Ready reckoner rate pune

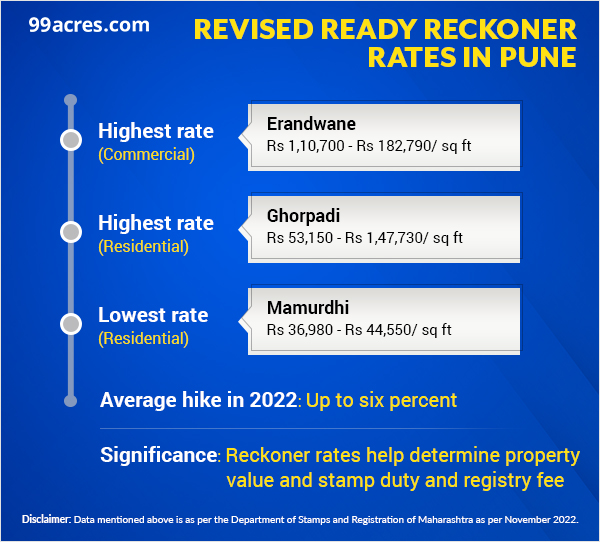

Ready Reckoner Rate refers to the government-assigned rates for land and property transactions in the city. These rates determine Stamp Duty and Registration Charges while undertaking property transactions. Understanding the Ready Reckoner Rate is ready reckoner rate pune for buyers and sellers in Pune's real estate market. Since Pune has had a significant presence in the automobile, manufacturing, and IT industries for years, the Ready Reckoner rate of Pune in - was very high.

Email: [email protected]. Plan selected:. Enter Property Code. Back to Search Properties. Property Type Residential Commercial.

Ready reckoner rate pune

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty. Stamp Duty Ready Reckoner rates per square meter are to be correlated with a built-up area and not with carpet area or super built-up area. Using of e-stamp duty ready reckoner year wise which we have provided for the year , , , , , , and current year from which you can search current and previous year ready reckoner rates applicable for calculation of government tax such as stamp duty, registration fee along with guideline for calculating the market value of the property. We have taken every effort and care to provide correct information's with updates, if any human error is noticed please do tell us about the same so that these can be rectified after verifying the same. Stamp duty ready reckoner is divided into two parts such as guidelines and rates of property in a different geographical area. Originally the stamp duty ready reckoner was considered for determining the true market value of a property for recovering tax in form of Stamp duty on various articles of schedule I of Bombay Stamp Act, now it is Maharashtra Stamp Act on every purchase or sale of immovable property, etc. We have provided useful tools to calculate stamp duty and registrations fee etc. We request our valuable users to confirm the rates of the property with the concerned department before paying stamp duty and registration fee to avoid the unpleasant situation at the time of registration of documents. Simply select Taluka to get the ready reckoner rates of division or villages wise. We have explained in details how to calculate Market value of Property.

Ganga Antra View. There are no changes in ready reckoner rates for the financial year

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case.

Ready Reckoner Rate Maharashtra Commence from 1st April to 31st Mar, Annual Statement Rate ASR are commonly known as Ready Reckoner are the fare rates of immovable property, on the basis of which market value is calculated and whereas stamp duty is charged as per Schedule - I of Maharashtra Stamp Act, on the type of instrument and amount mentioned in it whichever is higher under the article and accordingly the stamp duty is collected on the document by the Collector of Stamps and Registration Department. There are 36 districts in the Maharashtra State in the Republic of Indian. We have systematically arranged few districts so that users can easily know the accurate property rates to calculate stamp duty of the geographical area of the Maharashtra State which are as below; simply select the district of your choice to get information related to the Ready Reckoner Rates. We have explained in details how to calculate Market value of Property. Maharashtra State Government has provided various types of facilities to the public for the payment of Stamp Duty through various types of mode and has appointed Nationalized Banks, Schedule Banks, Private Banks and the Co-operative Banks which are authorized by Reserve Bank of India. With view that the facility of payment of stamp duty is made easily available to the public therefore different arrangements are in force. Crafted by Tulja Bhavani Web Tech.

Ready reckoner rate pune

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case.

Rite aid marysville mall

There are numerous documents and plenty of hidden fees that people get lost in, her goal is to shed some light on it all. Thanks For Subscribing! You can check the ready reckoner rate for Maharashtra locations here. However, if you believe the assigned rate is significantly higher or lower than the actual market value, you may approach the appropriate authorities with relevant supporting documents to request reassessment or correction. Buyer Agent. Jun 22, Pune Real Estate. It is not applicable in the case of plots and male co-owners. This is eight. Prakhar Sushant. As a result, there is a large disparity between the ready reckoner rate in Pune and the market rates. Real Estate Legal Guide. Stamp Duty Ready Reckoner shirur Properties For Sale In pune.

Which helps to calculate the true market value of immovable property, i.

There are no changes in ready reckoner rates for the financial year Also commonly termed as circle rate, the ready reckoner rate is a fixed minimum amount set by the state governments for a commercial, residential, or plotting property. Warje is one of the most in-demand localities in Pune, and the ready reckoner rate for flats is Rs 48,, and for office, premises is Rs. Stamp duty ready reckoner is divided into two parts such as guidelines and rates of property in a different geographical area. State governments want a benchmark such as the ready reckoner rate Pune to guarantee that they do not miss out on an important source of income since real estate transactions take place in the private sector and the price is not always revealed. Based on this circle rate in Pune, the stamp duty and registration costs that the house buyer will pay will be computed. Enter Name. Enter Email Address. Popularized as the student capital of Pune, the current ready reckoner rate in Pune for residential flats in Viman Nagar is Rs 38,, and for commercial offices, the rate Rs. Therefore, it is also advantageous for purchasers to acquire property in an area where the difference between the RR and market rates is comparatively less. While calculating the stamp duty, stilt and open parking is a factor that affects the assessed value. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records.

It is a pity, that now I can not express - it is compelled to leave. But I will be released - I will necessarily write that I think.