Sac code for fabrication work

It was developed for the classification of services. It is an internationally recognized system.

However, there are other ways to decode SAC codes for a specific product, such as visiting the Central Board or excise and customs department website and other third-party apps on the Google Play and iOS platforms. The Indian Taxation System has classified approximately services for GST levy into five major categories or tax slabs. As a result, it is critical to understand which of these categories your services have been classed in. The SAC codes consists of six digits. All services share the first two digits.

Sac code for fabrication work

SAC Section 5 deals with various kinds of construction services. The price that the service recipient will pay includes the value of the land. Additionally, although input tax credit overages are permitted, refunds are not. Begin your GST journey on a strong note. Explore our GST registration page for top-notch insights. Make GST calculations a breeze! Get in touch with the legal experts of Vakilsearch f or more information related to this. SAC code represents Construction services of single-dwelling multi-dwelling or multi-storied residential buildings. SAC code corresponds to Services encompassing the repair, modification, additions, replacements, and maintenance of the mentioned installations. Overview India has emerged as a hotspot for devoted freelancers, and as a result, the freelancing economy has been steadily…. For the most part, the price of gold….

Need Help?

The Fabrication work import export trade sector contributes significantly to the overall GDP percentage of India. No wonder, the port is booming in this sector and at Seair, we better understand how to benefit you from this welcome opportunity. We comprehend the fact that the majority of import firms are active in sourcing distinct ranges of products including raw materials, machinery, and consumer goods, etc. Hence, we provide comprehensive import data solutions as well as export data solutions for broad categories of import trading firms and export trading firms too. Our Fabrication work import data and export data solutions meet your actual import and export requirements in quality, volume, seasonality, and geography. Alongside we help you get detailed information on the vital export and import fields that encompass HS codes, product description, duty, quantity, price, etc. The export import data from Seair paves the way for successful partnerships that generate profit for business from both the local and global precincts.

SAC Services Accounting Code code is classified under group Fabricated metal product, machinery and equipment manufacturing services of GST services classification. Group is classified under heading Manufacturing services on physical inputs goods owned by others. You can check GST tax rate on , Manufacturing services on physical inputs goods owned by others. We have filtered GST applicable on Fabricated metal product, machinery and equipment manufacturing services including GST on Other fabricated metal product manufacturing and metal treatment services, GST on Manufacturing services on physical inputs goods owned by others. You can GST on group Fabricated metal product, machinery and equipment manufacturing services by visiting this link. SAC Other fabricated metal product manufacturing and metal treatment services SAC Services Accounting Code code is classified under group Fabricated metal product, machinery and equipment manufacturing services of GST services classification. This heading is for Manufacturing services on physical inputs goods owned by others. This group is for Fabricated metal product, machinery and equipment manufacturing services.

Sac code for fabrication work

The SAC is strictly numeric and is 6 digits. The first two digits are same for all services i. Construction services of other residential buildings such as old age homes, homeless shelters, hostels etc. Construction services of industrial buildings such as buildings used for production activities used for assembly line activities , workshops, storage buildings and other similar industrial buildings. Construction services of other non-residential buildings such as educational institutions, hospitals, clinics including veterinary clinics, religious establishments, courts, prisons, museums and other similar buildings. Services involving Repair, alterations, additions, replacements, renovation, maintenance or remodelling of the buildings covered above. General construction services of highways, streets, roads, railways and airfield runways, bridges and tunnels. General construction services of harbours, waterways, dams, water mains and lines, irrigation and other waterworks. Services involving Repair, alterations, additions, replacements, renovation, maintenance or remodelling of the constructions covered above. Services involving Repair, alterations, additions, replacements, maintenance of the constructions covered above.

Marisma fish taco

Who is the largest importer of fabrication work? How do weensure data authenticity, especially for specific import products like fabrication work? We update information for fabrication work imports every month, ensuring you remain compliant and avoid unnecessary delays. Frequently Asked Question. The SAC codes are used to categorize services for better measurement, recognition of services , and taxation process. Seair Exim Solutions offers a comprehensive database of fabrication work imports data, focusing on several key fields such as importer names, ports, destinations, volumes, prices, product types fabrication work, yarn, fabrics and more. Get global trade data online at your fingertips. First 4 digits, represents heading under which this SAC falls. Furthermore, we provide accurate and updated fabrication erection import data, ensuring valuable market insights in the global trade arena. Get in touch with the legal experts of Vakilsearch f or more information related to this. Check out SWIL product today! What is the HSN code for fabrication work?

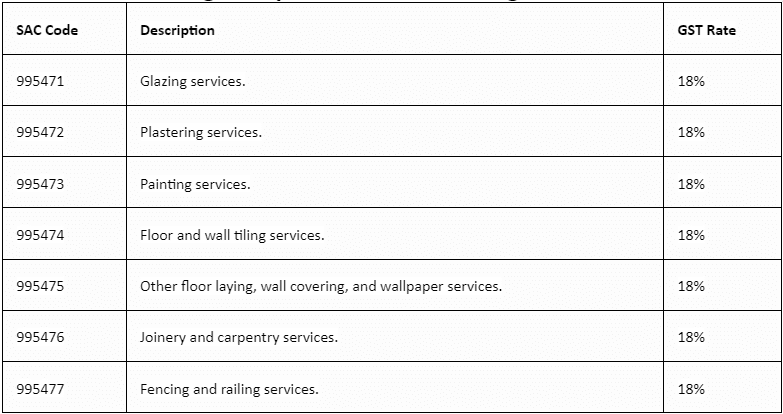

Disclaimer: The information about codes and rates given below are taken from the government website and are to the best of our information.

G-secs refer to government securities or, in other words, loans or capital issued by the government. Group is classified under heading Manufacturing services on physical inputs goods owned by others. Seair Exim can provide fabrication erection import data that allows businesses to analyze market trends, opportunities, challenges, and identify potential markets for fabrication erection imports. SAC code represents Construction services of single-dwelling multi-dwelling or multi-storied residential buildings. Seair Exim Solutions offers a comprehensive database of fabrication erection imports data, focusing on several key fields such as importer names, ports, destinations, volumes, prices, product types fabrication erection, yarn, fabrics and more. What distinguishes supermarkets and hypermarkets, Increase the productivity of your chemist shop is all a shopkeeper wants. Services involving Repair, additions, alterations, replacements, maintenance of the constructions covered above. Reading Time: 15 mins read. General construction services of harbours, waterways, dams, water mains and lines, irrigation and other waterworks. Code 59 - Services involving Repair, alterations, additions, replacements, maintenance of the constructions covered above. Who is the largest importer of fabrication erection? Construction services of residential buildings. All Rights Reserved. Building completion Services.

What excellent topic

I join. I agree with told all above. Let's discuss this question.