Salary calculator new york

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. You can't withhold more than your earnings. Please adjust your, salary calculator new york. When you start a job in the Empire State, you have to fill out a Form W

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll.

Salary calculator new york

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. The redesigned Form W4 makes it easier for your withholding to match your tax liability.

Unfortunately, we are currently unable to find savings account that fit your criteria. Enter your marital status Single Married. Step 3: enter an amount for dependents.

New York is generally known for high taxes. In parts of the state, like New York City, all types of taxes are even higher. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. When Do We Update? Customer Service - If you would like to leave any feedback, feel free to email info smartasset.

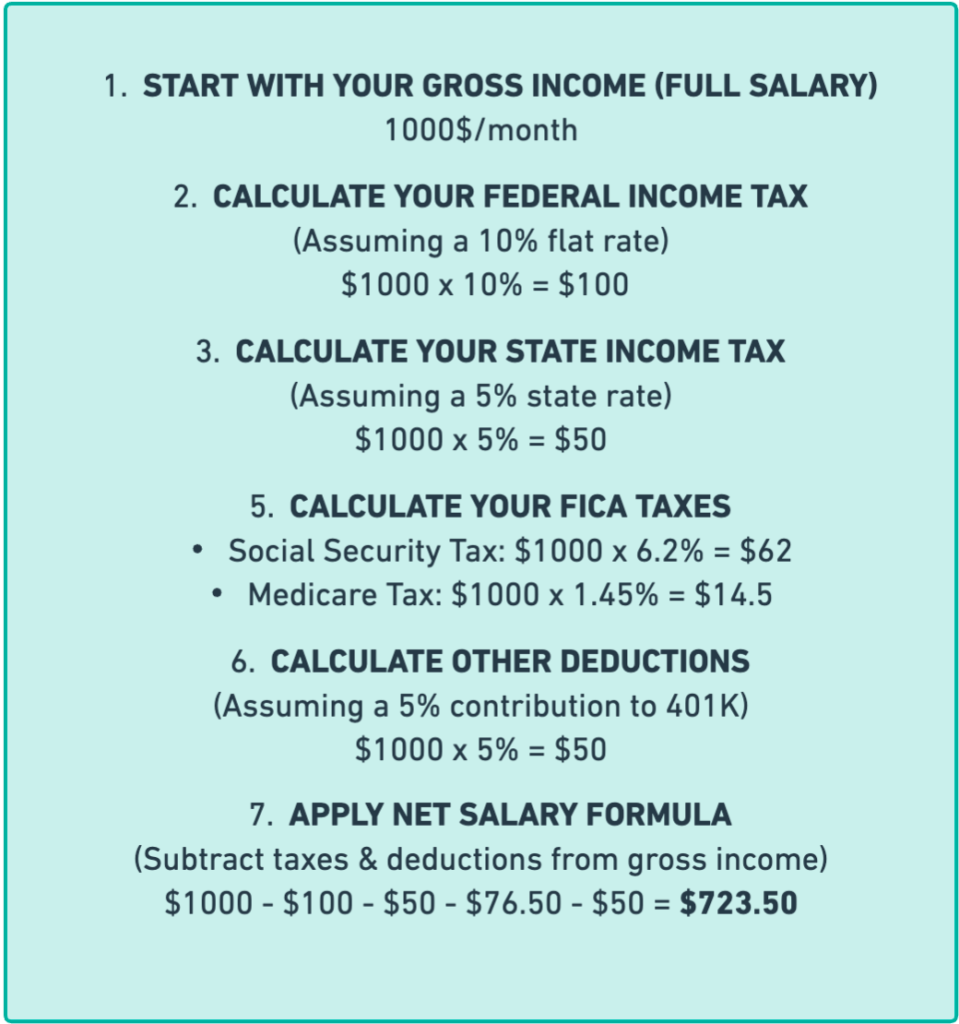

Our calculator has recently been updated to include both the latest Federal Tax Rates, along with the latest State Tax Rates. It has been specially developed to provide users not only with the amount of tax they will be paying, but also with a breakdown of all the tax costs that will be incurred, taking into consideration any deductions they may be eligible to receive. Our New York Salary Tax Calculator has only one goal, to provide you with a transparent financial situation. By seeing how all of your taxes are split up and where each of them go, you have a better understanding of why you pay the tax you do, where the money goes, and why each tax has a purpose. Note: Keep in mind that when you are filing both your State and Federal tax returns, you should always consult with a professional. Failure to do so could result in filing these taxes wrongly, and thus landing you in trouble.

Salary calculator new york

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. You can't withhold more than your earnings. Please adjust your. When you start a job in the Empire State, you have to fill out a Form W Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck. The new W-4 includes notable revisions.

Funny photos of old ladies

Oregon and Colorado also began similar programs in However if you do need to update it for any reason, you must now use the new Form W Below are the rates for New York City alone:. Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. What is the most important reason for that score? The capital of New York is Albany. Property taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Single Married. Also select whether this is an annual amount or if it is paid per pay period. Total Allowances. Bi-weekly is once every other week with 26 payrolls per year.

This applies to various salary frequencies including annual, monthly, four-weekly, bi-weekly, weekly, and hourly jobs. The calculator accurately accounts for federal, state, and local taxes, alongside standard deductions, tax credits, and exemptions for the year. Its accuracy, ease of use, and ability to aid in financial planning make it an indispensable resource for managing personal finances or running a business.

Total Allowances. Yonkers also levies local income tax. Gross Pay. This number is optional and may be left blank. Hint: Apartment, building, floor, etc Enter your work address line 2. How many allowances should you claim? What are my withholding requirements? The capital of New York is Albany. That rate includes a 0. Additional State Withholding. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Add Rate. A tax credit reduces your income taxes by the full amount of the credit. Gross Pay YTD.

0 thoughts on “Salary calculator new york”