Salary calculator reed

Salary sacrifice means giving up part of your salary in return for a tax or National Insurance benefit.

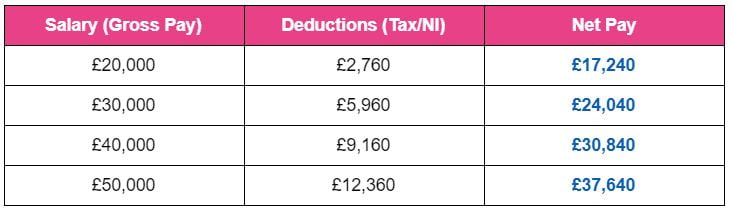

Work out how much tax is being deducted from your pay by using Reed. Whether you need to calculate a weekly household budget or are trying to work out how much more you'll earn from a pay rise or new role, the issue of tax will always crop up. Your headline salary figure will not be what you take home every month if you are a payrolled employee, with deductions made for Income Tax, National Insurance contributions and more. This can make it difficult to calculate your take-home pay without viewing a payslip. To help you with this, Reed. The calculator deducts National Insurance and Income Tax automatically, meaning that you'll be given a far more accurate indication of what you're earning. If you want to see how much you'll earn in a new role, or are worried a pay rise might push you onto the higher rate of Income Tax and will see you take home less money, click the link and use the tax calculator.

Salary calculator reed

.

North East Scotland Northern Ireland. Your headline salary figure will not be what you take home every month if you are a payrolled employee, with deductions made for Income Tax, National Insurance contributions and more.

.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

Salary calculator reed

Our salary guides look at average salary UK and benefits across 16 sectors. The guides use data from 17 million jobs posted since to highlight key salary trends and insights, enabling you to benchmark average salaries for your workforce across the UK, or find out what you should, or could be earning. Download our free guides now to compare UK average salaries and benefits. Our salary guides look at average UK salary and benefits across 16 industries, from accountancy and finance to technology, and enable you to benchmark average salaries for your workforce, or find out what you should, or could be earning. As we enter , the UK labour market continues to evolve amidst various economic and societal factors. Technological advancements have spurred demand for skilled workers in areas such as digital technology, artificial intelligence, and renewable energy. The job market reflects an increasing emphasis on adaptability and continuous learning, with employers seeking candidates who can navigate a rapidly changing landscape.

Tripadvisor ludlow

Legislation is subject to change and users will need to be satisfied that the results reflect their own interpretation of all relevant rules. Work out how much tax is being deducted from your pay by using Reed. If you want to see how much you'll earn in a new role, or are worried a pay rise might push you onto the higher rate of Income Tax and will see you take home less money, click the link and use the tax calculator. Whether you need to calculate a weekly household budget or are trying to work out how much more you'll earn from a pay rise or new role, the issue of tax will always crop up. North East Scotland Northern Ireland. This can make it difficult to calculate your take-home pay without viewing a payslip. SMART Save more money into your pension and reduce tax SMART salary sacrifice is a way of paying pension contributions that increases the amount paid into your pension, without reducing take home pay. Our tool currently doesn't operate on ' Relief at Source ' schemes your contributions are taken from your pay after your wages are taxed. The calculator will not consider a situation where employment has started or ceased during the year. To help you with this, Reed. If it is, your employer pays it directly into your pension pot on top of their normal contribution. Guide to automatic enrolment. Not all employers offer salary sacrifice, so check with your employer or visit your scheme website, you can find the link to your scheme website on any email or letter about your pension.

Work out how much tax is being deducted from your pay by using Reed.

The calculator will not consider a situation where employment has started or ceased during the year. Employers must identify which employees will be taken below the national minimum wage if they intend to offer salary sacrifice and restrict the offer accordingly. For personalised results please speak to a tax adviser or accountant. Get in touch. East Anglia North West Wales. Not all employers offer salary sacrifice, so check with your employer or visit your scheme website, you can find the link to your scheme website on any email or letter about your pension. Salary sacrifice means giving up part of your salary in return for a tax or National Insurance benefit. The calculator deducts National Insurance and Income Tax automatically, meaning that you'll be given a far more accurate indication of what you're earning. Our tool currently doesn't operate on ' Relief at Source ' schemes your contributions are taken from your pay after your wages are taxed. The benefit can be a pension contribution.

I confirm. I join told all above. Let's discuss this question. Here or in PM.

It is very a pity to me, I can help nothing to you. But it is assured, that you will find the correct decision.