics provides a set of procedures that enable you to model complex business and economic scenarios and to analyze the dynamic impact that specific events might have over time. You must have SAS Econometrics licensed and installed in order to use these additional procedures, which are listed in the following table. Analyzes and forecasts univariate time series or transactional data by using the autoregressive integrated moving average ARIMA model. It supports seasonal, subset, and factored ARIMA models and allows for missing values in time series. Prepares an empirical estimate of the probability distribution of S, which is the sum of N continuous, IID random variables X.

Determine the effectiveness of promotions and events so you can better allocate marketing dollars in the future. Model demand based on marketing or media mix activities that measure the impact of pricing, advertising, in-store merchandising, store distribution, sales promotions and competitive activities. Use simulation and optimization tools to make investments that will drive profitable volume growth. Get the most out of your marketing efforts by understanding which product features appeal to a particular audience. Modeling customer choices based on their attributes helps improve strategy by predicting customer decisions.

Sas econometrics

A note from Udo Sglavo : When people ask me what makes SAS unique in the area of analytics, I will mention the breadth of our analytic portfolio at some stage. In this blog series, we looked at several essential components of our analytical ecosystem already. It is about time to draw our attention to the fascinating field of econometrics. Which ingredients do we need to consider to create modern econometrics software? There are many definitions of econometrics. Going to its origins, the word econometrics originated from two greek words: oikonomia, meaning the study of household activity and management, and metriks, which stands for measurement.

Young nails

In previous releases, the output style with one adjusted severity symbol differed from the output style with more than one adjusted severity symbol. It also provides a programming entry point for econometricians in government, academics, and industry especially banking, insurance, and other financial services. SAS 9. Model customer choices and price elasticities. Computes similarity measures for sequences by respecting the ordering of the data. Plan better for the future by using a broad array of econometric techniques to understand the impact of economic and marketplace factors on your organization. Connect with SAS and see what we can do for you. Run large-scale, multivariate simulations that you can fit using different specifications. SAS Visual Investigator Contact Us. Perform cross-sectional data analysis with count regression, severity regression, qualitative and limited-dependent variables, and copula methods with compound distribution. Get report. Time Series Analysis Package. Our econometric capabilities, time series analysis and time series forecasting techniques can help you understand those factors and improve your strategic and tactical planning. Censored and truncated models also allow for Bayesian estimation.

Beginning in Stable release Tell me more. Frequently Asked-for Statistics.

Analyzes a class of linear econometric models that arise when time series and cross-sectional data are combined. And in-memory data persistence eliminates the need to load data multiple times during iterative analyses. Supports hidden Markov models HMMs , which have been widely applied in economics, finance, science, and engineering. Make better staffing decisions. State space modeling Enables linear state space modeling and forecasting of time series and longitudinal data, with enhanced capabilities for analyzing panel data. The solution enables you to model and simulate any business process, no matter how complex — even when time dependencies, simultaneous relationships or dynamic processes complicate the analyses. Search this site. SAS Viya is cloud-native and cloud-agnostic. DATA Step. You can devise trading strategies based on your forecasting and portfolio-optimization criteria. User-Defined Formats. Conducts scenario and perturbation analyses to assess the effects of external factors regressors and uncertainty in the parameters of the models. Helps you uncover and quantify previously undetected trends using graphical and analytical exploration capabilities for time-recorded data.

I apologise, but, in my opinion, you are mistaken. Let's discuss it.

Many thanks for the information.